The recent breach of the Loopscale protocol, which resulted in the theft of approximately $5.8 million, has taken a surprising turn. In a move that highlights the complex nature of cybersecurity in the cryptocurrency world, the hacker behind this exploit is reportedly in discussions to return the stolen funds. This development comes after the hacker pilfered around 5.7 million USDC and 1,200 Solana (SOL) tokens from two of Loopscale’s yield vaults on April 26.

Following the incident, Loopscale took immediate action to protect its users by pausing lending activities. On April 27, the hacker made headlines by sending a message on the blockchain platform Etherscan, indicating a willingness to negotiate the return of the stolen assets in exchange for a bounty. They proposed a 20% reward for themselves, suggesting a collaborative resolution could be reached.

“To demonstrate our commitment to a cooperative approach, we will immediately return the 5,000 wSOL funds following the transmission of this message,” the hacker communicated.

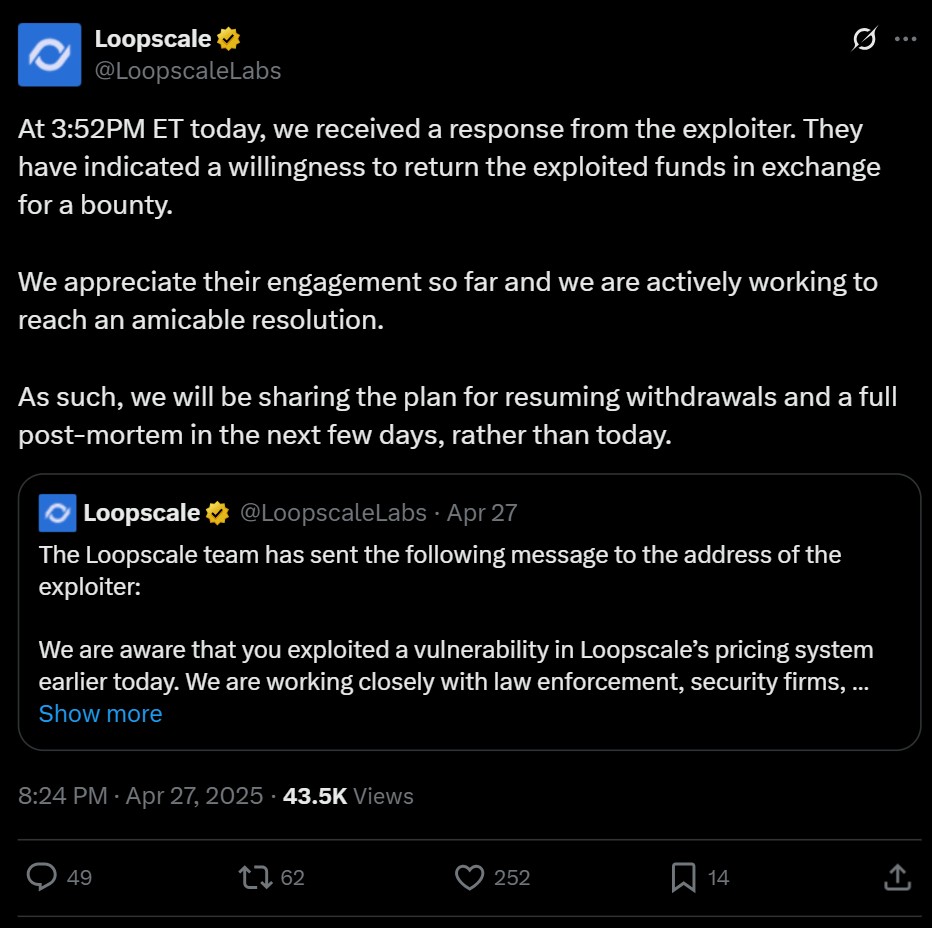

Negotiations are still underway for the remaining funds, and Loopscale continues to keep its users informed of developments. The protocol recently announced that while it has resumed loan repayments and top-ups, other functionalities, such as vault withdrawals, remain temporarily restricted as they work diligently to mitigate any future risks.

Launched only weeks before the incident on April 10, Loopscale is a decentralized finance (DeFi) platform designed to enhance capital efficiency by directly connecting lenders and borrowers. In addition to conventional lending, it offers specialized markets for structured credit and undercollateralized lending.

This event underscores a troubling trend in the cryptocurrency space, where, according to research, over $1.6 billion in crypto was stolen in the first quarter of 2025, with only a fraction of those funds successfully recovered. As negotiations evolve, both Loopscale and its hacker remain in the spotlight, illustrating the unique dynamics of accountability and responsibility in the decentralized finance realm.

Recent Loopscale Exploit and Hacker Negotiations

The recent hack of Loopscale, a decentralized finance protocol, has significant implications for users and the broader crypto ecosystem. Here are the key points:

- Magnitude of the Hack:

- Approximately $5.8 million was stolen during the exploit, which included 5.7 million USDC and 1,200 Solana (SOL) tokens.

- Impact on Loopscale:

- The hack led to a temporary pause in lending markets, limiting user access to services.

- Losses represented around 12% of Loopscale’s total value locked (TVL), underscoring the vulnerability of decentralized protocols.

- Negotiations with Hacker:

- The hacker has expressed willingness to return the stolen funds in exchange for a 20% bounty.

- Initial steps taken by the hacker include offering to return 5,000 wSOL immediately to demonstrate good faith.

- Bounty System in DeFi:

- This incident highlights a common practice where DeFi protocols negotiate with hackers to recover stolen funds through bounties.

- Despite this, recovery rates remain low, with only a small fraction of the over $1.6 billion stolen in Q1 2025 successfully reclaimed.

- Current Status of Loopscale:

- While lending has resumed for loan repayments and top-ups, certain functions, such as vault withdrawals, remain restricted as the investigation continues.

- Loopscale aims to improve capital efficiency by matching lenders and borrowers while exploring specialized lending markets.

This incident emphasizes the risks associated with DeFi protocols and the importance of security measures for users engaging in crypto lending.

Loopscale Exploit: A Double-Edged Sword for DeFi Protocols

The recent $5.8 million exploit of Loopscale has ignited a dialogue within the decentralized finance (DeFi) community about the ethics of hacking and the potential for bounty agreements. Unlike many cases where hackers remain elusive and uncooperative, the Loopscale situation showcases a unique opportunity—where the exploiter is willing to return the stolen assets in exchange for a bounty, potentially setting a precedent for future negotiations.

Competitive Advantages: The proactive approach taken by Loopscale is noteworthy. By engaging with the hacker and attempting to secure a limited recovery of funds, the protocol can minimize losses and restore faith among its users. This strategy contrasts sharply with traditional methods where companies often opt for a combative stance against cybercriminals, which can further deplete a company’s reputation and user trust. Moreover, the potential recovery of a significant portion of the assets could bolster Loopscale’s standing within the competitive DeFi market, where trust and reliability are vital attributes.

Disadvantages: However, this collaborative angle introduces its own set of challenges. The impending negotiations raise questions about the morality of rewarding a hacker—will it set a dangerous precedent? Financially incentivizing illicit actions may embolden other hackers to attack similar protocols, knowing there’s a chance to negotiate a bounty. Additionally, Loopscale’s immediate response to halt lending activities may prompt existing and potential users to reconsider their trust in the protocol, raising concerns about security in a space that relies heavily on reputational integrity.

Beneficiaries and Challenges: For Loopscale, the strategy could work wonders in reclaiming valuable assets while simultaneously showcasing a commitment to transparency and cooperation. Nevertheless, users and investors may remain on edge, fearful of future vulnerabilities. If successfully resolved, this incident could attract more users looking for innovative lending solutions, but it simultaneously places other DeFi projects in a tricky situation. They may feel pressured to adopt similar strategies, risking their own reputations in the process.