In a financial landscape that’s shifting faster than many had anticipated, a new trend is emerging—one that puts investment advisers on the cusp of becoming the dominant players in the U.S.-listed spot Bitcoin (BTC) exchange-traded fund (ETF) market by next year. This change won’t just be a subtle rebalancing of market participants; it’s poised to reshape how Bitcoin ETFs are approached, understood, and incorporated into portfolios across the board.

If you’re an investor or an adviser reading this, you may feel both excited and a bit apprehensive about what this means for your investment strategy. You’re not alone. It’s a challenging yet thrilling time, as traditional financial players are beginning to deeply engage with what was once considered a niche corner of the market. This paradigm shift signals an evolution in the level of trust being placed in Bitcoin as a viable and scalable financial instrument.

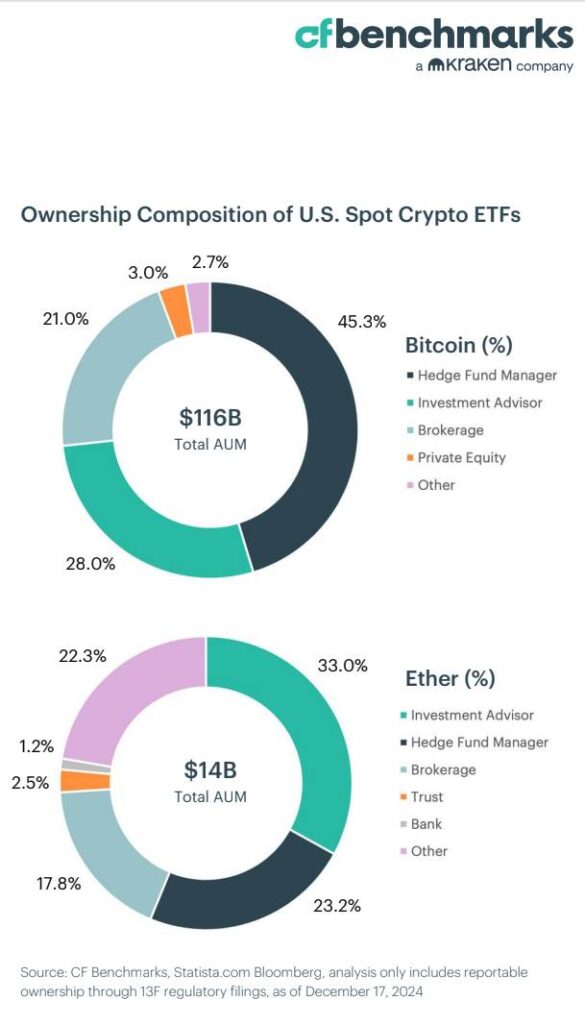

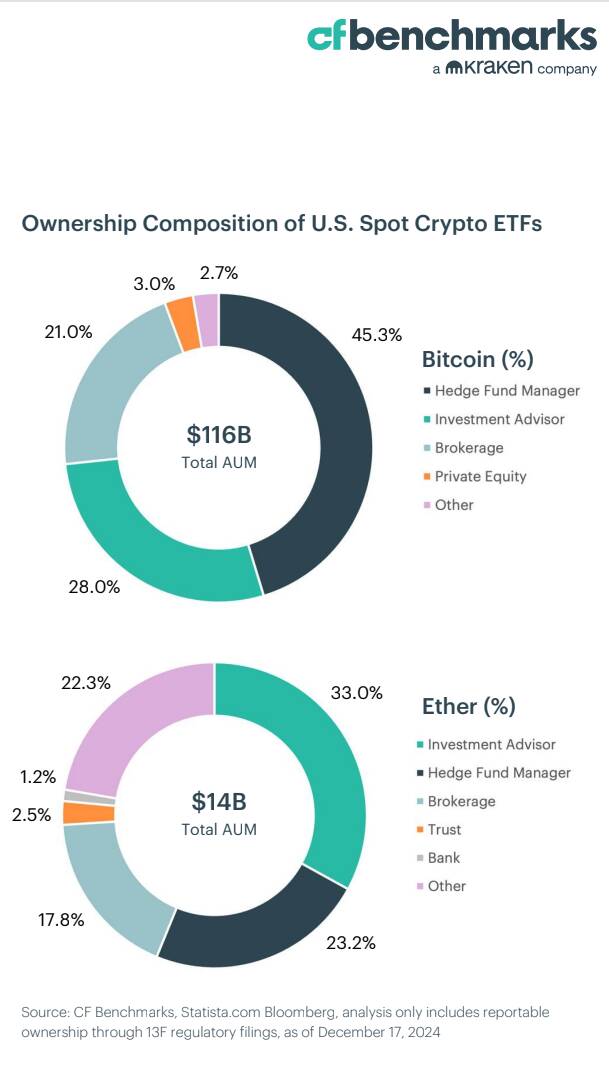

When spot BTC ETFs entered the U.S. markets at the start of 2023, they unlocked new possibilities for investors longing to gain Bitcoin exposure without the complexity of owning and securing the actual cryptocurrency. Since then, these products have grown to manage over billion, a staggering milestone that underscores the appetite for digital assets in traditional financial markets. Hedge funds have dominated this space, representing 45.3% of holders, while investment advisers have held a relatively modest 28% share—so far.

But 2025 is expected to flip the script. According to projections from CF Benchmarks, investment advisers are likely to leap ahead, claiming over 50% of the share in spot Bitcoin ETFs. Why? A combination of factors stands behind this seismic shift: surging client demand, increased product understanding, and the overdue embrace by the mammoth trillion U.S. wealth management industry. In short, Bitcoin ETFs are maturing, and their potential for inclusion in mainstream portfolios is being recognized like never before.

As an investor, you’ve probably asked yourself, “Why now?” The answer lies in a broader change happening across financial systems. Bitcoin ETFs are no longer merely high-risk, fringe investments. Many are beginning to see them as powerful tools for portfolio diversification, inflation hedging, and even wealth preservation. That realization has turned investment advisers—the gatekeepers of retail and high-net-worth individual capital—into enthusiastic advocates for these instruments.

There’s no denying that this transformation brings more than just numbers on a chart. It represents a cultural shift within the advisory community, a willingness to explore, learn, and adopt tools that might have previously seemed daunting or overly unconventional. While hedge funds have leaned on their adventurous nature to fuel early growth in Bitcoin ETFs, investment advisers are carving a path of stability and trust, incorporating these into model portfolios with thoughtfulness and due diligence.

If you’re working with a financial adviser or considering engaging one, this is an encouraging development. It means a wider array of professional services supporting your decisions, backed by an evolving understanding of digital assets. For those who may have been hesitant to tiptoe into the Bitcoin or crypto space, this could mark the beginning of increased confidence, transparency, and accessibility.

The ground is shifting beneath the financial industry, but it’s not about chaos—it’s about growth. With investment advisers gearing up to take the lead in Bitcoin ETF holdings, it signals a new chapter where digital assets are not just for the daring but also for those seeking thoughtful, long-term strategies. The stage is set, and the next step in Bitcoin’s journey is one of trust, integration, and far-reaching potential.

While investment advisers are gearing up to take center stage, hedge funds—the early adopters and initial trailblazers of the BTC ETF market—are now facing a slow, yet steady decline in market share. For years, hedge funds have been at the forefront of embracing Bitcoin as an investable asset, often leveraging their ability to take on significant risk and experiment with unorthodox financial instruments. These firms initially thrived in the emerging Bitcoin ETF space, accounting for nearly half of all holdings when the products first launched. But as the landscape evolves, the unique strengths of hedge funds may no longer be enough to maintain their leading position.

If you’re someone who admires the bold and adventurous nature of hedge funds, you might feel a twinge of concern about their waning dominance. After all, these sophisticated entities were among the first to see beyond Bitcoin’s volatile reputation, identifying its potential as a hedge against inflation and as a diversifying “new asset class.” But this doesn’t mean hedge funds will disappear from the picture—it simply means their role may look different as the ecosystem matures.

So, why are hedge funds losing ground? The answer lies in the rise of a more cautious and inclusive approach to Bitcoin investing. Investment advisers are stepping onto the stage precisely because they cater to a broader audience—everyday investors, retirees, and high-net-worth individuals who may not have the appetite or infrastructure to manage direct crypto exposure. This shift toward a middle-ground approach, balancing risk and accessibility, is naturally better suited for advisers than for hedge funds, whose strategies often rely on aggressive alpha-seeking tactics.

Another factor contributing to hedge funds’ shrinking market share is the increasing pressure to operate within tighter regulatory frameworks. Hedge funds historically thrived in the “early adopter” era of Bitcoin trading, leveraging opaque markets and high-risk arbitrage opportunities. But as Bitcoin ETFs expand and gain regulatory approvals, their very existence is reshaping how Bitcoin is traded and held, transferring much of the competitive edge to providers who prioritize transparency and compliance—traits more closely associated with advisors than hedge funds.

Moreover, market dynamics are shifting in ways that do not cater as easily to hedge funds’ tactical strengths. For instance, many hedge funds relied on the volatile nature of Bitcoin for short-term gains, but as educational awareness grows and mainstream adoption stabilizes, Bitcoin ETFs are increasingly viewed as long-term, strategic allocations rather than speculative opportunities. This aligns better with the mindset of wealth management advisers structuring portfolios to weather economic cycles rather than chase quick returns.

Even so, it’s essential to remember that hedge funds are not fading into irrelevance. Rather, their role in the crypto ecosystem may shift toward specialization. Many are moving toward more complex strategies—like pairing Bitcoin exposure with other decentralized finance (DeFi) assets, tokenized real-world assets, or staking-focused investment vehicles. Hedge funds are uniquely equipped to explore niches that may remain out of reach for the broader advisory industry. This pivot could make them key players in developing the next wave of financial innovation in crypto markets, particularly as technologies like Ethereum scaling and asset tokenization continue to grow.

So what does this mean if you’ve been following Bitcoin ETFs and are now wondering whether hedge funds’ reduced dominance should concern you? The truth is, it doesn’t need to. While the shift in market share reflects a natural evolution, it actually signifies greater maturity in the industry. Hedge funds are rebalancing their focus, and investment advisers are stepping in to serve a different kind of investor—one seeking security and long-term stability in an exciting but sometimes intimidating asset class.

Ultimately, this transition builds more options for investors like you. It’s no longer just about the high-risk, high-reward strategies of hedge funds; it’s also about safer, more measured participation in the cryptocurrency market. Whether you lean toward the bold or the steady, this diversification of approaches ensures there’s something for everyone in the world of Bitcoin ETFs. And that, in itself, is a sign of just how far the market has come. The baton might be changing hands, but the race to integrate Bitcoin into mainstream finance is only just gathering speed.

As the cryptocurrency landscape continues to mature, the role of wealth management in facilitating clients’ exposure to digital assets is taking center stage. Historically cautious and methodical, the wealth management industry is now warming up to crypto, not as a speculative gamble, but as a meaningful component of comprehensive portfolio strategies. If you’re hesitant about how this shift might impact you—or if you’re eager to see what’s in store—you’re not alone. This evolution signals a pivotal moment where wealth managers are embracing the very thing that many thought they would forever resist.

For a long time, traditional financial advisers kept their clients at arm’s length from Bitcoin and other digital assets. The reasons were multifaceted—volatility fears, regulatory ambiguity, and a general lack of understanding about the technology behind crypto. These concerns weren’t baseless. Many investors still remember Bitcoin’s dramatic price swings or have read headlines about security breaches and fraud. If you’ve shared in these concerns, rest assured that wealth managers have heard them too. And they’ve started addressing those challenges in ways that bring clarity and confidence to the table, rather than chaos.

One of the most significant catalysts behind this shift is the advent of regulated Bitcoin ETFs. For advisers who previously balked at the complexity of holding private keys or navigating exchanges, these ETFs offer a more familiar and less intimidating entry point. With trillions of dollars currently flowing through the U.S. wealth management industry, advisers are rethinking how Bitcoin and crypto can fit into their clients’ objectives without upending legacy practices.

Here’s what’s driving this transformation:

- Client Demand: A growing number of retail and high-net-worth investors are asking their advisers about Bitcoin. Some see it as a hedge against inflation; others view it as an opportunity for diversification or exposure to an emerging technology. By responding to these inquiries, advisers are not just reacting—they’re proactively building trust by aligning their services with their clients’ evolving needs.

- Enhanced Education: The narrative around crypto has shifted from one of skepticism to one of curiosity and understanding. Many advisers are now investing in their education, obtaining certifications in blockchain and digital asset advisory. This deepened knowledge is giving them the tools to explain risks and rewards to clients in a balanced, transparent way.

- Regulatory Clarity: Despite varying opinions on how governments should handle digital assets, there’s no question that clearer regulations make the conversation easier. Advisers can now point to U.S.-regulated products like Bitcoin ETFs as a safer, more structured way to explore crypto without diving headfirst into unregulated waters.

- Portfolio Integration: Crypto is no longer seen as this standalone, risky outlier; instead, wealth managers are finding ways to fold it into broader investment strategies. Whether it’s a 1-2% allocation to mitigate inflation or using crypto as part of an ESG (environmental, social, governance) narrative through energy-efficient blockchains like Ethereum, the integration feels deliberate and thoughtful.

If you’re wondering whether this is just a passing trend or the start of something more entrenched, consider the scale of this shift. CF Benchmarks expects investment advisers to command over 50% of the Bitcoin and Ethereum ETF markets by next year. That kind of growth doesn’t come from speculative whims but rather from sustainable, strategic decisions to meet growing investor demand.

Moreover, this integration of crypto into wealth management isn’t just about Bitcoin ETFs. Digital assets are being viewed holistically, with advisers increasingly exploring opportunities in emerging areas like asset tokenization, staking, and decentralized finance (DeFi). Imagine real estate being tokenized so that you could own a fraction of a high-value property, all while having it professionally managed in your portfolio. These innovations are becoming more accessible thanks to advisers who are willing to step into the digital frontier and make it approachable for their clients.

Does this mean every adviser will fully embrace digital assets overnight? Probably not. But for those who recognize the transformative potential of blockchain technology, the shift is already underway. If you’re feeling overwhelmed or uncertain about how crypto might fit into your investment strategy, now is the time to lean on professional guidance. The technologies may be complex, but the aim of wealth managers remains simple: to advocate for your interests while minimizing risk.

The evolving role of wealth management in crypto is a testament to how far the industry—and public perception—has come. From skeptical onlookers to cautious adopters, investment advisers are now rewriting the playbook for how digital assets can play a key role in building wealth. And as they expand their expertise, they’re offering you, the investor, something invaluable: the chance to navigate this new frontier with confidence.

The financial world is no stranger to rapid innovation, but few trends have captured the imagination of investors and industry leaders quite like the rise of asset tokenization. This transformative shift is beginning to ripple across capital markets, promising a streamlined, accessible, and more efficient way to represent ownership of real-world assets (RWAs) like real estate, bonds, and commodities on blockchain networks. Coupled with advancements in blockchain scalability, it’s clear that 2025 will be a watershed year for this evolving technology. If you’ve been wondering what this means for your portfolio—or the financial ecosystem as a whole—you’re not alone. It’s an exciting yet uncertain time, and there’s a lot to unpack.

First, let’s break down what asset tokenization truly entails. Imagine owning a fraction of a luxury skyscraper or participating in the cash flow of a renewable energy project without the traditional barriers of minimum investment thresholds, geography, or intermediary fees. This is the promise of tokenized RWAs—assets that have been transformed into digital tokens recorded and traded on blockchains. No longer just a concept, tokenization is beginning to reshape the market; in fact, reports suggest that by 2025, tokenized real-world assets could surpass billion in value.

If you’re skeptical about these projections, you’re not alone. Many traditional investors are still wrapping their heads around the practical implications of tokenization. Questions like “How secure is it?” or “What kind of regulatory framework exists?” loom large. But the answers to these questions are beginning to come into focus, and the broader financial system’s confidence in blockchain technology is growing with each passing year. In fact, governments, financial institutions, and independent auditors are now paying closer attention to ensure this innovation aligns with existing laws and protections.

In parallel with tokenization, blockchain scalability is finally getting the attention it deserves, and for good reason. Blockchain networks need to process large volumes of transactions quickly, cheaply, and securely to support mass adoption. As tokenized assets gain traction and active user participation swells, major blockchains face the challenge of ensuring they can deliver on their promise without grinding to a halt under pressure. Ethereum, the frontrunner in this space, is already leading efforts to scale its network with advanced solutions like rollups and sharding. Meanwhile, blockchains such as Solana—often deemed the “speedster” of the Web3 world—are competing fiercely to carve out their own niche by providing ultra-fast, low-cost networks among institutional investors.

The ambitious growth projections for these technologies come with their fair share of growing pains, and as an investor, it’s natural to feel a bit apprehensive. Will the technology hold up? Will unforeseen bugs or vulnerabilities create risks to your capital? These wouldn’t be the first concerns to surface around new technologies. But rest assured, these concerns are being addressed with proactive measures, both technological and structural, to make the blockchain space more resilient and investor-friendly.

One example of this resilience is evident in the countless ongoing collaborations between blockchain foundations and independent developers. You may, for instance, have heard of the Ethereum Foundation’s consistent efforts to upgrade its network capacity, ensuring that as new tokenized assets flood into its ecosystem, it remains robust enough to handle increased transactional workloads. Similarly, Solana’s development of localized fee markets shows its commitment to keeping costs predictable and usage efficient even during periods of high demand. These efforts are paving the way for smoother on-chain operations, preventing common bottlenecks like skyrocketing gas fees or network congestion.

So what does this all mean for you as an investor? For starters, advancements in both blockchain scalability and asset tokenization are expected to dramatically lower the barriers to entry for markets that were once restricted to a select few. Whether you’re considering fractional ownership of a multimillion-dollar property or participating in the yield from tokenized debt instruments, this technology has the potential to democratize participation in lucrative asset classes. Furthermore, these emerging innovations align perfectly with wider market trends favoring transparency and efficiency. Blockchain technology’s inherent ability to provide clear records of ownership and transactions is a boon to wary investors seeking to minimize ambiguity in their financial decisions.

There’s also an ecological component at play here. Concerns about the environmental impact of blockchain technology have shadowed its meteoric rise, but those fears are beginning to diminish as major chains migrate to more energy-efficient operations. Ethereum’s transition to proof-of-stake in 2022 was a pivotal moment that slashed its energy consumption by over 99%, and other chains are following suit with their own eco-friendly upgrades. For investors prioritizing ESG (environmental, social, and governance) initiatives, these advancements lend significant credibility to the potential of asset tokenization to align with sustainable growth practices.

Regulatory clarity is another critical factor that will shape the growth of both asset tokenization and blockchain scalability in the coming years. While the regulatory status of digital assets has historically been murky, 2025 promises to bring cleaner lines of demarcation. As the U.S. and other developed markets roll out clearer frameworks addressing tokenization, stablecoins, and digital asset trading, institutional investors are expected to accelerate their adoption pace. These regulations, while occasionally stringent, serve to protect market participants from fraud and abuse—essential elements for driving mainstream comfort with blockchain innovation.

Still, there’s much work to be done. Scaling blockchain to process thousands of transactions per second (TPS)—what might be necessary for widespread tokenization adoption—won’t happen overnight. Ethereum is currently nearing levels that allow 1,600 TPS, a dramatic improvement from its prior limitations, but further development will be crucial. Emerging contenders like Solana and Avalanche will also play significant roles, potentially complementing Ethereum’s dominance in blockchain-based tokenization. In this competitive environment, a multi-chain future seems almost inevitable.

As we look ahead, the key takeaway is this: asset tokenization and blockchain scalability are no longer fringe ideas. They are becoming core pillars of how our financial systems will evolve. For investors, this convergence presents not just risks, but also opportunities to shape what wealth management will look like in the next decade. If you’re feeling daunted by these developments, that’s natural. After all, every revolutionary idea requires time to truly sink in. But you’re not alone in this journey. Every day, market leaders, regulators, developers, and advisers are striving to make this ecosystem smarter, safer, and more accessible for everyone.

The financial tools of the next generation are being built today, and you’re in a unique position to watch—or even actively participate—as this transformation unfolds. By staying informed and seeking professional guidance, you can ready yourself to embrace this new frontier with confidence, knowing that the landscape is slowly—but surely—maturing in ways that empower investors from all walks of life.

In the complex web of forces shaping the future of Bitcoin and broader cryptocurrency adoption, macroeconomic factors are emerging as some of the most significant drivers of change. As economic policy shifts, global markets adjust, and traditional financial systems face fresh pressures, Bitcoin’s role as a hedge, an asset class, and a store of value is becoming more defined. For investors like you, curious about what all of this means, the intersection of macroeconomic trends and Bitcoin adoption holds immense potential—and perhaps, a measure of reassurance amid uncertainty.

One of the biggest macroeconomic shifts underway is the evolving stance of central banks, particularly the U.S. Federal Reserve. Over the past couple of years, interest rate hikes have dominated the conversation, creating ripple effects across everything from housing markets to equity valuations. However, CF Benchmarks anticipates that 2025 will bring a “dovish pivot” from the Federal Reserve. In response to rising national debt servicing costs and signs of a softening labor market, it’s expected that the Fed might explore unconventional monetary policies like yield curve control or enhanced asset purchases—strategies that ease debt burdens but carry inflationary risks. For Bitcoin, this policy environment could prove to be profoundly favorable. Why? Because Bitcoin has increasingly been lauded as a hedge against inflation and a counterbalance to monetary debasement.

If you’ve been uneasy about persistent inflation or worried about the value of your dollar eroding over time, you’re not alone. The economic pressures we’re witnessing aren’t unique to the U.S.; many global economies are battling similar challenges, leading to greater scrutiny of fiat currency systems altogether. With Bitcoin’s finite supply capped at 21 million coins, more institutional and individual investors are beginning to see it as a digital equivalent of gold—scarce, decentralized, and beyond the reach of manipulative monetary policy. Bitcoin’s ability to exist independently of central bank decisions is part of its growing appeal in unstable economic climates.

Another factor boosting Bitcoin adoption is the increasing debt loads governments worldwide are accumulating. High levels of sovereign debt mean that governments often resort to fiscal strategies that devalue their local currencies, adding layers of vulnerability to fiat-based investments. This environment makes Bitcoin’s non-sovereign nature exceedingly attractive, particularly for individuals looking to preserve wealth against potential default risks or government-led monetary interventions. By acting as a hedge against these vulnerabilities, Bitcoin is finding its way into portfolios not just as a speculative asset but as a pillar of long-term security.

Geopolitical uncertainty also plays a significant role in setting the stage for Bitcoin adoption. The turbulence caused by ongoing conflicts, trade wars, and power shifts between global superpowers has forced investors to rethink the traditional avenues of safeguarding wealth. In this volatile environment, Bitcoin’s decentralized and borderless characteristics shine brightly. Whether it’s sanctions, capital controls, or regional instabilities, Bitcoin offers a financial alternative that transcends national boundaries—a quality that’s resonating with investors in regions experiencing heightened political or economic turmoil.

As these macroeconomic forces converge, another noteworthy trend is the demand for greater financial inclusion. In parts of the world where access to reliable banking services remains a challenge, cryptocurrencies like Bitcoin are stepping in to fill the gap, enabling transactions, savings, and investments for the unbanked. The rising adoption of Bitcoin in developing economies showcases its potential as both a lifeline and a tool for empowerment. If financial inclusion is a cause close to your heart, the rise of Bitcoin also represents a deeper, transformative story—one where economic participation becomes available to more people than ever before.

On the regulatory front, clarity is unfolding at an encouraging pace, which could also spur Bitcoin adoption. The incoming U.S. administration has signaled an interest in providing a clearer framework for digital assets that balances innovation with investor protection. This is a positive sign for anyone hesitant about the risks of a still-maturing market. Regulatory transparency not only legitimizes Bitcoin in the eyes of institutional investors but also deters bad actors, creating safer environments for everyday investors to explore this asset class.

Importantly, Bitcoin’s upward trajectory isn’t entirely just about hedging risk or navigating economic turbulence. It’s also about opportunity—an innovative asset class with untapped growth potential. As fiscal and social attitudes lean toward digital transformation, Bitcoin continues to benefit from its status as a first mover. Think about it this way: when companies, institutions, and individuals look to the future of decentralized finance, Bitcoin is often where the conversation begins. Its cultural and financial significance is undeniable, and macroeconomic forces are simply accelerating its path to widespread adoption.

If you’re tempted to align your portfolio with these trends but still feel apprehensive, that’s completely understandable. Cryptocurrencies like Bitcoin can feel like uncharted territory, especially if you’re accustomed to traditional investments like stocks or bonds. But the macroeconomic backdrop of rising inflation, dovish monetary policies, and geopolitical restructuring suggests this might be worth a second look. The key is taking small steps—whether through regulated Bitcoin ETFs or working with a trusted adviser who can guide you through this evolving landscape.

Macroeconomic forces can sometimes feel daunting, shaping the financial environment in ways that are hard to predict or control. But within these shifts, the growing recognition of Bitcoin as a powerful, viable asset is a point of consistency. Whether you’re drawn to its inflation-resistant properties, intrigued by its role in fostering a more inclusive global economy, or simply focused on diversifying your portfolio, there are numerous pathways to engage with this trend. As 2025 approaches, one thing is clear: Bitcoin is no longer just a speculative asset—it’s becoming an integral tool for navigating the complexities of the modern financial era.