India is emerging as a powerhouse in the global Web3 landscape, marking a significant year-on-year growth in software development, gaming, investments, and startup funding within the cryptocurrency sector. According to the India Web3 Landscape Report 2024 published by Hashed Emergent and shared with Cointelegraph, India’s share of global Web3 developers has impressively increased from 5% to 12% over the past decade, making it the second-largest developer base after the United States.

“India is currently home to the second-largest developer market and the third-largest founder base globally,” stated Tak Lee, CEO and Managing Partner at Hashed Emergent.

The report attributes this surge in Web3 talent to various factors such as robust retail crypto transactions via centralized platforms, the highest trading volumes in the region, growing institutional adoption, and increasing engagement in decentralized finance (DeFi). Notably, the Gen Z demographic is at the forefront, with around 80% of blockchain developers in India aged between 18 and 27.

Interestingly, despite an increase in investments within the Indian Web3 space—jumping 224% in 2024 compared to the previous year—challenges persist. Many Indian developers report a disparity between salaries offered locally and global industry standards, hampering larger-scale recruitment and retention. Furthermore, the high costs associated with acquiring customers (CAC) for Web3 gaming projects are prompting a shift towards quality gameplay over solely financial incentives.

“Several of these games are now focusing on having great quality games before integrating blockchain mechanics,” Lee explained.

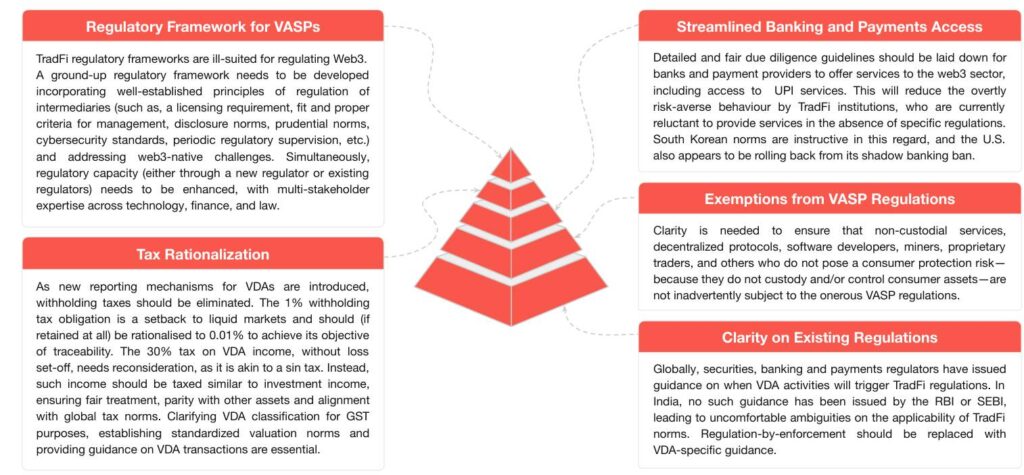

Moreover, while investing in the Indian Web3 ecosystem presents unique opportunities, issues remain regarding the lack of clear regulations and guidance. The high taxation on cryptocurrency is also influencing trading behaviors, which often involve small-scale, frequent trades, underscored by a significant female presence in the market, representing one in ten futures traders.

As the landscape evolves, calls for regulatory reform are growing, suggesting that India needs to enhance its regulatory environment to better support innovation within the Web3 sector. With a clearer and more supportive framework, stakeholders believe that India can fully capitalize on its burgeoning position in the global Web3 arena.

India’s Growing Role in the Global Web3 Ecosystem

India is emerging as a significant player in the global Web3 landscape, particularly in areas such as software development, gaming, and investment. The following points highlight the key aspects of this development and their potential impact on readers’ lives:

- Increase in Global Developer Share: India’s share of global Web3 developers has increased from 5% to 12% in the past decade, making it the second-largest contributor after the United States.

- Factors Driving Crypto Adoption:

- Retail crypto transactions on centralized platforms.

- High trading volumes.

- Growing institutional adoption.

- Increased retail participation in decentralized finance (DeFi).

- Gen Z Dominance: About 80% of blockchain developers in India are aged between 18 and 27, indicating a youthful and innovative workforce.

- Emerging Technologies: Preference for blockchains like Solana, with other platforms such as Ton, Aptos, and Base gaining traction.

- Investment Growth: Investments in India’s Web3 ecosystem surged by 224% in 2024, highlighting a positive trend for funding opportunities.

- Challenges in Workforce Compensation: Developers face a mismatch between salary expectations and employers’ willingness to pay, impacting talent retention.

- Gaming Sector Struggles: High customer acquisition costs and the challenge of retaining players beyond financial incentives are pressing issues for Web3 gaming projects.

- Call for Regulatory Clarity: The Indian Web3 sector needs clearer regulations to facilitate growth and attract investments, particularly for virtual asset service providers (VASPs).

- Small-Scale Trading Patterns: Traders engage primarily in small, frequent crypto trades, indicating diverse participation levels within the market.

- Women in Crypto: The increasing participation of women, represented by 1 in 10 futures traders, signals potential for wider engagement in the sector.

“India must overcome its negative policy perception that stifles innovation.” – Tak Lee, CEO of Hashed Emergent

The trends in India’s Web3 ecosystem present various possibilities for readers, especially those interested in technology, investments, and emerging markets. As the landscape evolves, staying informed can provide opportunities for participation in growth sectors and understanding the broader economic implications of Web3 innovations.

India’s Rising Influence in the Global Web3 Landscape

The dynamic world of Web3 is witnessing a significant shift, with India emerging as a formidable player in software development, gaming, and investor engagement. According to the India Web3 Landscape Report 2024, the country’s share of global Web3 developers has surged from 5% to 12% over the last decade, second only to the U.S. This impressive growth can be attributed to several factors, including high trading volumes and increasing institutional and retail adoption.

Competitive Advantages: India’s Web3 landscape benefits from a burgeoning developer community where around 80% are young professionals aged 18 to 27. This youth-driven enthusiasm brings fresh ideas and innovation, particularly in decentralized finance (DeFi), payments, and social finance (SocialFi). Additionally, the substantial growth in investment—224% from the previous year—highlights a growing confidence in the Indian market, drawing attention from local funds and corporate venture arms alike. Furthermore, the presence of fast-developing ecosystems like Solana, Aptos, and Base positions India advantageously within a global context, suggesting a healthy competition among various blockchain technologies.

Competitive Disadvantages: Despite these promising developments, India’s Web3 sector faces significant hurdles. Chief among these are regulatory uncertainties and an insufficient alignment with global salary standards, which may deter some of the most skilled professionals. Many startups struggle to secure funding, predominantly relying on crowd sales in the absence of traditional venture or private equity capital. Furthermore, the challenges of high customer acquisition costs in gaming compounded by a lack of engaging gameplay have reduced the attractiveness of Web3 games, potentially alienating traditional gamers.

This emerging landscape could significantly benefit young entrepreneurs and developers eager to make their mark within the crypto world. Additionally, investors seeking opportunities in emerging markets may find India’s growing Web3 ecosystem an attractive venture. However, established businesses and investors operating under conventional models may face challenges due to the evolving regulatory atmosphere and the need for a more robust ecosystem to support large-scale investments.

As India pushes for a more progressive regulatory framework to enhance investor confidence and streamline operations, stakeholders, including policymakers, need to recognize the potential of Web3. Ensuring that regulations nurture this burgeoning sector rather than stifle innovation will be crucial as India carves out its niche in the expansive global Web3 framework.