In today’s vibrant world of cryptocurrency, several significant developments have captured the spotlight, drawing attention from investors and enthusiasts alike. Notably, Pavel Durov, the founder of the popular messaging platform Telegram, has made headlines by relocating from France to Dubai after receiving permission from a French court. Known for its favorable business landscape, Dubai has become increasingly appealing to tech icons like Durov, further fueling the city’s status as a global hub for innovation.

Meanwhile, in another high-profile move, David Sacks, a prominent venture capitalist, and his firm have divested over 0 million in cryptocurrency and related stocks. This strategic shift comes ahead of his appointment as a key advisor at the White House, where he is set to help shape the legal framework for the digital asset industry. The memorandum detailing these transactions sheds light on Sacks’ commitment to mitigate potential conflicts of interest as he steps into this influential role.

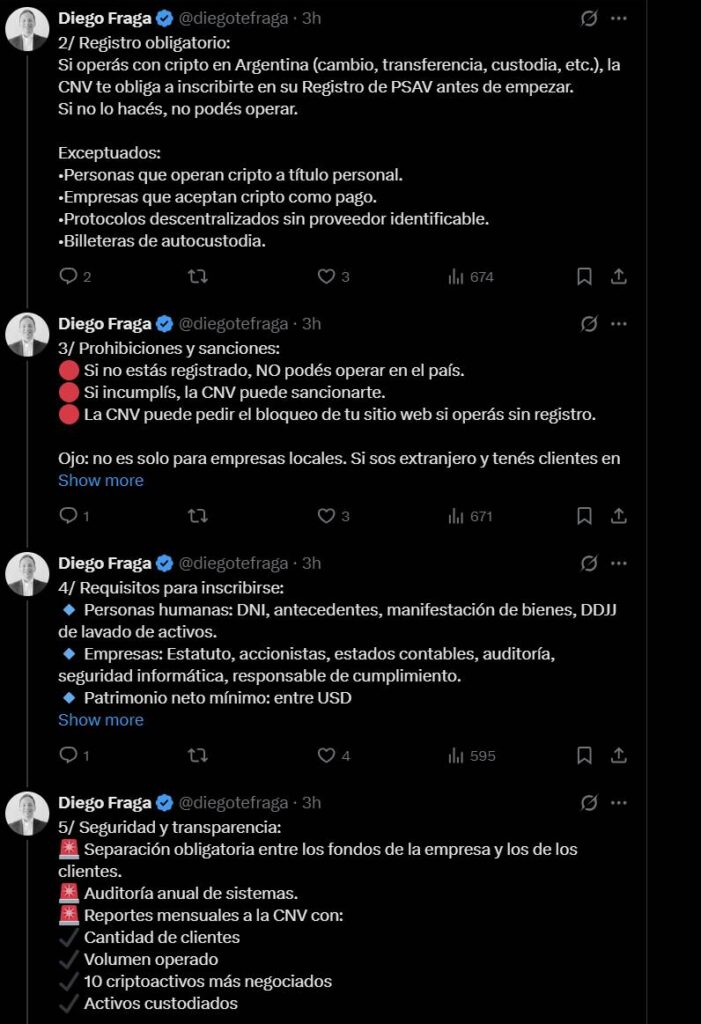

On the regulatory front, Argentina has moved to enhance the landscape for digital assets with the introduction of new rules for virtual asset service providers (VASPs). These regulations aim to establish rigorous standards for registration, security, and transparency within the crypto ecosystem, reflecting a growing commitment to user protection and stability in this dynamic sector. As local businesses adapt to these guidelines, the Argentine government signals its intent to embrace the evolving world of digital finance with a framework designed to promote responsible growth.

“Transparency, stability, and user protection in the crypto ecosystem”

From Durov’s strategic exit to Sacks’ noteworthy financial maneuvers and Argentina’s proactive regulatory steps, today’s news paints a picture of a rapidly changing cryptocurrency industry. As these stories unfold, they highlight the interplay between innovation, regulation, and opportunity that continues to define the digital asset landscape.

Today’s Crypto Landscape: Key Developments

Here are the significant updates in the cryptocurrency world that might affect crypto enthusiasts and investors:

-

Pavel Durov’s relocation to Dubai:

- Durov, the founder of Telegram, received court approval to leave France, relocating to Dubai, known for its business-friendly environment.

- This move highlights the flexibility and strategic choices available for tech entrepreneurs regarding their bases of operation.

-

David Sacks’ divestiture from crypto:

- Sacks and his venture capital firm sold over 0 million in crypto and related stocks to mitigate potential conflicts of interest before taking a White House role.

- This divestiture underscores the growing need for transparency and regulatory compliance in the crypto market, affecting how investors perceive leaders in the field.

-

New regulations for Argentina’s crypto firms:

- Argentina’s National Securities Commission has established strict rules for virtual asset service providers (VASPs), focusing on transparency and security.

- These regulations include registration requirements, cybersecurity measures, and obligations to prevent money laundering, which could set a precedent for other countries considering similar frameworks.

- Such regulations may instill user confidence in the crypto ecosystem, affecting investment decisions and market dynamics.

Pavel Durov’s Move to Dubai and Its Ripple Effect on the Crypto Landscape

The recent actions of notable figures within the crypto scene, including Pavel Durov’s move to Dubai, highlight the shifting dynamics in the digital asset industry. While Durov’s relocation presents opportunities, it also raises questions about accountability and regulation in decentralized spaces, especially for entrepreneurs and tech innovators. The allure of Dubai’s business-friendly policies and its reputation as a haven for the financially ambitious can certainly attract more crypto professionals seeking freedom from regulatory constraints.

On the other hand, David Sacks’ significant divestment of over 0 million in crypto assets before stepping into a governmental role illustrates caution and strategic foresight. This approach minimizes conflict of interest and positions him as a credible leader in crafting policies for the burgeoning crypto sector. However, this level of transparency could unsettle investors who may view his actions as a bearish signal for the market’s momentum. Entrepreneurs and nascent firms might find themselves navigating an environment increasingly rife with skepticism unless trust is reinstated through regulatory clarity.

Meanwhile, Argentina’s new regulations for its virtual asset service providers (VASPs) signal a decisive move towards enhancing stability and user protection in the crypto ecosystem. These rigorous guidelines on registration, cybersecurity, and reporting impose an added layer of compliance that could potentially stifle innovation, particularly for smaller or emerging companies that struggle to meet stringent requirements. While the objective is to foster a safer market, established players might benefit from the barriers, leaving startups to grapple with their survival amidst increased regulatory pressure.

In summary, the contrasting narratives presented by Durov, Sacks, and Argentina’s regulators paint a complex picture of the current crypto landscape. For entrepreneurs, these developments can either serve as catalysts for growth through improved regulation or hinder progress if compliance costs outweigh benefits. The balance of freedom and responsibility will continue to shape the future of digital assets and the opportunities they present for businesses and investors alike.