The cryptocurrency landscape is buzzing with excitement as it gears up for the launch of the first Solana futures exchange-traded fund (ETF). Volatility Shares has announced that it will debut two Solana futures ETFs, the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), on March 20. This significant development not only signifies a major step for Solana but also sets the stage for a potential Solana spot ETF in the future, as experts in the industry suggest this could be the “next logical step” for crypto-based trading products.

Industry analyst Ryan Lee from Bitget Research believes that this move could enhance institutional interest in the Solana token (SOL), potentially increasing demand and liquidity while helping Solana better compete with Ethereum in the market. He stated, “The launch of the first Solana ETFs in the US could significantly boost Solana’s market position,” a prospect that has many watching closely.

“Solana ETFs are in motion creating the possible avenues for more wide-scale adoption.” – Anmol Singh, co-founder of Bullet

Despite the optimism, some experts express caution. Challenges such as disappointing inflows, as seen with the recent spot Ether ETF, have raised questions about the immediate impact of the Solana futures ETF. Bloomberg’s senior ETF analyst, Eric Balchunas, highlighted the potential for Solana’s futures ETF to underperform, suggesting it may struggle to attract capital.

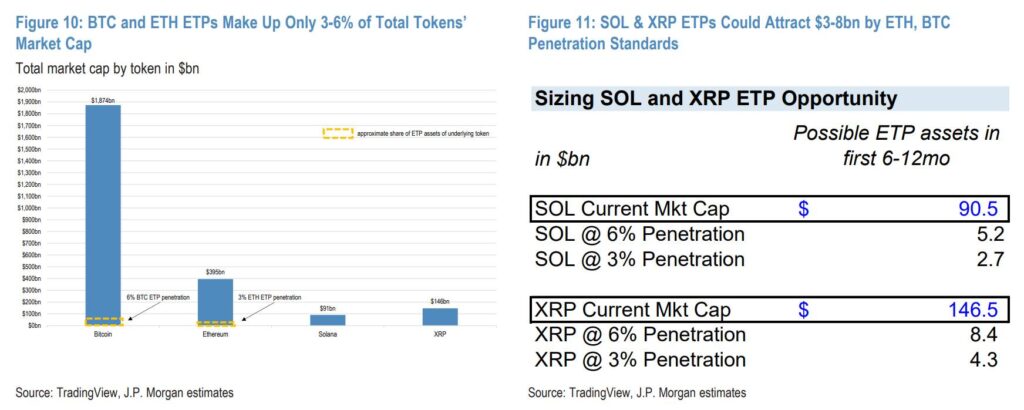

While the futures ETF is expected to validate Solana’s status as a leading cryptocurrency—especially in light of US President Donald Trump’s Working Group on Digital Assets including Solana in its strategic reserve—the long-term outlook remains complex. According to a recent JPMorgan report, a future spot Solana ETF could attract between billion to billion in net assets within the first six months, significantly exceeding the adoption rates of Ether ETFs.

However, cautious investors should note that the approval timeline could stretch out into 2026 due to the SEC’s meticulous review processes, which have been known to take considerable time. Overall, the landscape for Solana is changing, and the upcoming futures ETFs mark a pivotal moment in its journey towards broader acceptance and institutional engagement.

The Launch of Solana Futures ETFs: Implications for the Crypto Market

The introduction of Solana futures exchange-traded funds (ETFs) marks a pivotal moment in the cryptocurrency sector. Here are the key points regarding this development:

- Debut of Solana Futures ETFs:

- The first Solana futures ETFs, Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT), are set to launch on March 20.

- This move could lead to the eventual launch of a spot Solana ETF.

- Institutional Adoption:

- Ryan Lee from Bitget Research believes that the futures ETFs could significantly enhance Solana’s market position.

- They could attract institutional investments, providing a regulated vehicle that could bring billions in new capital.

- Competition with Ethereum:

- The ETF launch may increase demand and liquidity for SOL, potentially helping it narrow the market cap gap with Ethereum.

- However, Ethereum’s established ecosystem remains a competitive hurdle.

- Investor Sentiment and Concerns:

- Some analysts caution that the Solana futures ETF may not meet initial investor expectations concerning inflows.

- Past experiences with other crypto ETFs, particularly the spot Ether ETF, indicate potential challenges in attracting capital.

- Future Spot ETF Potential:

- The success of the futures ETFs could pave the way for a spot Solana ETF, which is expected to attract significantly larger inflows.

- JPMorgan suggests that a spot ETF for Solana could gather between billion to billion in net assets within its first six months.

- Regulatory Framework and Timeline:

- The SEC’s review process for ETF filings could delay the timeline for a spot Solana ETF until 2026.

- Investors need to remain aware of regulatory challenges that could impact market dynamics.

“Solana ETFs are in motion, creating possible avenues for more wide-scale adoption.” – Anmol Singh, co-founder of Bullet

These developments in the crypto industry may significantly influence investor decisions and market dynamics, shaping the future landscape of cryptocurrency investments and the broader financial market. Understanding these factors could enhance readers’ investment strategies as the crypto sector evolves.

Solana Futures ETFs: A New Chapter in Crypto Trading

The launch of the first Solana futures exchange-traded funds (ETFs), specifically the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), marks a pivotal moment in the cryptocurrency landscape. This development brings both opportunities and challenges in the rapidly evolving crypto market, especially in comparison to existing products like Ethereum ETFs and Bitcoin ETFs.

Competitive Advantages

One of the standout advantages of the Solana futures ETFs is the potential for heightened institutional interest in Solana (SOL). With forecasts suggesting that these products could narrow the market cap gap between Solana and Ethereum, there’s a strong impetus for institutional investors seeking regulated investment avenues. Analysts anticipate that the introduction of these ETFs could channel billions in capital towards Solana, reinforcing its market position and liquidity. Furthermore, the emerging legitimacy as a top cryptocurrency is a crucial step for Solana, especially in light of endorsements from prominent regulatory figures, drawing favorable comparisons to Bitcoin’s trajectory.

Competitive Disadvantages

Beneficiaries and Challenges

Those who stand to benefit from the launch of these Solana futures ETFs include institutional investors looking for new opportunities in the crypto market, as well as current Solana holders who may witness increased demand and price appreciation. On the flip side, existing investors in Ethereum ETFs and the wider crypto community could face challenges should investor interest in Solana rise, potentially siphoning away market capital from established players. Furthermore, if the expected inflows do not materialize, it could lead to a negative sentiment surrounding future crypto products, dampening investor optimism and creating a ripple effect across the entire sector.