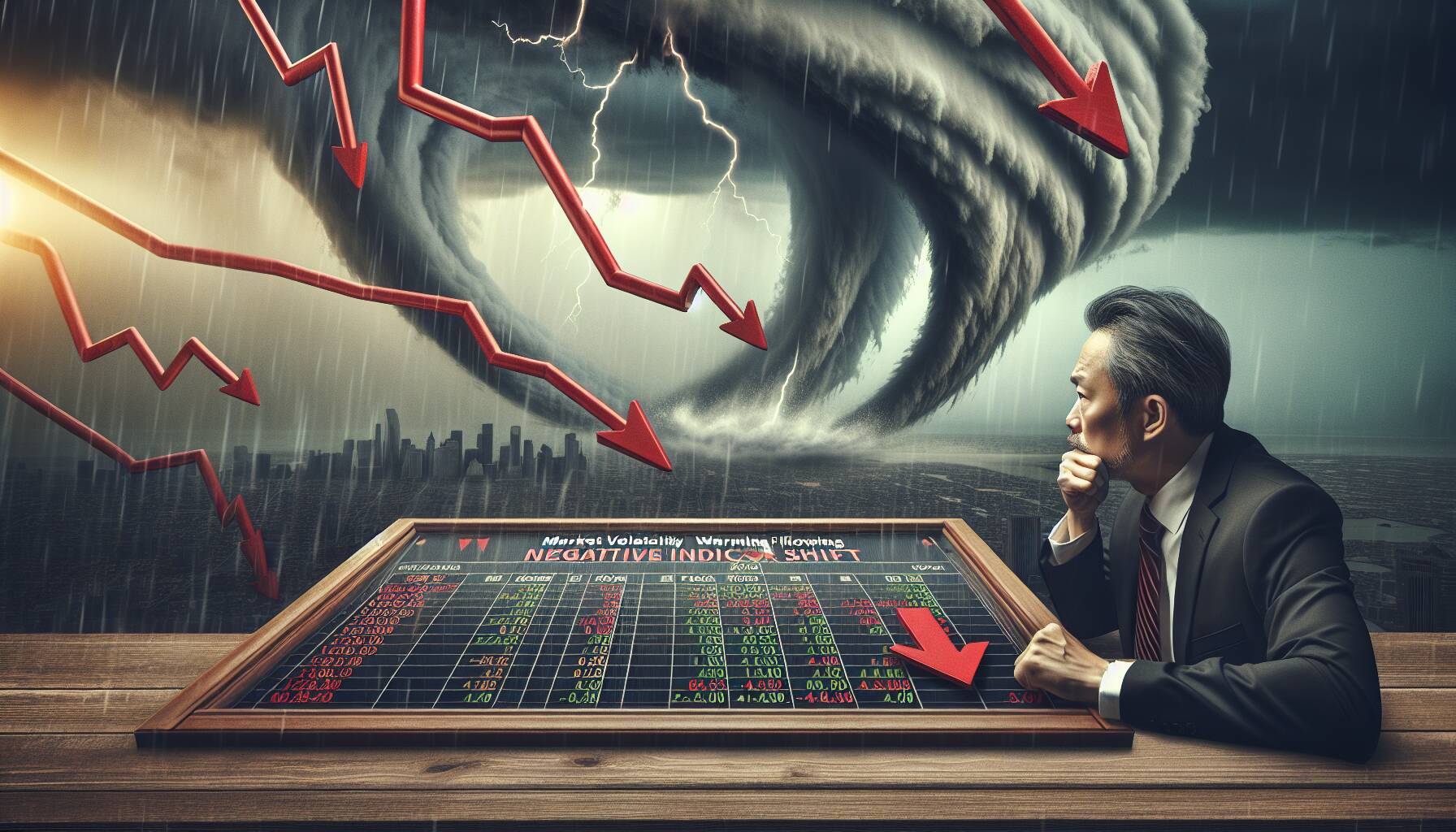

The cryptocurrency market is experiencing a notable shift, as a key indicator has flipped to negative, signaling potential downside volatility in the near future. Traders and enthusiasts alike are keeping a close eye on this development, as it could herald challenging times for various digital assets.

Market sentiment plays a crucial role in the world of cryptocurrencies, where rapid price fluctuations are commonplace. The recent change in this key indicator suggests that caution may be warranted as investors adjust their strategies amidst these evolving conditions.

“With the current negative trend, many market participants are reassessing their positions,” noted a market analyst. “It’s essential to remain informed as the situation develops.”

Furthermore, historical data indicates that similar negative flips in market indicators have often preceded periods of increased volatility. As a result, there’s a heightened interest in understanding the broader implications this could have on the ongoing investment landscape.

As the situation unfolds, investors are encouraged to stay alert and monitor the developments closely, ensuring they are well-equipped to navigate the challenges that may arise in this dynamic environment.

The Key Indicator’s Negative Flip

Understanding the implications of the key indicator’s negative flip can be crucial for navigating potential market volatility:

- Negative Indicator Flip: A reversal in the key indicator often signifies a foreboding trend in market performance.

- Impacts on Investments: Investors may face increased risk of losses due to anticipated downside volatility.

- Market Sentiment: This negative shift can alter investor behavior, leading to panic selling and further exacerbating market declines.

- Risk Management Strategies: Investors might need to reassess their portfolios and implement more conservative strategies to mitigate risks.

- Economic Indicators: A negative flip may be indicative of broader economic issues, potentially influencing consumer confidence and spending.

The key indicator’s movement serves as a warning to market participants to prepare for potential downturns.

The Impact of Negative Indicators on Market Volatility

The recent shift in key indicators towards a negative outlook has raised concerns about potential downside volatility in the market. This change is pivotal, as similar news in the financial sector often showcases contrasting perspectives on economic stability. For instance, while some analysts celebrate bullish trends, others caution about underlying weaknesses signaled by such indicators.

Competitive Advantages: The prevailing narrative surrounding negative flips often highlights the opportunity for savvy investors. Those positioned to capitalize on market corrections can benefit significantly from buying undervalued assets during periods of downturn. Furthermore, traders utilizing advanced analytics can refine their strategies, thus taking advantage of volatility to enhance portfolio performance.

Disadvantages: On the flip side, the emergence of downside volatility can create significant challenges for less experienced investors or those heavily invested in high-risk assets. The fear of loss may prompt irrational decision-making, exacerbating financial strains. Additionally, institutional players, who typically thrive on stable environments, may face hurdles as they recalibrate strategies to cope with increased unpredictability.

This new wave of negative sentiment could benefit risk-tolerant investors and those relying on short-selling strategies, while simultaneously posing obstacles for conservative investors and market novices. As the financial landscape evolves, remaining vigilant and adaptable will be crucial for navigating these turbulent waters.