In a recent incident that has stirred the cryptocurrency community, Gracy Chen, CEO of the Bitget exchange, has vocalized her concerns over Hyperliquid’s management of a critical event involving the JELLY token. On March 26, Hyperliquid, a blockchain platform known for its perpetual trading features, announced the delisting of perpetual futures contracts for JELLY after detecting what it termed “suspicious market activity.” Chen expressed that this incident could jeopardize the integrity of the network, cautioning that Hyperliquid might be on a path to becoming “FTX 2.0,” a reference to the infamous exchange that collapsed in 2022 amid allegations of fraud.

“Trust—not capital—is the foundation of any exchange…and once lost, it’s almost impossible to recover,” said Chen regarding the incident.

The controversy sparked when Hyperliquid’s decision to reimburse affected users—and the manner in which it was handled—raised red flags about the network’s apparent centralization. Hyperliquid operates with a comparatively small number of validators, leading to claims that its operations mirror centralized exchanges rather than functioning as a decentralized platform. Critics, including Chen, have highlighted that despite Hyperliquid’s efforts to promote itself as an innovative decentralized exchange, its actions may belay a more traditional, centralized approach.

“Hyperliquid may be on track to become FTX 2.0,” Chen remarked, emphasizing her concern regarding the platform’s ethical and professional response.

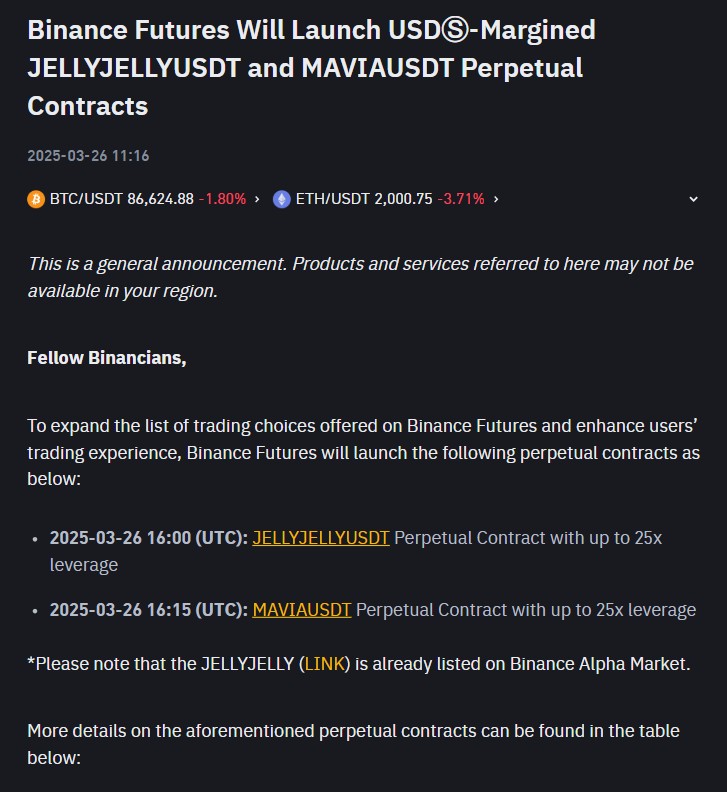

The JELLY token, which was launched in January by Venmo co-founder Iqram Magdon-Ismail, initially saw its market capitalization soar to around 0 million. However, it later saw significant fluctuations, particularly following Binance’s introduction of perpetual futures related to JELLY on the same day as the Hyperliquid incident.

This isn’t the first time Hyperliquid found itself embroiled in controversy. Earlier in March, the platform faced losses after a significant liquidation event involving a large Ether position, leading to approximately million in losses for liquidity providers.

As Hyperliquid holds a commanding 70% of the market share for leveraged perpetual trading, it remains crucial for the platform to address these growing pains effectively. Analysts point out that the decentralized aspect of cryptocurrency exchanges is often evaluated against the number of validators supporting a network—a stark contrast with giants like Ethereum, which boasts a vast validator network to mitigate risks of manipulation. The future of Hyperliquid and the handling of its current challenges could significantly influence its reputation and operations moving forward.

Gracy Chen Critiques Hyperliquid’s Stability After Market Incident

In a recent incident involving the cryptocurrency exchange Hyperliquid, CEO Gracy Chen voiced significant concerns regarding the platform’s management and potential risks it poses to the cryptocurrency ecosystem. Below are the key points from the incident and its implications:

- Criticism of Hyperliquid’s Response:

- Gracy Chen described Hyperliquid’s handling of a March 26 incident as “immature, unethical, and unprofessional.”

- The incident involved the delisting of perpetual futures contracts for the JELLY token due to suspicious market activity.

- Risk of Centralization:

- Chen warns that Hyperliquid resembles more of a centralized exchange rather than a decentralized one, raising fears of a potential FTX-like collapse.

- The network operates with a small number of validators (only 8), compared to competitors like Ethereum and Solana, which are supported by many more validators (1000 and 1 million respectively).

- Impact on Trust:

- Chen emphasized that trust is the foundation of any exchange, and a loss of trust is detrimental to its credibility and operations.

- The decision to settle positions at favorable prices for some users could set a dangerous precedent for future trading practices.

- Market Responses and Reactions:

- Critics, including BitMEX founder Arthur Hayes, argue that the reputational impacts of the incident may be overblown, suggesting that traders prioritize profits over platform safety.

- Hyperliquid’s earlier issues with a significant liquidation event of a 0 million Ether position have raised questions about its operational integrity.

- Future Implications:

- The incident is a reminder for traders to exercise caution when using platforms with centralized features and to prioritize security and transparency in their trading practices.

- As Hyperliquid holds roughly 70% market share of leveraged perpetuals trading, its stability will significantly impact the broader cryptocurrency market.

Hyperliquid’s Turbulent Waters: Comparing Risks and Reactions in Crypto Trading

The recent turmoil surrounding Hyperliquid, particularly its response to the March 26 incident involving the JELLY token, has drawn scrutiny and criticism from notable figures in the cryptocurrency realm, including Gracy Chen, CEO of Bitget. Chen’s assertion that Hyperliquid’s approach may lead to it becoming “FTX 2.0” resonates within the broader context of the decentralized finance (DeFi) landscape, where trust and transparency are paramount. Hyperliquid, which currently dominates the leveraged perpetuals market, controlling about 70% of its share, faces a unique challenge as it attempts to balance its rapid growth with the ethical considerations of its centralization.

Comparing similar cases in the crypto space, trust issues have recently plagued other exchanges like FTX and more recently, Terraform Labs. While both platforms initially garnered significant user confidence, their eventual collapse highlighted the critical importance of governance and user trust. Hyperliquid’s recent actions, including the delisting of perpetual futures contracts and the controversial decision to reimburse users, showcases a different approach; however, its small validator set—comprised of only eight validators—puts it at a heightened risk of perceived or real centralization. This contrasts sharply with larger ecosystems like Ethereum, which is supported by a myriad of validators, ensuring a more distributed and resilient network.

The competitive advantages here are clear. Hyperliquid’s rapid growth and major market share position it to capitalize on trading volumes when the market is bullish. However, the incident with JELLY raises red flags about its operational integrity and could deter potential investors and traders who prioritize decentralization. This scenario opens the door for competitors with stronger decentralized governance models, like Solana, to seize market share. The collateral damage from Hyperliquid’s decisions may also alienate a segment of users who are increasingly wary of centralization following earlier crises like FTX.

Potential beneficiaries of Hyperliquid’s challenges could include decentralized exchanges (DEXs) with more robust governance structures, such as Uniswap, which may attract users seeking safer trading environments. Conversely, institutional traders or whales, who thrive on high-leverage scenarios, could find opportunities in the volatility surrounding Hyperliquid. Yet, if Hyperliquid fails to address its governance issues and transparency concerns, it could wind up fueling further skepticism in a market already riddled with distrust, affecting not only its reputation but potentially the broader ecosystem.

In summary, the scrutiny surrounding Hyperliquid has illuminated the critical importance of decentralization and governance in today’s cryptocurrency exchanges, setting the stage for either redemption or further disillusionment in the eyes of traders and investors alike.