The cryptocurrency landscape is buzzing with discussions about the evolving role of Layer 2 networks (L2s) in relation to the Ethereum mainnet. These innovative additions have emerged as a remarkable achievement in blockchain technology, effectively alleviating congestion on Ethereum’s primary network and significantly lowering transaction fees. However, the overwhelming success of L2s has prompted a reconsideration of their impact on Ethereum itself, especially regarding the revenue generated from transaction fees.

“People in the Ethereum Foundation will tell you that, ‘Yes, we effed up by being too ivory tower,’” noted David Hoffman, owner at Bankless, during a recent panel at Cornell Tech’s blockchain conference. This sentiment echoes the concerns being raised about the seismic shifts occurring within the Ethereum ecosystem.

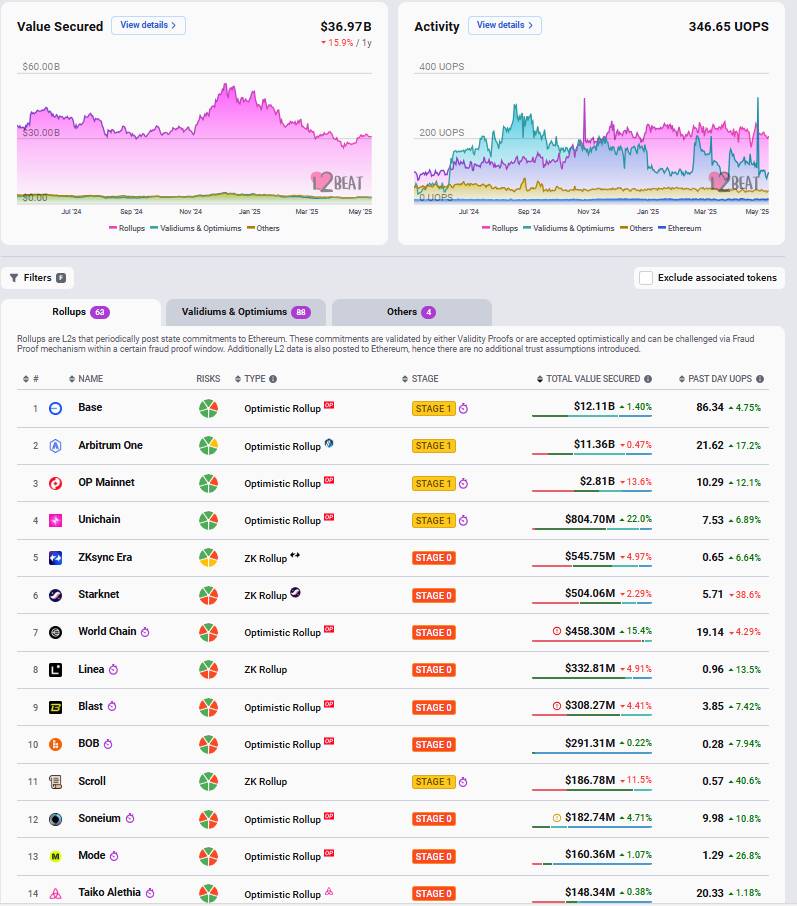

As L2s like Base and Optimism amass substantial revenue, questions arise about the fairness of revenue distribution between these networks and their parent Ethereum. Speakers at the conference pointed out that while L2s are reaping millions from transaction fees, the Ethereum mainnet is surprisingly not receiving a proportional share of these earnings, sparking debates about whether Ethereum should adopt a more aggressive approach to share in this financial bounty.

Following the recent Dencun upgrade, the capabilities of L2s have expanded dramatically. With tools now in place to scale and reduce costs, platforms like Base are generating impressive profits, yet the vast majority of fees are not being funneled back to the Ethereum network. This disparity has left some industry experts questioning whether L2s could ultimately become more of a drain on Ethereum than a source of growth.

James Beck, head of growth at ENS Labs, articulated the sentiment circulating among Ethereum enthusiasts: “Well, the price of ETH has been dropping compared to these other tokens. What do we do to make Ethereum more powerful?”

Discussions are also turning towards potential long-term solutions, such as implementing “based rollups,” wherein transaction sequencing occurs on Ethereum itself instead of the centralized L2 services. While this could enhance security, critics warn that any sort of tax on L2s might stifle competition and divert trading activity to rival platforms.

As stakeholders in the Ethereum community navigate these challenges, there is a glimmer of optimism. A collaborative workshop attended by top researchers and developers aims to address interoperability issues and promote a more decentralized framework. With new leaders in the Ethereum Foundation expressing a commitment to accountability and innovation, the hope is that Ethereum can adapt and evolve, ensuring its standing as a vital component within the broader blockchain ecosystem.

Layer 2s and Their Impact on Ethereum

The rise of Layer 2s (L2s) has significantly affected Ethereum, leading to both opportunities and challenges. Here are the key points regarding this dynamic:

- Success of Layer 2s:

L2s have alleviated congestion on the Ethereum mainnet, which has reduced gas fees and maintained security.

- Concerns Over Revenue Loss:

There are rising concerns that L2s are siphoning off transaction fees from the Ethereum mainnet without fair compensation.

- Demand for Strategic Pivot:

Industry voices, like David Hoffman, argue that Ethereum needs to adapt and find ways to capture a larger share of revenues, particularly from sequencing fees.

- Financial Imbalance:

L2s like Base have generated significant revenue from transaction fees while transferring only a small fraction back to Ethereum, raising questions about their long-term viability.

- Dencun Upgrade Impacts:

The Dencun upgrade has increased L2 profitability, leading to questions about whether L2s are ultimately beneficial or harmful to Ethereum’s ecosystem.

- Centralization Risks:

Many L2s operate with centralized sequencers, posing risks such as vulnerabilities to hacks, exemplified by previous high-profile attacks.

- Future Upgrades:

Upcoming Ethereum upgrades are expected to enhance blob throughput, potentially increasing fee capture from L2s.

- Philosophical Challenges:

Imposing taxes on L2s could contradict Ethereum’s ethos of decentralization and risk moving activity to competing ecosystems.

- Need for Cooperation:

It may require social pressure and collaboration within the Ethereum community to address the revenue and centralization issues among L2s.

“Ethereum is still well-positioned to provide the infrastructure for the ‘network of networks.’”

These developments can impact readers by shaping the future of Ethereum, influencing transaction costs, security, and overall user experiences in blockchain environments. As L2s evolve, their relationship with Ethereum could significantly alter investment strategies and participation in decentralized finance (DeFi) platforms. Understanding these dynamics is crucial for anyone involved in or considering involvement in the Ethereum ecosystem.

Layer 2s: The Double-Edged Sword in Ethereum’s Ecosystem

Layer 2 protocols have revolutionized the blockchain landscape, especially within the Ethereum ecosystem. While they’ve alleviated congestion issues on the Ethereum mainnet and decreased transaction gas fees, their rapid success raises significant questions about the implications for the core network. Critics argue that these L2 solutions might be siphoning off vital fee income and overall activity, creating an imbalance that could undermine Ethereum’s financial health.

Competitive Advantages: L2 solutions like Base, Optimism, and Arbitrum have capitalized on the need for faster and cheaper transactions, attracting a growing user base eager to escape the high costs and delays of the Ethereum mainnet. Their innovative approaches, such as the economic model introduced by the Dencun upgrade, have further solidified their position, offering users a more seamless experience. Notably, Base’s ability to generate substantial transaction revenues—nearly $98 million since its inception—demonstrates a significant advantage in user acquisition and retention.

Competitive Disadvantages: However, the benefits L2s render come with complexities. Many Ethereum stakeholders express concerns that the financial prosperity of these L2s could come at the expense of the mainnet. With Base reportedly contributing a mere 8% of its fees back to Ethereum, the long-term sustainability of the main blockchain is questioned. The centralized nature of L2s also raises security concerns; issues like the potential for a single point of failure in transaction sequencing and hacks, such as the $2.6 million incident involving Linea, put the entire ecosystem at risk.

Who Stands to Gain or Lose: These mixed dynamics present both opportunities and pitfalls. Ethereum developers and users who lean towards decentralization may find the L2 structure problematic, as it appears to counteract the ethos of an open and participatory blockchain. Conversely, the L2 solutions themselves benefit from user growth but may risk alienating established Ethereum users if they perceive linkages weakening between the layers. Moreover, if Ethereum were to impose a fee structure on L2s—often referred to as a ‘tax’—it could stifle innovation and lead users to migrate to alternative blockchains like Solana, jeopardizing Ethereum’s market position.

Ultimately, the discussions rooted in forums like the Cornell Tech conference highlight a critical evolution within the Ethereum community. Active dialogue regarding how to rectify this financial imbalance and enhance the collaborative synergy between L2s and the mainnet is paramount. As strategies emerge, such as ‘based rollups’ that maintain decentralization while enhancing security, the focus remains on striking the right balance between innovation and financial accountability.