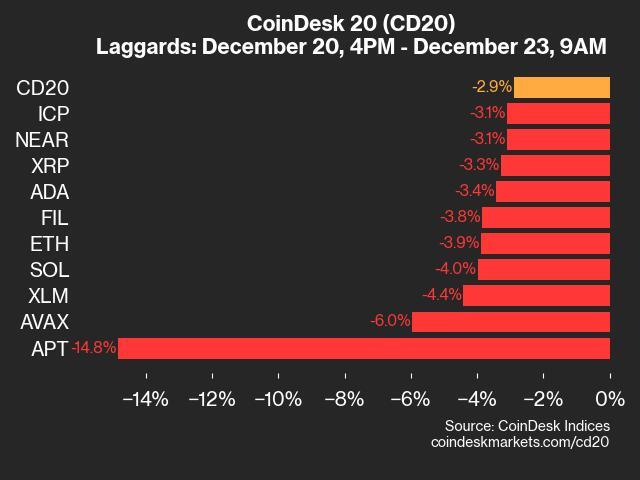

This past weekend saw a dip in momentum for the 20 top-performing assets within the digital asset index. The index registered a decline, closing the weekend at 3319.53—a 2.9% drop that underscores the ongoing volatility many may have already been feeling in the market. For those who keep a close watch on their portfolios, this downturn might feel particularly frustrating, especially after periods of relative stability.

In times like these, it’s natural to feel a mix of emotions: concern over portfolio health, a lingering uncertainty about what might come next, and even a sense of being overwhelmed by rapid market movements. If you’re feeling like the weekend might have thrown a curveball in your plans, know that you’re not alone. The fluctuations in the space are a challenge even for seasoned investors. But if history has shown us anything, it’s that market trends are rarely one-dimensional, and each decline carries the potential for lessons and opportunities.

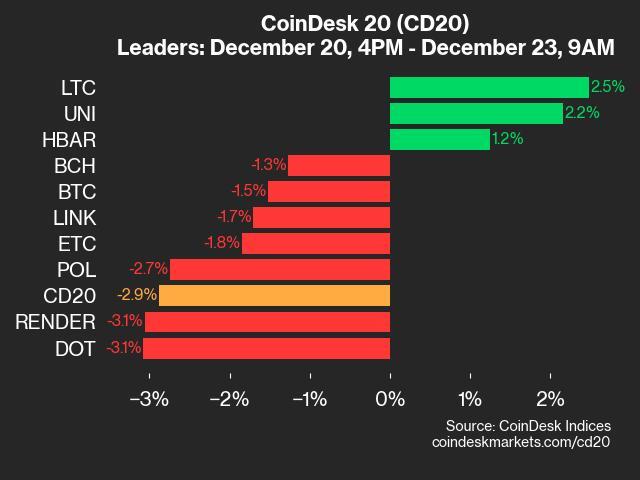

Amid the dip, it’s worth noting that not all assets followed the downward trajectory. In fact, three of the 20 tracked digital assets bucked the trend, offering sparks of positivity. While a decline of almost 3% in the index feels significant, the diversity within the basket highlights the dynamic nature of the space, where some assets still shine even as the broader trend points downward.

While the numbers may not have delivered an uplifting start to the week, they remain a reflection of the intricate ecosystems at play. This weekend’s performance offers a moment to pause, analyze, and contextualize within the larger journey of the markets. In the end, every shift—whether up or down—is part of your ongoing learning and growth as a participant in this ever-evolving field.

Let’s dig a little deeper into the assets that turned heads this weekend—both for better and for worse. Among the top gainers, Litecoin (LTC) and Uniswap (UNI) managed to defy the broader market dip. With Litecoin posting a respectable 2.5% gain and Uniswap close behind at 2.2%, these tokens offered reminders of resilience. For those who have been holding onto LTC or UNI, seeing their upward momentum might provide a welcome boost of confidence amidst the noise of market pullbacks. Whether it was due to unique developments within these ecosystems or a shift in investor sentiment, these positive moves are worth celebrating, even if they’re modest compared to larger market past cycles.

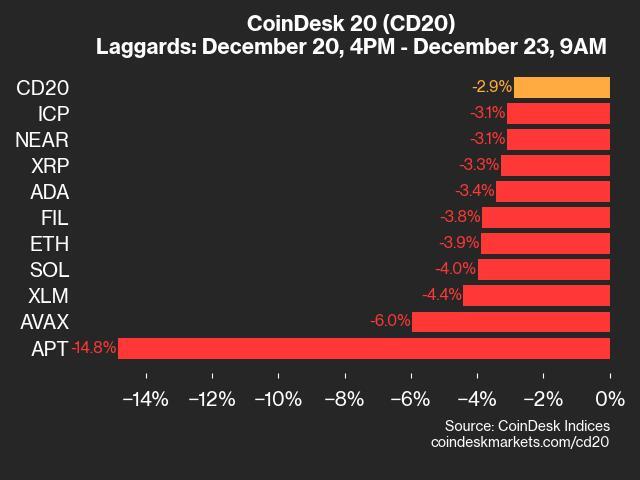

On the flip side, Aptos (APT) and Avalanche (AVAX) took the hardest hits, leaving investors questioning what might be driving these dramatic changes. Aptos bore the brunt of the weekend’s decline with a staggering 14.8% drop, followed by Avalanche’s 6.0% fall. These numbers may feel jarring, especially if you’ve been holding positions in these two assets and watching your screen with growing unease. Drops of this magnitude can trigger doubt or even fear, but they also serve as critical moments to reassess strategies, reevaluate risk tolerance, and remember that even the most promising projects can face hurdles.

For assets like APT and AVAX, the losses might stem from a combination of broader market sell-offs and project-specific developments—or lack thereof. While these moves can feel personal when they hit portfolios, it’s worth remembering that market mechanics often extend beyond singular trends. For those taking notes, events like these could represent not just setbacks but opportunities to better understand an asset’s behavior under pressure.

The disparity between the outperformers and underperformers this weekend underscores just how varied digital asset performance can be, even within a single index. This reality can be both a challenge and an opportunity in the crypto space. The challenge lies in navigating this complexity, while the opportunity often presents itself in deepening your market knowledge and refining your approach. Whether your assets are gaining, losing, or holding steady, every twist and turn forms part of the bigger picture—one you’re actively exploring with every step.

Aptos (APT) undoubtedly captured much of the attention this weekend, but not in the way most investors might have hoped. The 14.8% drop over such a short timeframe reflected just how quickly sentiment can shift in the digital asset space. For those who have been tracking APT, this significant decline might feel disheartening, especially given the relatively strong narrative surrounding the project in recent months. It’s never easy to see a steep drop in an asset you believe in, and it’s completely understandable to feel a wave of frustration or concern.

APT entered the market with high hopes, aiming to redefine blockchain performance through its focus on scalability and efficiency. However, the market often demands more than solid tech or vision—it craves momentum and confidence, two factors that seem to have waned for this asset over the weekend. Whether due to broader market uncertainty, diminishing speculative interest, or perceived shortcomings in the project’s recent developments, APT’s weekend performance reflects challenges that even standout names in the blockchain space aren’t immune to.

For some, the immediate instinct might be to fear that such a drop signals long-term trouble, but it’s important to remember that the digital asset market is notoriously volatile. While APT’s fall is significant, such corrections are often, to some degree, a normal part of a token’s lifecycle—particularly for relatively new projects still carving out their space in a competitive landscape. Every dip brings with it an opportunity to pause and reflect: Is this a momentary stumble in its larger journey, or is it indicative of deeper issues? Asking these kinds of questions, rather than reacting impulsively, can provide a valuable perspective during tumultuous times.

In understanding what led to this weekend’s sell-off, potential explanations lie in a mix of external market conditions and internal project-related factors. For one, bearish sentiment across the broader crypto market might have provided a backdrop where assets like APT, which inherently carry more speculative interest, became more susceptible to larger moves to the downside. On top of that, Aptos faces stiff competition from other Layer 1 blockchain networks, many of which have garnered significant developer and investor attention. If there’s a perceived lack of new momentum or innovation, it can take a toll on its price action.

For holders of APT, moments like this often bring a crossroads: Should you double down and view this as a discounted entry point, or take a more cautious approach and reevaluate your exposure? Neither answer is universally right or wrong—it comes down to personal strategy, risk tolerance, and your long-term conviction in Aptos and the role it aims to fill in the blockchain industry.

The team behind Aptos remains steadfast in its vision, and it’s worth staying tuned for any developments or milestones they may achieve in the near future. Many projects go through periods of highs and lows, and how a team navigates adversity can be equally as important as how it handles success. If you’re someone who’s questioning whether to hold or fold your APT position, take comfort in the idea that these moments of reflection can be incredibly empowering. They push you to revisit your strategy, refine your goals, and deepen your understanding of the market and the assets you invest in.

As challenging as a double-digit drop can feel, remember that the broader market is fluid, and today’s laggard can often become tomorrow’s leader. Whether Aptos rallies back soon or faces a longer journey back to bullish territory, this weekend serves as an opportunity to reevaluate with patience and clarity, rather than panic. You’ve shown resilience by staying engaged with developments like these, and that alone is a testament to your commitment as a participant in the often unpredictable world of digital assets.

Zooming out from individual standout performances, the broader crypto market over the weekend paints a picture of mixed sentiment and shifting momentum. The nearly 3% dip in the digital asset index isn’t an isolated incident—it reflects a larger trend seen across multiple asset classes recently. For those navigating the digital markets, the sense of unease this decline may evoke is undoubtedly real. After all, the space is known for its dynamic swings, and periods of heightened uncertainty can leave even seasoned investors questioning their strategies.

One key factor that may have influenced the broader market movement is the ongoing concern over macroeconomic conditions. The global economic landscape, including inflation worries, fluctuating interest rates, and geopolitical tensions, continues to weigh heavily on risk assets. Cryptocurrencies, often labeled as speculative by many mainstream analysts, are no exception to these pressures. For many investors, this adds another layer of complexity to an already volatile market, and it’s easy to see why such headwinds might amplify the need for caution.

Another consideration lies in the notable lack of major market-moving catalysts in recent weeks. Major network upgrades, protocol launches, or institutional adoption news—often drivers of renewed investor enthusiasm—were largely absent from the headlines over the weekend. Without fresh narratives to spur buying activity, assets across the board seemed to respond to the broader risk-off sentiment. In such times, it’s understandable to feel the weight of market inertia, but it’s also an opportunity to observe which projects continue to execute behind the scenes despite the quieter periods. The crypto market often rewards consistent effort over time, even if that effort isn’t immediately reflected in price action.

Despite the downturn, however, there are nuanced lessons to extract from the weekend. The resilience shown by tokens like Litecoin and Uniswap against the broader headwinds indicates that there may still be pockets of optimism or niche narratives causing selective upswings. These movements are a reminder that while collective trends are significant, there’s always room for individual assets to carve their own path—an aspect that sets the crypto space apart from traditional markets.

For long-term participants, these moments of relative market stagnation don’t necessarily signal a time to panic but rather an opportunity to refocus on individual conviction. It can be helpful to ask yourself a few reflective questions during such moments: Are the assets I’m holding aligned with my broader investment views? Do I understand the fundamentals and challenges each project faces? Am I emotionally prepared to weather ongoing volatility? By addressing these questions, you can navigate the market from a place of informed confidence rather than reactive fear.

Volatility, while challenging, can also be a critical driver of opportunity. For investors taking the long view, periods like this weekend—though uncertain—can serve as moments to reassess allocation strategies and identify undervalued projects that may have been overlooked amidst the noise. It’s important to remember that historically, significant market recoveries have often followed downturns like these. That perspective doesn’t make the waiting game easier, but it does reinforce the importance of patience and discipline in managing your portfolio through turbulent times.

As the market continues to ebb and flow, the most important takeaway remains your ability to adapt and persist. This weekend’s performance may not have provided the rally some were hoping for, but it does highlight the reality of an evolving market landscape. Whether it means leaning into deeper research, redefining your strategies, or simply holding steady and waiting for the next wave of momentum, every choice you make now shapes your journey as a participant in this groundbreaking financial frontier. Keep investing in your understanding, trust the process, and know that every market movement—up or down—is a step further along in the story you’re writing for your financial future.