As the cryptocurrency market continues to navigate a turbulent path, one notable area of concern is the memecoin sector, particularly on the Pump.fun platform. Recent reports indicate a significant slowdown, with the graduation rate of tokens sinking below 1% for the fourth consecutive week. The term “graduation rate” refers to the percentage of tokens that successfully complete the incubation phase and become fully tradable on decentralized exchanges within the Solana network.

Data from Dune Analytics reveals that this is a historic low for Pump.fun, a platform that has never boasted particularly high graduation rates. The best-performing week back in November saw only 1.67% of memecoins reach the market, a figure buoyed by an unprecedented surge of token launches at that time. However, as both token creation and investor enthusiasm wane, the average number of weekly graduations has plummeted to around 1,500, highlighting a stark decline in market interest.

“Memecoins are dying, and they’re not responding to positive market signals,” noted analysts from Matrixport, reflecting on the characteristics that have tarnished this sector’s reputation.

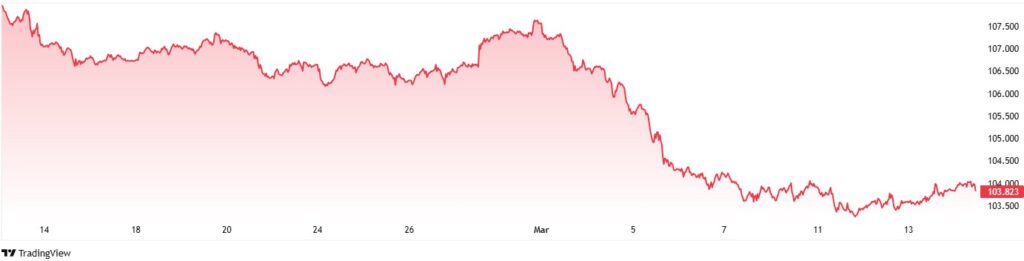

Despite indications of improving liquidity and a weakening US dollar, which normally could bolster market confidence, the memecoin segment continues to flounder. Analysts suggest that historical trends show these tokens are often viewed as risky investments or mere cash grabs. Even high-profile entries, such as political figures launching their own tokens, have not been immune to the downturn, with some tokens plummeting significantly in value since their peaks.

The broader implications of the sluggish memecoin market extend to the overall cryptocurrency landscape, with reports indicating a staggering trillion decrease in market capitalization attributed to the struggles of these speculative assets. This environment is causing investors to approach capital deployment with renewed caution, potentially leading to constrained rebounds in other areas, including Bitcoin, which is also facing pressure from the lingering aftereffects of the memecoin malaise.

“This redistribution of wealth may lead investors to remain cautious, causing rebounds—even those triggered by better-than-expected inflation data—to be limited,” the Matrixport report further emphasizes.

As we observe the dynamics of tokens on platforms like Pump.fun, the memecoin frenzy seems to be hitting a wall, leaving many to wonder what the future holds for this once-prominent segment of the cryptocurrency market.

The Decline of Memecoins on Pump.fun

The memecoin market, particularly on the Pump.fun platform, is facing significant challenges, impacting investors and market participants. Here are the key points to consider:

- Graduation Rate Challenges:

- The “graduation rate” of Pump.fun has been below 1% for four consecutive weeks, indicating a decline in token success stories.

- For a token to graduate, it must meet specific liquidity and trading requirements on the Solana DEX.

- This rate has been historically low, with a peak of only 1.67% back in November when many tokens were launched.

- Decline in Token Creation:

- The number of tokens launched on Pump.fun has dramatically decreased, with around 1,500 tokens reaching graduation weekly.

- This suggests a diminishing interest and investor appetite in the memecoin sector.

- Political Figures Joining the Scene:

- Prominent figures, such as US President Donald Trump, are launching their own memecoins, yet these have seen significant losses, dropping by 84% from their all-time highs.

- Such involvement can further tarnish the reputation of memecoins as mere speculative investments.

- Market Liquidity and Economic Factors:

- Despite a weaker US dollar leading to some liquidity improvements, the memecoin market continues to struggle.

- Market analysts highlight that, even with a more favorable economic environment, memecoins’ narratives remain weak.

- Wider Market Implications:

- The downturn in the memecoin market has contributed to a trillion drop in overall crypto market capitalization.

- This has caused a cautious mindset among investors, possibly limiting recovery in the crypto market despite positive economic indicators.

- Impact on Bitcoin Values:

- Ongoing struggles in the memecoin sector could lead to downward pressure on Bitcoin, with projections suggesting potential drops to around ,000.

- Such fluctuations could impact investors’ portfolios and long-term strategies in the cryptocurrency space.

“The continuing decline in the memecoin market reflects broader caution among investors, making it crucial to understand potential implications for the overall cryptocurrency landscape.”

The Decline of Memecoins: A Comparative Look at Market Dynamics

The recent downturn of the memecoin market on platforms like Pump.fun has created ripples across the crypto landscape, revealing both competitive advantages and disadvantages when compared to other crypto segments. With Pump.fun’s graduation rates falling below 1% for four consecutive weeks, the current state of memecoins reflects a significant shift in investor sentiment towards these assets. The stark contrast to more established cryptocurrencies like Bitcoin highlights a troubling trend for those enamored with the thrill of memecoins.

One advantage that traditional cryptocurrencies have over memecoins is stability. Projects with defined use cases and established backing tend to attract more serious investors, fostering a sense of trust that is currently absent in the memecoin arena. For instance, Bitcoin is enjoying attention from institutional investors who view its market behavior as a hedge against inflation, especially in light of fluctuations in the US dollar. In stark contrast, memecoins have devolved into what many are dubbing “lottery tickets” — enticing yet fundamentally lacking in long-term viability.

On the downside, the drastic depreciation of various memecoins, including those fronted by notable figures like Donald Trump, suggests that even high-profile launches are losing their luster. This could serve as a deterrent for new investors who may be hesitant to dive into an area that seems increasingly fraught with risk. The sensational narratives that once propelled these tokens to success no longer hold as much sway. For crypto newcomers, the declining success of memecoins may serve as a cautionary tale, nudging them toward more resilient projects.

The ripple effect of this downturn may mainly benefit seasoned investors, who might seize reduced prices to acquire undervalued memecoins or shift their focus towards more stable assets. Alternatively, overleveraged investors or those new to crypto who poured their savings into memecoins could face financial hardships, further breathing life into the skeptics’ narrative surrounding these volatile assets. In essence, while experienced traders can identify the current market landscape as an opportunity, it could pose a serious shortfall for less informed participants, underscoring the disparity in crypto literacy among investors.

Despite indications of recovering liquidity in the broader market, it is clear that the unfortunate state of memecoins reflects deeper issues among investors: caution, uncertainty, and a potential aversion to risk. This environment underlines the complexity of the crypto landscape, where even small fluctuations can bear significant implications. As memecoins continue to falter under the weight of their reputations, the focus may gradually shift back to the established players that offer tangible benefits and greater long-term investment clarity.