In a striking development from Argentina’s cryptocurrency scene, a lawyer is pushing for an international arrest order for Hayden Davis, the founder of the controversial memecoin LIBRA. This news, reported by the Buenos Aires newspaper Pagina 12, highlights rising concerns about Davis potentially evading authorities, particularly given his status as a U.S. citizen and his financial resources, which might aid in his concealment.

Attorney Gregorio Dalbon expressed the urgency of the situation, suggesting that Davis’s continued freedom poses significant procedural risks, prompting the request for an Interpol red notice as part of the efforts to locate and extradite him.

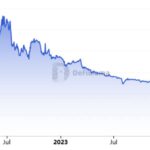

LIBRA, which once boasted a staggering market cap of .4 billion, has experienced a dramatic descent, plummeting over 95% in value just last month. This volatility comes on the heels of promotional support from Argentine President Javier Milei, who later recanted his endorsements after claiming ignorance about the project’s specifics. The fallout has been severe, with losses for investors estimated to reach a staggering 1 million, according to data from Nansen.

The request for an arrest order underscores the growing scrutiny of the cryptocurrency industry, where investor trust is increasingly tested against the backdrop of regulatory challenges and market fluctuations. The situation surrounding LIBRA serves as a stark reminder of the risks inherent in the memecoin landscape, attracting both legal action and public attention in the ever-evolving world of digital finance.

International Arrest Order Issued for Memecoin Founder Hayden Davis

Recent developments regarding the memecoin LIBRA and its founder, Hayden Davis, have raised significant concerns in the financial community and among investors. Here are the key points from the situation:

- International Arrest Request: An Argentine lawyer has formally requested an international arrest order for Hayden Davis, aiming to prevent him from evading legal consequences. This highlights concerns about accountability in the crypto industry.

- Risk of Flight: Attorney Gregorio Dalbon expressed fears that Davis, as a U.S. citizen, might evade arrest due to his financial resources, increasing the urgency for action.

- Interpol Involvement: The request includes a call for an Interpol red notice to locate Davis, indicating the international scope of the case and the seriousness of the allegations.

- LIBRA’s Market Collapse: LIBRA previously reached a market cap of .4 billion but has since experienced a dramatic decline of over 95%, resulting in significant financial turmoil.

- Investor Losses: Reports suggest that LIBRA’s collapse has led to estimated losses of 1 million for investors, which raises questions about investor protection in the cryptocurrency sphere.

- Political Fallout: Argentine President Javier Milei initially promoted LIBRA but later distanced himself from the project after its failure, reflecting the complex interplay between politics and cryptocurrency.

This situation exemplifies the risks associated with investing in cryptocurrencies and highlights the need for regulatory oversight and investor education in the crypto market.

International Arrest Warrant for LIBRA’s Founder: Implications and Insights

The recent developments surrounding Hayden Davis, the founder of the LIBRA memecoin, have sent shockwaves through both the cryptocurrency community and the legal landscape. A lawyer in Argentina, Gregorio Dalbon, has taken the dramatic step of requesting an international arrest order for Davis, citing concerns over his potential to evade justice due to significant financial resources. This situation not only highlights the vulnerabilities of the cryptocurrency market but also raises questions around the regulatory oversight of digital assets.

Competitive Advantages: One of the notable aspects of this news is how it spotlights the increasing scrutiny of cryptocurrency projects, especially those backed or endorsed by public figures, such as Argentine President Javier Milei. The public backtracking by Milei after the LIBRA memecoin’s sharp decline emphasizes the need for clearer regulations and accountability within the burgeoning crypto space. Such actions could potentially pave the way for more stringent guidelines that protect investors from losses, which might engender greater trust in the market in the long run.

Moreover, this case brings to light the role of international cooperation in addressing crimes related to digital currencies. The pursuit of an Interpol red notice signifies a move towards a global approach in handling cryptocurrency fraud, demonstrating a growing acknowledgment of the need for jurisdictional collaboration in a borderless digital economy. This could bolster regulatory frameworks worldwide, enhancing consumer protection.

Disadvantages and Challenges: On the flip side, the situation presents several challenges, particularly for investors who have been hit hard by the dramatic 95% decline in the LIBRA’s market cap and the staggering estimated losses of 1 million. Such an arrest could prolong the recovery process for affected parties, as legal proceedings may take substantial time to unfold. Additionally, the portrayal of the memecoin and its founder as fugitives could embolden anti-cryptocurrency sentiment, complicating efforts for legitimate projects to gain acceptance and regulatory approval.

This news could substantially benefit regulatory bodies and legal authorities who are keen on establishing stricter compliance measures within the crypto ecosystem. Conversely, it creates potential problems for investors and the broader crypto community, where uncertainty reigns and the damage to trust can have long-lasting effects. Emerging projects may struggle to differentiate themselves in an environment tainted by high-profile scandals, making it crucial for new players to establish robust governance frameworks from the outset.