Hyperliquid is making waves in the cryptocurrency world as a remarkable player in the decentralized finance (DeFi) space. Emerging as a standout success in the current bull market, daily trading volumes have soared to an impressive billion, positioning Hyperliquid as the largest decentralized exchange (DEX) derivative platform, capturing nearly 60% of the market share. While it still trails behind centralized exchanges like Binance Futures, which average about billion in daily volume, Hyperliquid’s rapid growth indicates a shift in the trading landscape.

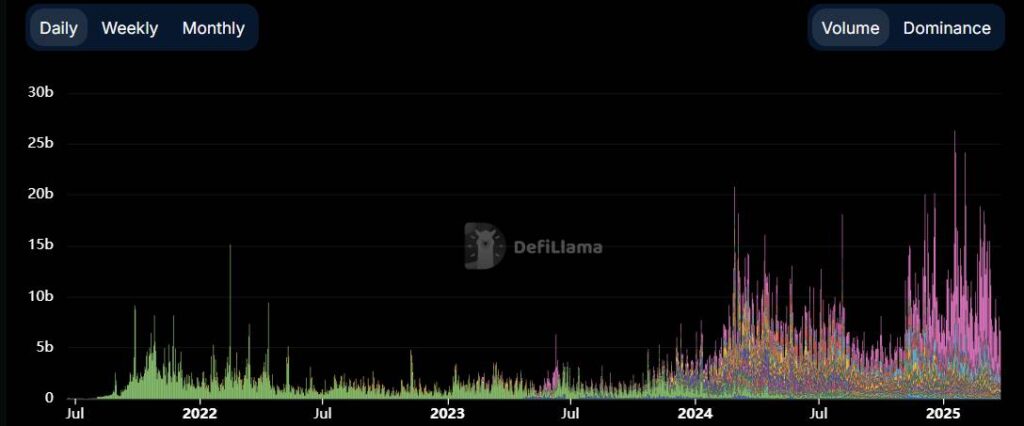

Launched in 2023, Hyperliquid gained significant traction in April 2024, fueled by the introduction of spot trading and an aggressive listing strategy that attracted a new wave of users. However, the real turning point came in November 2024 with the launch of its native HYPE token, which sent trading volume into a frenzy, resulting in over 400,000 users and processing more than 50 billion trades, according to data from Dune Analytics.

“Most L1s build infrastructure and hope that others will come build the killer apps. Hyperliquid takes the opposite approach,” said Jeff Yan, a co-founder.

This innovative philosophy, coupled with the launch of HyperEVM in February 2025, has transformed Hyperliquid into a general-purpose layer-1 blockchain, accommodating third-party DeFi apps atop its infrastructure. The strategy behind Hyperliquid not only enhances its own offerings but also aims to create a mutually beneficial ecosystem where liquidity from its DEX bolsters the entire infrastructure.

Ranking as the 14th largest derivatives exchange by open interest, with .1 billion, Hyperliquid is steadily closing in on established names in the industry, including Deribit and the derivatives divisions of Crypto.com and BitMEX. It’s a pioneering moment for a DEX to compete so closely with traditional centralized exchanges. Hyperliquid’s acceptance of a variety of collateral, including native Bitcoin (BTC), positions it uniquely among decentralized platforms, providing users an option to engage in a more flexible trading environment.

“No DEX has ever come this close to matching Tier 1 CEX volume,” remarked a user, highlighting Hyperliquid’s impressive market share.

Despite facing challenges, such as the recent JELLY token scandal, which halted trading due to exploitation issues, Hyperliquid continues to thrive within the DeFi community. Although it has yet to capture significant institutional investment flows like its centralized competitors, the ongoing development of its layer-1 ecosystem could pave the way for Hyperliquid’s evolution into a dominant fixture in the DeFi landscape.

Hyperliquid: A Standout in the DeFi Bull Market

Hyperliquid has emerged as a significant player in the decentralized finance (DeFi) space, showcasing key trends and data that could influence users and traders in the crypto market.

- Record Trading Volume: Hyperliquid has reached daily trading volumes of billion, making it the largest decentralized exchange (DEX) derivatives platform, holding nearly 60% of the market share.

- Shift Towards Centralized Exchange (CEX) Competition: Although still behind Binance Futures ( billion daily average), Hyperliquid shows potential to encroach on CEX territory.

- Launch of HYPE Token: The introduction of the HYPE token in November 2024 propelled Hyperliquid’s trading volume and user engagement, resulting in over 400,000 users and 50 billion trades processed.

- Expansion to General-Purpose Layer-1 Chain: With the launch of HyperEVM, Hyperliquid aims to support third-party DeFi applications, potentially boosting its ecosystem and liquidity.

- Innovative Approach: Hyperliquid differentiates itself by focusing on enhancing native applications first and building infrastructure around them, unlike traditional methods.

- Close Competition with Established Exchanges: It ranks 14th among derivatives exchanges by open interest at .1 billion, outperforming older platforms and challenging Tier 1 CEXs.

- Specialized Trading Options: Hyperliquid is notable for accepting BTC natively, allowing wrapping and unwrapping, which enhances its trading capabilities for users focused on Bitcoin.

- Growing Popularity of Perpetual Swaps: Perpetual swap trading tools are reviving, with Hyperliquid accounting for a significant share of the growing market in 2025.

- Market Resilience: Despite setbacks like the JELLY token scandal, Hyperliquid remains a favored choice for DeFi traders, indicating user trust in its platform.

“No DEX has ever come this close to matching Tier 1 CEX volume.” – User analysis

The developments around Hyperliquid not only reflect its growing market position but also point to evolving opportunities for retail traders and investors, especially in the decentralized ecosystem. Understanding these trends could have significant implications for users looking to capitalize on DeFi innovations and trading strategies.

Hyperliquid: A New Contender in the DeFi Arena

Hyperliquid has emerged as a formidable player in the decentralized finance (DeFi) space, marking a significant shift in the trading landscape. Its impressive daily trading volumes, recently reaching billion, position it as the largest decentralized derivatives exchange, capturing nearly 60% of the market. Yet, in a comparative landscape marked by giants like Binance Futures, which boasts billion in average daily volume, Hyperliquid still has room to grow.

Competitive Advantages: One of the standout features of Hyperliquid is its quick adaptation and innovative approach. The integration of spot trading in April 2024, along with an aggressive listing strategy, has allowed it to attract a robust user base of over 400,000. The recent launch of the HYPE token provided a turbo boost, resulting in a surge of trading activity and an expansion of its platform features. Additionally, Hyperliquid’s recent transition to a general-purpose layer-1 chain with HyperEVM means that it isn’t just a trading hub but is evolving into a broader DeFi ecosystem, promoting a unique flywheel effect where liquidity can circulate through various applications built on its infrastructure.

Competitive Disadvantages: However, despite its rapid growth, Hyperliquid still faces some challenges. Institutional flows have not yet flocked to this platform, and it remains behind major centralized exchanges (CEXs)—notably, Binance remains a significant benchmark. The community is also still reeling from the JELLY token scandal, which could tarnish its reputation, potentially making some users wary of trading on the platform. While Hyperliquid is making strides in specialized trading pairs by supporting collateral like Arbitrum USDC and native BTC, it must solidify its reputation to foster trust among a broader audience.

The implications of Hyperliquid’s rise are multifaceted. Current decentralized traders, especially those looking for alternatives to centralized platforms, may find a newfound competitive edge on Hyperliquid, especially in BTC perpetual futures, where it has recently gained significant market share. Conversely, traditional CEXs may feel the pressure as Hyperliquid continues to chip away at their dominance, forcing them to innovate and perhaps lower fees to compete. However, if Hyperliquid fails to maintain this momentum and address its reputation vulnerabilities, it could risk alienating potential users and stalling its growth trajectory.