The cryptocurrency landscape is buzzing as the team behind the Official Melania Meme (MELANIA) token recently executed a significant selling spree, unloading over $1.5 million worth of tokens in just three days. This aggressive selling pattern has sparked discussions about a potential programmatic selling strategy that might impose additional downward pressure on the token’s value. According to blockchain data, the MELANIA team sold $930,000 in tokens on April 28, following an earlier sale of $630,000 just two days prior. Crypto intelligence platform Lookonchain noted this trend, identifying it as a strategy reminiscent of dollar-cost averaging (DCA), which involves buying or selling predetermined amounts of an asset at regular intervals to mitigate emotional decision-making.

Despite these sales, MELANIA managed to stage a notable recovery of over 21% in the past week. However, it’s essential to highlight that the token still sits about 96% below its all-time high of $13.7, achieved on January 20, coinciding with the inauguration of former U.S. President Donald Trump. This historical context adds an intriguing layer to the token’s narrative, especially as it compete for attention alongside other cryptocurrencies.

“The #Melania team didn’t just add or remove liquidity to sell $MELANIA, they also employed a DCA strategy for direct sales!” – Lookonchain

Meanwhile, the memecoin market continues to attract interest, capturing around 27% of global investor attention in the first quarter of 2025, according to a recent report from CoinGecko. This sector was closely followed by artificial intelligence tokens, which commanded over 35% of the investment narrative. As the market evolves, many analysts, including CoinGecko’s co-founder Bobby Ong, suggest we find ourselves recycling old narratives rather than witnessing the emergence of new ones.

In the background of these developments, large investors are making strategic moves, with one newly created whale wallet recently depositing $1.33 million worth of USDC stablecoins to take a leveraged short position on the Official Trump (TRUMP) memecoin. Such maneuvers indicate a cautious approach from some market participants amid uncertainty surrounding the memecoin’s trajectory. This complicated interplay reflects broader trends within the cryptocurrency world, as enthusiasm wanes and the exploration of new narratives remains on the horizon.

Analysis of the Melania Meme Token and Market Trends

Key points regarding the Official Melania Meme (MELANIA) token and its market dynamics include:

- Significant Token Sales:

- The MELANIA team sold over $1.5 million worth of tokens in just three days.

- Specifically, $930,000 was sold on April 28, two days after a $630,000 sale.

- Programmatic Selling Strategy:

- Selling patterns suggest the use of a dollar-cost averaging (DCA) strategy for these sales.

- DCA is commonly used by investors to minimize the impact of volatility and emotional decision-making.

- Market Recovery:

- Despite the heavy selling, MELANIA experienced a 21% recovery over the past week.

- It still remains about 96% below its all-time high of $13.7 from January 20.

- Investor Behavior:

- Large investors are positioning for declines in the market, as seen with a $1.33 million short position on the Official Trump (TRUMP) token.

- This behavior may indicate cautious sentiment among big players in the memecoin market.

- Market Trends:

- Memecoins were the second-most dominant crypto sector in Q1 2025, capturing about 27% of market interest.

- There is a lack of new narratives emerging in the crypto market, as investors continue to focus on older trends.

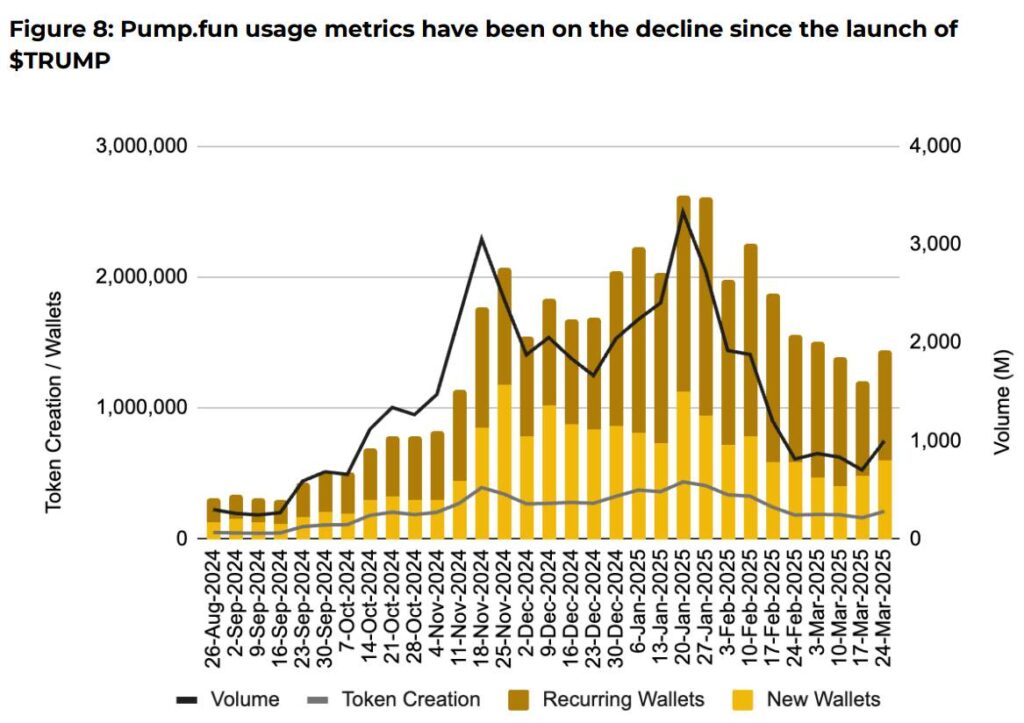

- Decline in Memecoin Activity:

- The launch of the TRUMP token did not perform as expected, potentially signaling the end of the memecoin supercycle.

- Weekly active wallets using memecoin launchpads have significantly decreased.

Understanding these dynamics is crucial for investors to navigate the evolving landscape of cryptocurrency investments and make informed decisions.

Comparative Insights on the MELANIA Token’s Market Dynamics

The recent selling spree by the team behind the Official Melania Meme (MELANIA) token has ignited a flurry of discussions within the cryptocurrency community, especially in light of its strategic approach to dollar-cost averaging (DCA). With over $1.5 million in tokens sold in just three days, the team’s methodology indicates a calculated effort to manage their holdings. However, this selling pattern raises questions about the sustainability of MELANIA’s value, especially considering its significant fall since its all-time high.

In comparison to other memecoins like the Official Trump (TRUMP) token, MELANIA seems to be treading a precarious path. While both tokens experienced turbulence, the selling activity in MELANIA suggests that the team is attempting to minimize emotional decision-making associated with price volatility. On the flip side, it may also be seen as a lack of confidence in the token’s future, potentially discouraging new investors. The DCA strategy, while typically a sound investment approach, could inadvertently signal to the market that the team is anticipating further declines, adding a layer of downside pressure.

The competitive disadvantage for MELANIA is amplified by the contrasting situation with the TRUMP token, which has seen speculative bets against its price by large investors. A notable whale wallet recently took a short position with substantial leverage against TRUMP, indicating a lack of confidence in its future price movements. This could lead MELANIA to face heightened scrutiny as investors weigh their options in a market where speculative, high-risk trading often reigns supreme.

Investors seeking to engage in the memecoin space should consider how the current dynamics could affect their strategies. Those who thrive on volatility and speculative trading might see opportunities in MELANIA, particularly given its recent recovery of over 21%. Yet, for more cautious investors, the substantial price drop from its all-time high to its current valuation might be a red flag. The fear of missing out (FOMO) can drive decisions, but the associated risks could be greater than expected. Consequently, as the sentiment surrounding memecoins shifts, MELANIA may find itself at a crossroads, influencing both seasoned traders and newcomers in unpredictable ways.