In a striking development within the cryptocurrency landscape, betting against Ether has emerged as a standout strategy for exchange-traded funds (ETFs) in 2025. According to Bloomberg analyst Eric Balchunas, two ETFs designed for leveraged short positions in Ether (ETH) have dominated the performance charts this year, securing the top two spots in a Bloomberg Intelligence ranking. The ProShares UltraShort Ether ETF (ETHD) has surged approximately 247%, while its counterpart, the T Rex 2X Inverse Ether Daily Target ETF (ETQ), is up around 219%. This trend marks a significant downturn for Ether itself, which has plummeted about 54% year-to-date as of early April.

Eric Balchunas noted that the implications for Ether could be “brutal,” especially considering the fact that these ETFs utilize financial derivatives to achieve their performance, often experiencing twice the volatility of the underlying asset. However, it is essential to point out that leveraged ETFs do not always perfectly track the performance of their corresponding assets. In fact, Ether’s struggles are reflected in broader trends, with its native token waning since the March 2024 launch of the Dencun upgrade. This upgrade, intended to reduce costs for users, drastically cut the network’s fee revenues by approximately 95%, providing a challenging environment for Ethereum’s financial ecosystem.

“Ethereum’s future will revolve around how effectively it serves as a data availability engine for L2s,” said arndxt, author of the Threading on the Edge newsletter, emphasizing the importance of Layer-2 scaling solutions.

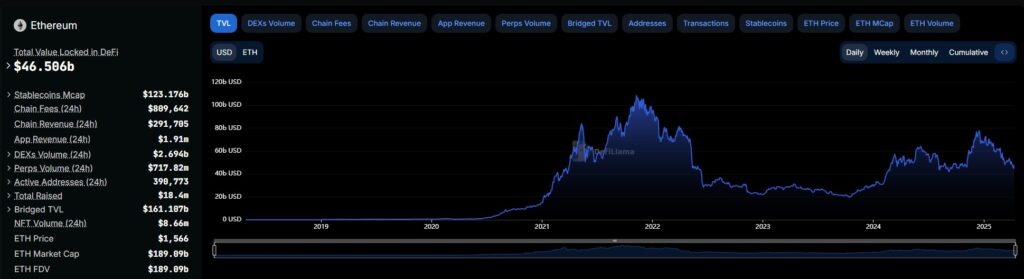

While Ethereum remains the top blockchain network with about $46 billion in total value locked (TVL), its performance has experienced a noticeable slowdown. Layer-2 chains like Arbitrum and Base have struggled to generate significant revenue, with Ethereum earning a mere 3.18 ETH from transactions on these platforms in a recent week. Experts argue that to reclaim its pre-Dencun peak fee revenues, transaction volumes on Layer-2 networks would need to soar by an astonishing 22,000%. Furthermore, a current report from asset manager VanEck highlights a general decline in usage across smart contract platforms, indicating that the cryptocurrency market grapples with cooling sentiment amid geopolitical tensions, including potential US tariffs and a looming trade war.

Key Insights on Ether and ETF Performance in 2025

The current performance of Ether and related Exchange Traded Funds (ETFs) reveals significant trends in the crypto market. Below are the essential points gathered from recent analyses.

- Best Performing ETFs:

- ProShares UltraShort Ether ETF (ETHD) and T Rex 2X Inverse Ether Daily Target ETF (ETQ) have outperformed other investment strategies in 2025.

- ETHD is up approximately 247%, while ETQ has increased by about 219% year-to-date.

- Impact on Ether:

- Ether’s price is down approximately 54% year-to-date, indicating a bearish market sentiment surrounding the cryptocurrency.

- The success of these ETFs suggests a growing interest in shorting Ether, which could further influence its downward trajectory.

- Financial Derivatives:

- Both high-performing ETFs rely on financial derivatives to inversely track Ether’s performance, amplifying volatility and risk.

- Leveraged ETFs are complex and do not always perfectly track their underlying assets, making them a risky investment choice for inexperienced traders.

- Ethereum’s Revenue Challenges:

- The Dencun upgrade in March 2024 significantly reduced Ethereum’s fee revenue by approximately 95%, impacting its overall financial health.

- Investment in layer-2 (L2) scaling solutions has not yet led to recovery in transaction revenue, thus challenging Ethereum’s long-term viability.

- Layer-2 Transaction Needs:

- To return to pre-upgrade revenue levels, transaction volumes on L2 chains would need to increase over 22,000-fold.

- Ethereum’s future success is tied to how well it can support L2 transactions, as outlined by market experts.

- Market Sentiment Effects:

- Cooling sentiment and impending economic policies, such as US tariffs, are causing decreased usage across smart contract platforms, including Ethereum and Solana.

- The overall decline in market activity suggests a broader trend of caution among traders which could further affect Ether and related investments.

Betting Against Ether: The Rise of Inverse ETFs and Its Implications

In a striking turn of events in the cryptocurrency markets, two exchange-traded funds (ETFs) have surged to the forefront as the best-performing strategies by taking a bold stance against Ether (ETH). This trend, highlighted by Bloomberg analyst Eric Balchunas, sees the ProShares UltraShort Ether ETF (ETHD) and T Rex 2X Inverse Ether Daily Target ETF (ETQ) thriving with exceptional gains of 247% and 219% year-to-date, respectively. However, these successes come during a tumultuous period for Ether, which has fallen approximately 54% in the same timeframe, as recorded by Cointelegraph.

Such impressive returns position these ETFs favorably in a competitive landscape filled with various investment options. Leveraged short ETFs like ETHD and ETQ are particularly appealing to savvy traders looking to capitalize on downturns in the market. Unlike traditional investments that rely on the asset’s performance, these ETFs utilize financial derivatives to multiply gains (and risks), which can attract a certain type of high-risk investor. This unique strategy allows them to outperform many conventional funds amidst the ongoing bearish trends in the crypto market.

However, these leveraged ETFs come with significant caveats. Their performance can be unreliable; they do not always correlate perfectly with the underlying asset, which could lead to unexpected losses if the market swings unexpectedly. Moreover, they may create volatility that is daunting for average investors. These products primarily cater to experienced traders and could pose substantial risks for less seasoned individuals who might not fully grasp the mechanics of leveraged investments.

The current state of Ether, particularly following the Dencun upgrade, illustrates the complicated terrain these ETFs inhabit. Ethereum’s sharp decline in revenue—down by 95% after efforts to reduce users’ transaction costs—poses challenges not only for the ETH token but also for investors in these inverse ETFs. While current market sentiment appears negative, the underlying fundamentals of Ethereum, including its total value locked at $46 billion, could provide a cushion of support that longer-term investors might seek to explore, especially if layer-2 solutions become more effective.

The broad implications of this ETF strategy can greatly impact market sentiment surrounding Ethereum and other smart contracts platforms. Traders may feel emboldened by the swift gains from ETHD and ETQ, which could accentuate volatility even as Ethereum’s base performance remains lackluster. Still, with a looming economic climate shaped by tariff pressures and market adjustments, the strategy of betting against Ether could attract both opportunities and risks for different profile investors, particularly those focused on short-term gains. As Ethereum continues to face its trials, the adept trader might find this as an auspicious moment to engage with these financial instruments—if they navigate the complexities wisely.