India continues to carve out a significant role in the global Web3 ecosystem, with its contributions to software development, gaming, investments, and startup funding showing impressive year-on-year growth. According to the India Web3 Landscape Report 2024 by Hashed Emergent, shared with Cointelegraph, India’s share of global Web3 developers surged from 5% to 12% over the past decade, making it the second-largest talent hub after the United States.

Tak Lee, CEO and Managing Partner at Hashed Emergent, attributes this remarkable rise in India’s crypto adoption to several key factors, including robust retail transactions via centralized platforms, strong trading volumes, and a growing interest in decentralized finance (DeFi). Notably, the landscape is increasingly dominated by Gen Z, with about 80% of blockchain developers in India aged between 18 and 27, showcasing a youthful and dynamic workforce.

“Several of these games are now focusing on having great quality games before integrating blockchain mechanics,” Lee explains, highlighting both the promise and challenges of the gaming sector within Web3.

Despite experiencing substantial growth, the Indian Web3 sector faces hurdles—most prominently the challenges associated with securing salaries that align with global standards and the high costs associated with customer acquisition in gaming. However, the investment landscape is notably more optimistic, with 2024 witnessing a 224% increase in Web3 funding compared to the previous year, coming from a mix of local funds and corporate investment arms.

As regulation remains a pressing issue, Indian firms are advocating for clearer guidelines that could bolster innovation and investment. A recent trend following regulatory initiatives has seen a notable shift towards decentralized exchanges or self-custodial solutions, as traders seek safer avenues amid policy uncertainties. While the taxation and regulatory framework for cryptocurrencies in India presents obstacles, experts believe that with thoughtful reforms, the Indian Web3 sector has the potential to thrive and lead on the global stage.

India’s Growing Influence in the Global Web3 Ecosystem

India is emerging as a significant player in the global Web3 landscape, particularly in software development, gaming, investments, and startup funding. Here are the key points highlighting this transformation:

- Developer Growth:

- India’s share of global Web3 developers has surged from 5% to 12% over the last decade.

- It is now the second-largest developer market, following the United States.

- Demographics of Web3 Developers:

- Approximately 80% of blockchain developers in India are between the ages of 18 and 27.

- Gen Z’s involvement is crucial, especially in sectors like DeFi, Payments, AI, and SocialFi.

- Funding Boom:

- Investments in the Indian Web3 ecosystem increased by 224% in 2024 compared to the previous year.

- Funding is sought through diverse channels, including local funds and ecosystem projects.

- Challenges Faced by Developers:

- Employers are reluctant to offer salaries that meet global industry standards.

- High customer acquisition costs (CAC) hinder the growth of Web3 gaming projects.

- Regulatory Environment:

- The absence of clear regulations is a barrier to investments and growth for many Web3 startups.

- Recent initiatives, like URL blocking of unlicensed crypto exchanges, redirect funds to regulated exchanges.

- Policy Recommendations:

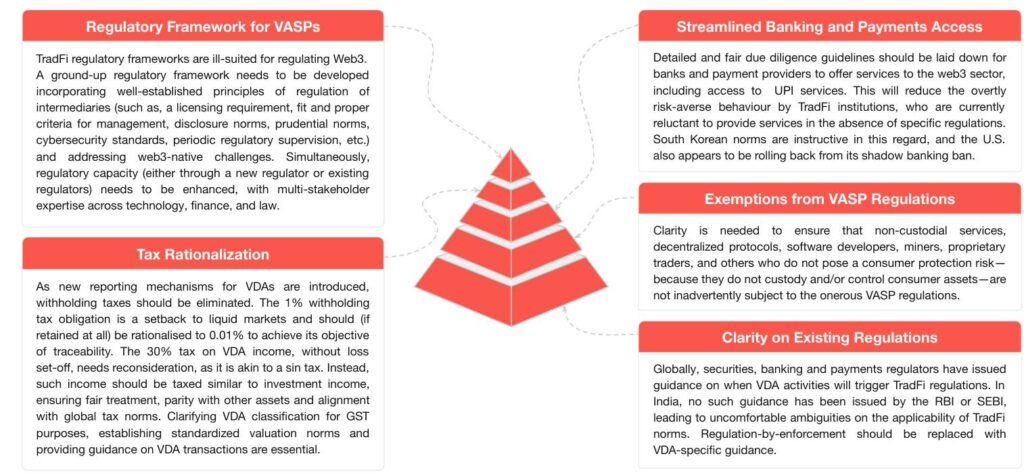

- Call for a regulatory framework for virtual asset service providers (VASP) and tax rationalization.

- Need for streamlined banking access and exemptions from stringent regulations to foster innovation.

“India must overcome its negative policy perception that stifles innovation and instead focus on identifying and addressing the pain points faced by stakeholders.”

This information impacts readers’ lives by illustrating the opportunities arising in India’s tech ecosystem, especially for young developers and entrepreneurs looking to engage with or benefit from the growing Web3 sector. Understanding these trends may motivate readers to explore professional paths in technology and finance, particularly in emerging areas like decentralized finance.

India’s Web3 Landscape: A Comparative Insight into the Global Ecosystem

As evident in the India Web3 Landscape Report 2024 by Hashed Emergent, India’s growth in the Web3 space is remarkable, especially given the persuasive challenges posed by a volatile regulatory environment. When juxtaposed with other nations leading the charge in crypto innovation, India showcases a unique blend of advantages and disadvantages that shape its role in the global Web3 ecosystem.

One of India’s standout features is its substantial growth trajectory in developer talent, which surged from capturing 5% to 12% of the global share in just a decade. This is particularly impressive when compared to regions like Europe and Southeast Asia, which are facing slower adoption rates. The vibrant participation of the Gen Z demographic, accounting for a striking 80% of blockchain developers, is a significant factor that distinguishes India from its competitors. This youth-driven energy not only injects creativity and innovation but also aligns with the emerging trends in decentralized finance (DeFi), gaming, and social finance known for appealing to a younger audience.

However, this progress isn’t without its pitfalls. Despite the increasing interest and investment inflow, challenges persist—most notably, the reluctance of employers to offer salaries that match those in more established markets, which could discourage top talent from remaining in the country. Additionally, the gaming sector in India grapples with high customer acquisition costs and a need to elevate gameplay quality beyond mere financial incentives. In regions like North America, gaming developers often benefit from more experienced ecosystems and better funding channels, allowing them to refine their products before introducing blockchain elements.

In terms of funding, while India saw a remarkable 224% increase in Web3 investments in 2024, the absence of robust growth capital means many startups are forced to resort to innovative methods like crowd sales to secure their futures. This contrasts sharply with more mature markets such as the United States, where established venture capital networks are readily accessible, enabling startups to grow at a much faster pace. The dynamic environment of India, with traditional investments lagging behind, could either present an opportunity for growth-focused investors or be a barrier for fledgling companies aiming for sustainable scalability.

Moreover, the regulatory landscape continues to plummet prospects in India, echoing sentiments shared by tech firms and developers alike. The calls for progressive regulations resonate strongly with those in the crypto space looking to capitalize on India’s burgeoning talent pool and market potential. Countries like Singapore have set precedents with clear regulations that foster innovation while ensuring compliance, making them more attractive for crypto enterprises. In contrast, India’s pressing need for clarity in its legal framework could be a double-edged sword, potentially stifling innovation while also creating opportunities for regulatory experts and compliance-related services.

In terms of targeted beneficiaries, the evident growth in small-scale crypto transactions and the leaning towards decentralized exchanges indicates ample room for companies that can innovate in the user experience. This burgeoning industry could particularly benefit from investing in educational programs aimed at newcomers in the crypto market, thus expanding their reach beyond the current demographics. On the flip side, startups that cannot navigate the regulatory quagmire may face prolonged challenges, leading to market exits compared to their counterparts in more favorable regulatory environments.

Ultimately, India’s journey within the Web3 landscape reflects a complex interplay of growth potential and systemic challenges. As the country continues to innovate, understanding these dynamics will be crucial for stakeholders across the board—from developers and investors to regulators and policy advocates—keen on tapping into the future of the digital economy.