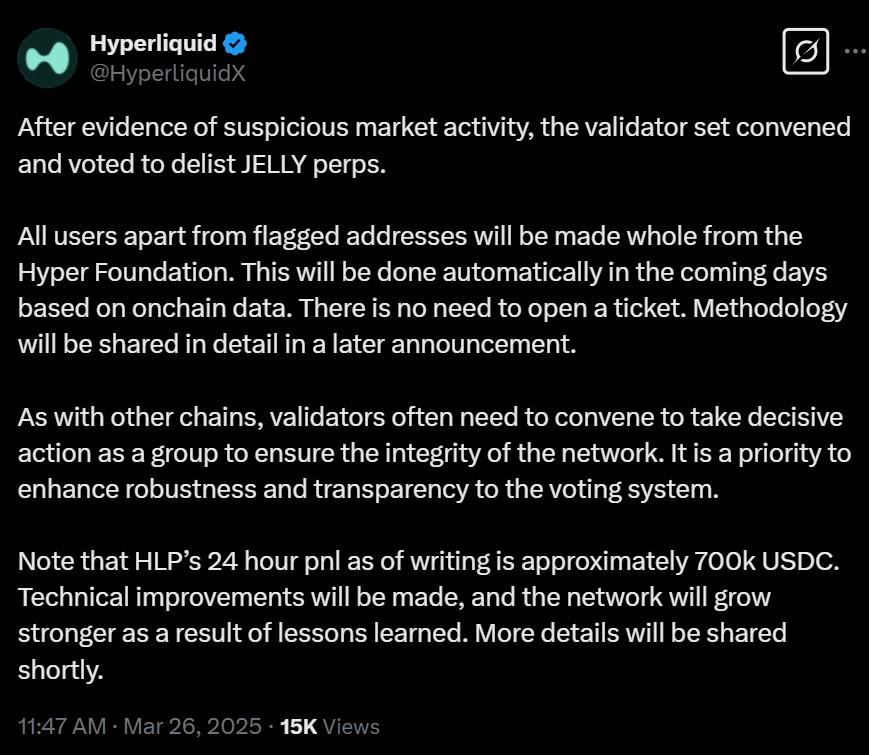

In a significant development in the cryptocurrency world, Hyperliquid has announced the delisting of perpetual futures contracts linked to the JELLY token after uncovering what it describes as “evidence of suspicious market activity.” This decision comes amidst Hyperliquid’s ongoing evolution as a leading platform for leveraged trading in the Web3 space. The news was shared in a post on the X platform on March 26, indicating that the Hyper Foundation, which serves as the nonprofit arm of the Hyperliquid ecosystem, plans to reimburse most users affected by the incident.

According to the platform, “All users apart from flagged addresses will be made whole from the Hyper Foundation,” and users can expect these reimbursements to occur automatically based on on-chain data within the coming days. Despite the turmoil, Hyperliquid reported that its primary liquidity pool (HLP) generated a positive net income of around 0,000 in a 24-hour period, showcasing some resilience amid the challenges.

This incident highlights both the potential risks and the rapid growth of Hyperliquid’s platform, which has quickly become a popular destination for traders engaging with leveraged perpetual futures, commonly referred to as “perps.” These instruments allow traders to take significant positions without an expiration date, provided they secure them with margin collateral, such as USDC.

“The incident began when a trader opened a massive M short position on JellyJelly and then deliberately self-liquidated by pumping JellyJelly’s price on-chain,” explained Abhi, founder of Web3 company AP Collective.

Initially launched in January by Venmo co-founder Iqram Magdon-Ismail, the JELLY token experienced a meteoric rise to a market capitalization of approximately 0 million. However, it has since seen a drastic decline, trading at around million as of late March. This volatility in the token’s value underscores the complex dynamics at play within the cryptocurrency market.

Hyperliquid’s recent challenges follow a previous incident where margin requirements were raised after significant losses during a massive liquidation of Ether (ETH) positions. This move came in response to a whale trader who intentionally liquidated a substantial 0 million ETH long position that led to a million loss, prompting Hyperliquid to require traders to maintain a collateral margin of at least 20% for certain open positions.

The unfolding situation around Hyperliquid and the JELLY token serves as a stark reminder of the complexities and risks associated with cryptocurrency trading as platforms adapt to emerging challenges in the fast-paced market environment.

Impact of Hyperliquid’s Delisting of JELLY Token Perpetual Futures

The recent delisting of perpetual futures tied to the JELLY token on Hyperliquid has several significant implications for traders and investors:

- Suspicious Market Activity

- The identification of “evidence of suspicious market activity” raises concerns about market integrity.

- Traders may need to be more vigilant and conduct thorough research before engaging with new tokens and trading instruments.

- User Reimbursement

- The Hyper Foundation plans to reimburse most affected users, which can provide some security for traders worried about losses.

- This proactive response may influence users’ trust in the platform moving forward.

- Increased Liquidity Pool Income

- Despite the incident, Hyperliquid’s primary liquidity pool has shown a positive net income of around 0,000.

- This indicates resilience in the platform and may assure users of operational stability, despite market fluctuations.

- Rising Margin Requirements

- Following significant losses, Hyperliquid has increased margin requirements, which can lead to reduced risk but may also limit trading for smaller investors.

- Traders need to factor these changes into their trading strategies, as higher collateral may affect the ability to leverage positions.

- Pricing Volatility of JELLY Token

- The substantial fluctuations in JELLY’s market capitalization underscore the inherent risks of trading new tokens.

- Investors should exercise caution and consider volatility when investing in tokens like JELLY that have experienced large price swings.

Hyperliquid’s JELLY Token Fallout: Examining Market Dynamics and User Impact

The recent decision by Hyperliquid to delist perpetual futures linked to the JELLY token is a significant move that sends ripples through the cryptocurrency trading community. This action, prompted by perceived market irregularities, underscores the challenges of managing a rapidly evolving crypto ecosystem. Hyperliquid’s proactive stance—offering reimbursements to most users for losses—highlights a competitive edge when it comes to customer relations and brand trust. While Hyperliquid aims to maintain user confidence during turbulent times, this incident reveals both advantages and drawbacks in its operational strategies.

From a competitive perspective, Hyperliquid’s response to the market manipulation allegations showcases its commitment to safeguarding the interests of its user base. The Hyper Foundation’s promise to automatically reimburse affected users enhances customer loyalty and can attract new traders wary of similar issues on competing platforms. Additionally, the exchange’s recent performance, with a net income of approximately 0,000 over 24 hours, points to a resilient liquidity pool, positioning it as a robust contender in the leveraged trading sector.

However, the incident raises broader concerns not only for Hyperliquid but for the entire landscape of cryptocurrency trading. The fallout from such suspicious activities can deter novice traders who rely on stable and secure platforms to manage their investments. Increased scrutiny and the potential for regulatory backlash may burden Hyperliquid with higher operational costs or tighter compliance requirements. Furthermore, traders linked to the flagged addresses risk losing their trust in the platform—an essential currency in the crypto world.

On the flip side, competitors may seize this moment to highlight their security protocols or more stringent risk management strategies. Exchanges that prioritize transparency and maintain robust market oversight could attract traders skeptical of recent events on Hyperliquid. Companies that implement preventative measures against market manipulation may emerge as safer havens for traders seeking stability in a developing regulatory environment.

This incident particularly influences various stakeholders within the cryptocurrency ecosystem. Emerging traders, who may be unfamiliar with the risks associated with leveraged trading, could find themselves dissuaded by the recent volatility surrounding the JELLY token. Conversely, experienced investors may see this as an opportunity to exploit price discrepancies in the wake of the incident. As Hyperliquid navigates these choppy waters, its ability to reassure its user base will be critical, while competing exchanges may need to assess how best to position themselves in light of this unfolding situation.