The cryptocurrency and trading landscape is undergoing yet another significant shakeup, as Massachusetts’ securities regulator has initiated an investigation into Robinhood’s most recent offering of prediction markets. This newly launched feature, which enables users to wager on various event outcomes—including college basketball tournaments—has attracted scrutiny from officials who are voicing concerns about its implications for young investors.

“This is just another gimmick from a company that’s very good at gimmicks to lure investors away from sound investing,”

According to a report by Reuters, Massachusetts Secretary of State Bill Galvin has subpoenaed Robinhood, seeking to access information regarding the platform’s marketing strategies and the number of users engaging in these sports event contracts. Galvin’s apprehension centers around the risks posed by intertwining gambling with investment accounts, noting the potential allure it might hold for younger audiences.

Launched just last week on March 17, Robinhood’s prediction markets feature utilizes a platform regulated by the Commodity Futures Trading Commission (CFTC) and presents event contracts not only for college basketball but also for other significant metrics such as the federal funds rate. A company spokesperson assured that these products are offered in a regulated environment, highlighting the growing relevance of prediction markets among both retail and institutional investors.

“Prediction markets have become increasingly relevant for retail and institutional investors alike, and we’re proud to be one of the first platforms to offer these products to retail customers in a safe and regulated manner,”

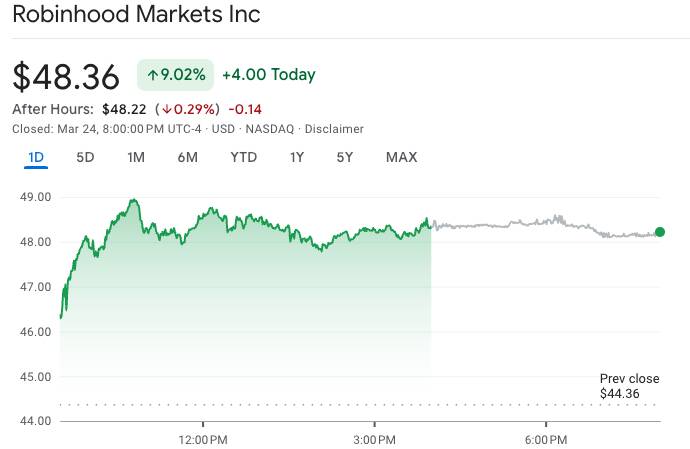

Despite the ongoing investigation, Robinhood’s market performance remains relatively stable. On March 24, the company’s share price saw minor fluctuations, closing at .36 after a notable rise throughout the day. This comes on the heels of an overall 30% gain in stock performance for the year so far, although it has notably declined from its February peak.

As the situation unfolds, Robinhood’s prediction markets will undoubtedly remain in the spotlight, especially as regulators continue to keep a watchful eye on the evolving intersection of gaming, trading, and investment. The CFTC, as well as Galvin’s office, have not yet responded to media inquiries regarding the investigation’s specifics, leaving many in the industry eager to see the outcome of this latest regulatory foray.

Massachusetts Investigates Robinhood’s Prediction Markets

Massachusetts’ securities regulator is currently probing Robinhood’s recent launch of prediction markets, raising concerns about the potential impacts on young investors. Here are the key points related to this development:

- Probe Launch: The Massachusetts Secretary of State, Bill Galvin, has subpoenaed Robinhood for information on its marketing and user engagement in sports event contracts.

- Concerns Over Gambling: Galvin expressed worries that Robinhood is linking gambling events to its brokerage services, especially targeting young audiences.

- Regulatory Framework: Robinhood’s prediction markets are offered through the Commodity Futures Trading Commission (CFTC)-regulated platform Kalshi, emphasizing a regulatory compliance aspect.

- Recent Partnerships: The prediction markets feature contracts on significant events, like college basketball tournaments and federal fund rates, indicating an expansion of user engagement.

- User Trends: The interest in prediction markets is growing among both retail and institutional investors, but the risks associated with such investments are being scrutinized by regulators.

- Market Reactions: Despite the regulatory scrutiny, Robinhood’s share price remained stable, reflecting market confidence thus far.

- Historical Context: Robinhood previously halted Super Bowl event contracts due to regulatory requests, showcasing the ongoing tension between innovation and compliance in the financial services sector.

Impact on Readers: The ongoing investigation could influence how readers view investment platforms and their offerings, especially if they are young or inexperienced investors. Understanding the risks associated with linking gambling and investment could lead to more informed decision-making in their financial activities.

Massachusetts Scrutiny of Robinhood’s Prediction Market: A Closer Look

The recent news from Massachusetts regarding Robinhood’s foray into prediction markets raises several discussions about the implications for users and the broader financial landscape. Massachusetts’ securities regulator has initiated an inquiry into Robinhood’s prediction markets, particularly concerned about the blend of gambling and investment, especially among younger audiences. This scrutiny is indicative of the growing regulatory pressure in the fintech sector—a trend that reflects a broader wariness of how innovative financial products can affect consumer behavior.

Competitive Advantages: Robinhood’s entry into prediction markets allows it to leverage its existing user base and brand recognition among retail investors. By utilizing a regulated platform like Kalshi, Robinhood aims to position itself as a trustworthy player in the prediction space. This innovation could open new revenue streams and potentially attract a demographic eager for alternative investment opportunities. Furthermore, the company’s ability to market these offerings as CFTC-regulated may enhance consumer confidence in a domain often criticized for its speculative nature.

Disadvantages and Challenges: However, the Massachusetts investigation uncovers critical vulnerabilities. The regulator’s concerns about the conflation of gambling and investment could hamper Robinhood’s growth in this sector. The adverse public perception of a platform associated with young gamblers can tarnish its reputation as a serious investment tool. Additionally, the pressure from regulators might deter other companies from exploring similar markets, stunting innovation within the industry. This dynamic could very well discourage cautious investors from participating in these new offerings, fearing regulatory backlash.

Beneficiaries and Affected Parties: On one hand, early adopters of Robinhood’s prediction markets, especially younger investors with an affinity for gambling, could reap significant benefits from this novel investment opportunity. However, traditional investors and retail customers accustomed to conventional investment methods might find this shift troubling, feeling it undermines the integrity of their investment approach. Moreover, other platforms venturing into prediction markets may now find themselves reevaluating their strategies, either to comply with potential regulatory changes or to differentiate themselves in a crowded field.

As scrutiny intensifies, Robinhood’s next steps could either solidify its reputation as an innovator or cast it as a risky endeavor in the eyes of investors and regulators alike. Keeping an eye on how this will unfold may provide vital insights into the future of fintech and consumer investment behaviors.