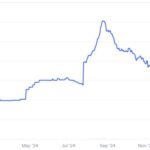

Maple Finance is making waves as a vital connection between decentralized finance (DeFi) and traditional finance (TradFi), rapidly establishing its role in the evolving landscape of institutional crypto lending. Co-founded in 2021 by Sidney Powell, Maple has already facilitated over $5 billion in loans, showcasing its significant impact on the market. After navigating through some rough patches in the crypto credit arena, Maple has demonstrated remarkable resilience, with its total value locked skyrocketing by over 580% in 2024—from approximately $44 million to an impressive $300 million.

At the heart of this resurgence is Maple’s innovative product offering, including the recently launched SyrupUSDC, which is crafted for global DeFi protocols, although it remains inaccessible to U.S. users. This approach allows Maple to attract a wider range of institutional clients by accepting various forms of collateral, significantly enhancing its customer base. In addition, Powell highlights key advantages such as low counterparty risk and native Bitcoin support, making it an attractive option for institutions seeking yield in a post-FTX world.

Sidney Powell is not only at the forefront of Maple’s growth but also contributing to wider discussions in the industry as a speaker at the Consensus 2025 Open Money Summit. Maple’s shift towards the SYRUP token reflects a foundational change in its governance model, emphasizing the importance of aligning incentives. Powell affirms that with no equity interests complicating matters, the focus is squarely on the SYRUP token, which provides clear and simplified governance within the platform.

As Maple prepares for continued expansion into Asia and Latin America, the firm is keenly aware of the regional nuances it needs to address. In Asia, relationship-building is paramount, while in Latin America, retail-driven products such as SyrupUSDC can unlock new customer bases. With plans to introduce a Bitcoin liquid staking token, Maple is poised to leverage the growing institutional interest in DeFi, helping clients navigate this dynamic and often unpredictable market.

Maple Finance: Bridging DeFi and Traditional Finance

Maple Finance is becoming increasingly influential in connecting decentralized finance (DeFi) with traditional financial systems. Here are some key points regarding its growth and relevance:

- Significant Growth:

- Maple facilitated over $5 billion in loans since its inception in 2021.

- In 2024, Maple’s total value locked (TVL) surged by 580%, growing from approximately $44 million to over $300 million.

- Innovative Products:

- Introduction of SyrupUSDC, a permissionless yield offering aimed at global DeFi protocols, which is not available to U.S. users.

- Expanded range of accepted collateral, including SOL and BTC, allowing more customized loans for institutional clients.

- Unique Governance Structure:

- Migration to a single token model with the SYRUP token enhances governance and aligns incentives.

- Elimination of equity holders reduces potential conflicts of interest, ensuring that the ecosystem is more cohesive and focused.

- Resilience in Market Volatility:

- Maple successfully managed one of the largest liquidation events without issuing any liquidations, thanks to rigorous underwriting processes.

- High collateralization ratios help safeguard against volatility, appealing to institutional investors.

- Expansion into New Markets:

- Plans to expand operations in Asia and Latin America, targeting high-net-worth individuals and leveraging local financial relationships.

- Introduction of bitcoin yield products aims to tap into existing bitcoin holdings in these regions.

- Focus on Institutional Adoption:

- Maple is positioning itself to attract traditional finance players, who are increasingly interested in crypto-backed lending.

- The rise of stablecoins as a proven model offers institutions a predictable entry point into the crypto space.

Impact on Readers: As Maple Finance continues to bridge the gap between DeFi and traditional finance, understanding its developments could lead retail and institutional investors to explore new opportunities in crypto lending and yield generation. This could be particularly significant in improving access to innovative financial products and encouraging the adoption of blockchain technologies across various sectors.

Maple Finance: A Bridge Between Traditional and Decentralized Finance

Maple Finance is positioning itself as a vital conduit between decentralized finance (DeFi) and traditional finance (TradFi), particularly in this age of recovery for crypto lending. Co-founded by Sidney Powell, the platform has successfully facilitated a staggering $5 billion in loans, establishing itself as a significant player in institutional crypto lending. Its focus on tokenized private credit aligns well with the growing interest from traditional financial institutions, particularly after the challenges faced by the crypto credit markets in recent years.

Competitive Advantages: One of Maple’s standout features is its impressive growth in total value locked (TVL), which shot up over 580% in 2024. The strategic launch of innovative products, such as SyrupUSDC, showcases an adaptability that resonates with the evolving DeFi landscape. Also, the seamless integrations with custodians, native BTC support, and lower counterparty risk are particularly appealing to institutional clients cautious after the tumultuous aftermath of the FTX incident. Furthermore, the shift to a single-token governance model with SYRUP aims to align interests cohesively, avoiding common pitfalls seen in other DeFi protocols with conflicting equity-holder motivations.

Competitive Disadvantages: However, the nuances of Maple’s approach could also be a double-edged sword. The restriction on U.S. users for products like SyrupUSDC due to jurisdictional regulations may limit its market potential domestically, potentially driving clients overseas or forcing them to look elsewhere for competitive yield opportunities. Additionally, while targeting institutional clients can provide high yields, it also entails higher expectations regarding product sophistication and risk management, which could be challenging to navigate consistently.

As Maple charts a course for expansion into Asian and Latin American markets, the strategic advantage of catering to relationships in Asia versus a more retail-driven approach in Latin America may also present both opportunities and obstacles. High-net-worth individuals in Asia may benefit immensely from Maple’s yield on BTC lending, while retail consumers in Latin America could face expectations of comfort and familiarity—a factor that may play into the platform’s user experience as they integrate into various applications.

Beneficiaries and Challenges: For institutions venturing into the crypto landscape, Maple represents a low-risk entry point, especially given its emphasis on stable assets and yield generation. However, for decentralized protocols or existing lending platforms, this increased competition could pressure them to innovate faster or lower their fees. Individuals and smaller investors may find themselves at a disadvantage if they are reliant on platforms that lack the sturdy infrastructure that Maple is aiming to create. In essence, while Maple Finance opens new doors for institutional players, it may introduce challenges for smaller entities struggling to keep pace with the evolving ecosystem.