The DeFi protocol Loopscale is making headlines as it successfully recovers a significant portion of funds lost in a major exploit over the weekend. In a development that has garnered attention within the cryptocurrency community, Loopscale announced on April 29 that approximately $2.88 million worth of Wrapped SOL (WSOL) has been returned to its wallets since the exploit was executed on April 26, when a manipulation of its RateX PT token pricing functions led to the theft of nearly $5.7 million.

According to Loopscale, its proactive negotiation efforts with the attacker are proving productive. Initially, the protocol offered a 10% bounty to the exploiter for the return of 90% of the stolen funds, along with a full release of liability. Remarkably, these negotiations have already yielded results, with significant amounts of WSOL returned in multiple transactions since the incident. As of April 28, recoveries included 10,000 WSOL worth about $1.48 million, and another 4,463 WSOL valued at approximately $660,000, following an initial recovery of 5,000 WSOL (around $740,000). Loopscale has reassured its community that discussions with the exploiter are ongoing, highlighting the potential for an amicable resolution.

“Our pursuit of an amicable resolution regarding Saturday’s incident continues to make progress,” Loopscale’s team stated.

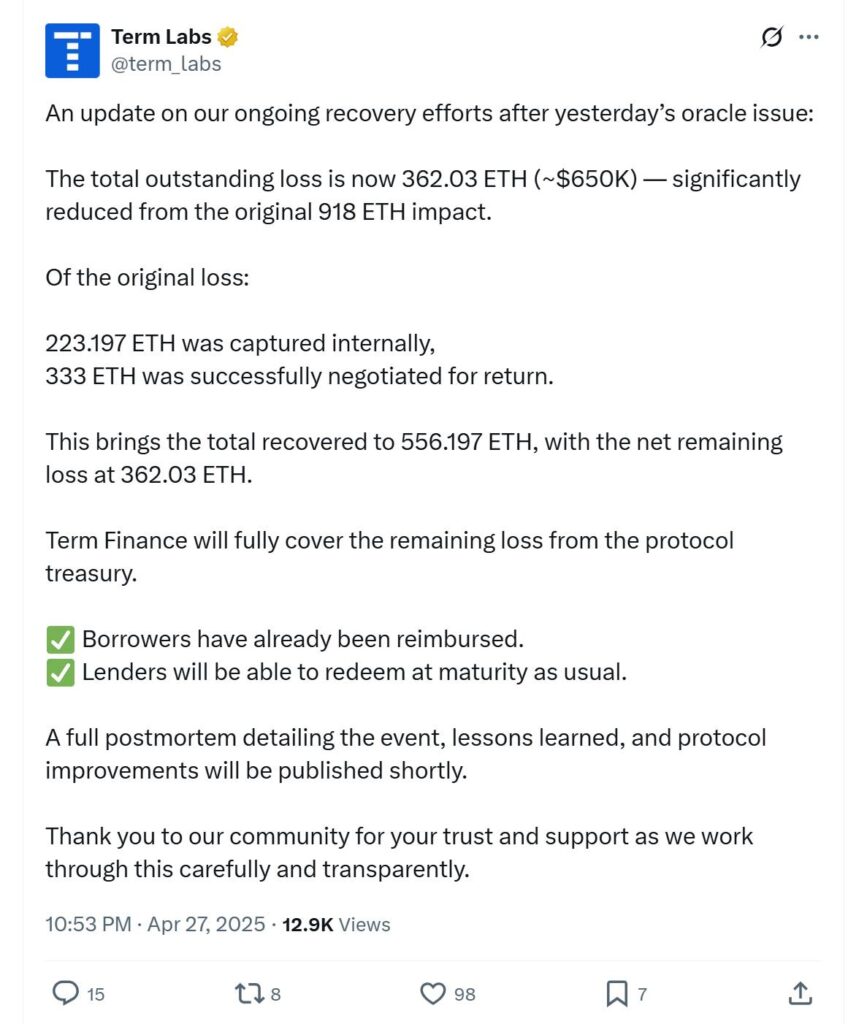

This situation contrasts sharply with the broader trend observed in decentralized finance (DeFi), where recoveries of stolen funds are often rare. However, there’s a glimmer of hope as other platforms, like Term Finance, have also seen success in reclaiming funds after suffering from exploits. In early April, Term Finance reportedly recovered $1 million of a $1.6 million loss caused by a misconfigured oracle.

While DeFi protocols face significant risks, especially with a surge in hacking activities—reportedly over $1.6 billion was stolen in the first quarter of 2025 alone—Loopscale’s ongoing recovery efforts emphasize the potential for constructive dialogue in the aftermath of such incidents. With law enforcement on alert for further action if negotiations stall, the unfolding events may signal a changing tide in how DeFi protocols manage crises and recover lost assets.

Loopscale DeFi Protocol’s Fund Recovery Progress

The recent incident involving the Loopscale DeFi protocol highlights significant developments in fund recovery within the decentralized finance space. Here are the key points regarding the events and their implications:

- Substantial Recovery of Stolen Funds:

- Loopscale has recovered approximately 19,463 Wrapped SOL (WSOL), valued at about $2.88 million, since the exploit.

- Initial returns included 10,000 WSOL (~$1.48 million), followed by 4,463 WSOL (~$660,000) and an earlier recovery of 5,000 WSOL (~$740,000).

- Engagement with the Attacker:

- Loopscale offered a 10% bounty for the return of the stolen funds, indicating a willingness to negotiate.

- Negotiations with the attacker have shown signs of progress, as a response was received expressing willingness to engage.

- Impact of the Exploit:

- The exploit led to a theft of approximately $5.7 million, representing about 12% of Loopscale’s total funds.

- Only vault depositors were impacted, not borrowers or loopers, indicating a limited scope of affected users.

- Increased Frequency of Fund Recoveries:

- Recent trends suggest an uptick in successful fund recovery efforts within DeFi, with projects like Term Finance also announcing successful recoveries.

- The entire space may benefit from improved practices in negotiation and recovery following incidents of hacking.

- Risks and Security in DeFi:

- The significant losses due to hacking events, including a report of over $1.6 billion stolen in Q1 2025, underline the importance of security in the DeFi sector.

- Users need to stay informed and vigilant regarding the risks associated with investments in DeFi protocols.

The situation demonstrates that while losses in DeFi can be substantial, collaborative approaches to recovery can lead to positive outcomes for the affected communities.

Loopscale’s DeFi Recovery: A Beacon of Hope or a Risky Gamble?

In the ever-evolving landscape of decentralized finance (DeFi), Loopscale’s recent exploit recovery stands out as a compelling case study. The protocol has managed to retrieve nearly half of the stolen funds—approximately $2.88 million—through negotiations with the attacker. This development places Loopscale ahead of many peers, showcasing its commitment to transparency and community involvement during crisis management.

Competitive Advantages: Loopscale’s proactive approach, offering a 10% bounty for the return of funds, is a strategic move that could increase the likelihood of recovering stolen assets. By engaging directly with the attacker and seeking an amicable resolution, Loopscale demonstrates a level of initiative that can foster trust within the community. This responsive stance contrasts with other platforms like KiloEx, which is merely compensating users impacted by a much larger $7.5 million hack without proactive recovery efforts.

Additionally, the success of Loopscale’s negotiation strategy aligns with a growing trend in the DeFi space where recovery through white-hat negotiations appears to be gaining traction. Last quarter, Term Finance showcased a similar success story by recovering a significant portion of its lost assets. This pattern may motivate other platforms to adopt a more hands-on approach when facing funding crises.

Potential Disadvantages: However, the resolution process is not without its risks. Engaging with hackers could set a precedent, potentially inviting more exploit attempts on Loopscale and similar protocols. While the offer of a bounty might seem attractive, it also raises ethical questions about legitimizing illicit behavior within the DeFi ecosystem. Moreover, if negotiations falter or the attacker fails to comply, Loopscale may face heightened scrutiny from the community and regulators alike, putting its operational integrity on the line.

In a broader context, the developments at Loopscale could be a double-edged sword for the DeFi sector. On one hand, the ability to recover funds could enhance user trust and draw in new participants who may have previously feared the risks associated with DeFi platforms. On the other hand, should the negotiations fail or backfire, it may deter future users or investors from engaging with Loopscale, resulting in a potential erosion of its customer base and capital.

Overall, while Loopscale’s recovery narrative highlights the possibility of reclaiming lost assets in the DeFi space, it simultaneously underscores the fine line that protocols must walk between risk management and community expectations. As these scenarios unfold, industry watchers and investors alike will be keenly observing the impacts on both Loopscale and the wider DeFi ecosystem.