A significant shift in leadership has taken place at Janover, a real estate financing company, following the acquisition by a group of former executives from Kraken, a major player in the cryptocurrency exchange arena. Joseph Onorati, the former chief strategy officer at Kraken, has now assumed the roles of chairman and CEO. This strategic move includes the purchase of over 700,000 common shares and the entirety of Janover’s Series A preferred stock, signaling a strong commitment to the company’s future.

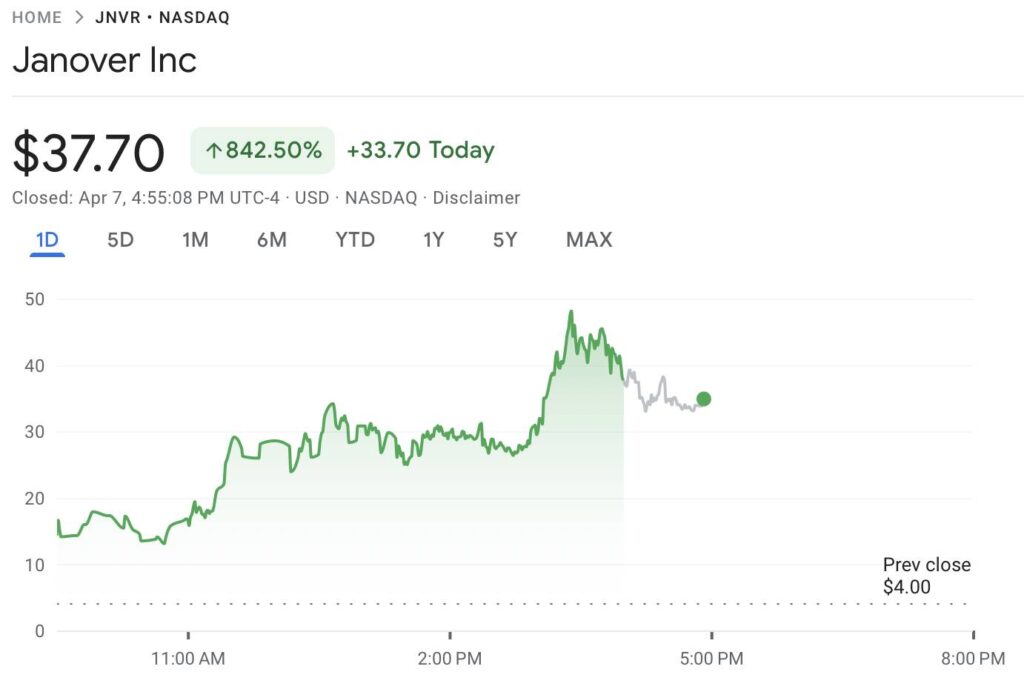

Parker White, a former director of engineering at Kraken, has been appointed as the new chief investment officer and chief operating officer, while Marco Santori, previously the chief legal officer at Kraken, will join Janover’s board. The executive team is eager to leverage their experience in the cryptocurrency sector to bolster Janover’s operations, particularly as the stock price experienced an astonishing 840% increase on April 7, coinciding with the announcement of the acquisition.

In a bold move toward integrating cryptocurrency into its core operations, Janover plans to establish a Solana (SOL) reserve treasury. This initiative involves acquiring Solana validators and staking SOL, along with additional purchases of the token. Such strategies indicate a growing trend among companies exploring how cryptocurrencies can enrich traditional business models. This approach is reminiscent of other firms that have successfully integrated digital assets into their balance sheets, with some even experiencing remarkable stock price increases as investors sought exposure to this burgeoning market.

“In December 2024, Janover began accepting payments for its services using Bitcoin (BTC), Ether (ETH), and Solana (SOL), further demonstrating its commitment to the evolving financial landscape,”

The company has also recently raised $42 million through an offering of convertible notes, attracting notable investors including Pantera Capital and, of course, Kraken itself. While this method of financing has gained traction within the industry, it has sparked debates regarding potential risks associated with the volatility of cryptocurrencies. Indeed, SOL has shown substantial fluctuations over the past year, with its price soaring to $274.50 and plunging as low as $107.68, highlighting the unpredictable nature of the crypto market.

This dynamic shift and Janover’s exploration into the crypto realm could signal the start of a new era in real estate financing, where traditional and digital currencies may effectively coexist and thrive.

Leadership Transition at Janover and Its Implications

Recent developments at Janover, a real estate financing company, present intriguing opportunities and considerations for investors and industry stakeholders. Here are the key points of interest:

- Executive Changes:

- Joseph Onorati steps in as chairman and CEO after former Kraken executives took control.

- Parker White appointed as chief investment officer and chief operating officer.

- Marco Santori joins the board as former chief legal officer at Kraken.

- Share Purchase:

- The new leadership has acquired over 728,632 common shares and all Series A preferred stock.

- Share price surged by 840% on April 7, indicating strong investor confidence.

- Investment and Funding:

- Janover raised $42 million through convertible notes, signaling significant market interest.

- Key participants include notable firms like Pantera Capital and Kraken, enhancing credibility.

- Crypto Integration:

- Plans to create a Solana (SOL) reserve treasury and acquire validators indicate a strategic digital asset move.

- Janover started accepting payments in Bitcoin (BTC), Ether (ETH), and SOL, broadening its appeal in a crypto-savvy market.

- Market Trends:

- Companies holding cryptocurrencies on their balance sheets have often seen stock price increases.

- Cryptocurrency investments come with volatility risks, exemplified by SOL’s price fluctuations over the past year.

Financial strategies involving cryptocurrency are gaining traction, but they come with their share of risks and volatility.

The changes at Janover not only reflect a shift in leadership but also a trend towards integrating digital assets within traditional financing frameworks. Investors and stakeholders should consider the potential volatility of these assets while keeping an eye on the strategic decisions made by Janover’s new executives.

Janover’s New Leadership: A Bold Move in Real Estate Financing with Crypto Ambitions

Janover’s recent transition in leadership, featuring a team of former Kraken executives, marks a significant shift within the real estate financing sector. With Joseph Onorati, the new CEO, at the helm, and supporting executives bringing a wealth of experience in fintech, Janover appears poised to carve out a competitive edge in an industry increasingly influenced by blockchain technology and cryptocurrency.

One competitive advantage Janover now holds is its strategic pivot towards integrating Solana into its operational framework. The proposed creation of a Solana reserve treasury and planned investments in SOL validators position Janover favorably within the evolving intersection of real estate and digital assets. This shift aligns with a notable trend as companies like Tesla and Semler Scientific have demonstrated the potential for equity gains when incorporating crypto into their business models. However, this innovative approach also presents a challenge: the inherent volatility of cryptocurrencies like SOL. Its price fluctuations can significantly impact investor sentiment and may deter more risk-averse stakeholders.

Moreover, while other firms have successfully navigated the complexities of crypto inclusion, critics argue that such strategies are fraught with risks, particularly concerning the use of debt instruments like convertible notes. Janover’s decision to raise $42 million through these notes may attract mixed reviews; while it provides immediate capital, its implications for long-term equity could be contentious. Stakeholders in other sectors might watch closely, weighing the benefits of leaning into digital currencies against the possible backlash from investors wary of market instability.

This strategic shift could offer substantial benefits to a new wave of investors seeking exposure to both real estate and cryptocurrency markets. Conversely, traditional investors who prioritize stability and consistency might find such ventures troubling. As Janover embarks on this ambitious journey, it may prompt a broader reevaluation among real estate financiers, challenging established paradigms while potentially alienating those cautious of the crypto landscape.

As Janover’s leadership reshapes its identity to meet the twin demands of real estate financing and crypto engagement, it stands at a crossroads where innovation could either usher in a new era of growth or expose the company to significant risks, reflecting the dual nature of today’s financial ecosystems.