In a significant development for the cryptocurrency sector, Bitcoin mining stocks have experienced a notable decline following reports that Microsoft has abandoned its plans to invest in new artificial intelligence data centers in the US and Europe. This news, first broken by Bloomberg, suggests that Microsoft is reacting to a perceived oversupply in the market for AI computing capacity. As a result, major crypto mining companies, including Bitfarms, CleanSpark, Core Scientific, Hut 8, Marathon Digital, and Riot, have all seen their shares drop between 4% and 12%, reflecting the increased vulnerability of these miners to fluctuations in the tech landscape.

“Miners are diversifying into AI data-center hosting as a way to expand revenue,” remarked Coin Metrics, highlighting a growing trend in the industry.

The bearish sentiment comes on the heels of Bitcoin’s upcoming “halving” in April 2024, which is expected to further shrink mining revenues. In response, many miners are looking to pivot towards supporting AI workloads as a means of diversifying their business models. Notably, Core Scientific has committed to providing 200 megawatts of hardware capacity for AI operations with CoreWeave.

Despite the potential for growth in AI-related ventures, challenges abound. A report from JPMorgan indicates that declining cryptocurrency prices have already placed significant strain on mining operations, exacerbated by the upcoming halving. Moreover, with Microsoft’s recent decision to delay expansion plans and scale back on AI collaborations, the potential for increased demand from this sector appears uncertain.

Analysts at TD Cowen have noted that Microsoft’s pullback from building new data centers could further complicate the landscape for Bitcoin miners.

As the market digests these changes, the future of Bitcoin mining stocks remains in a delicate balance, hinging on both the cryptocurrency market and the evolving dynamics of the tech sector. Given the heightened interdependence between AI infrastructure and cryptocurrency miners, it is crucial to watch how these developments will continue to shape the landscape moving forward.

Impact of Microsoft’s AI Data Center Investment Decisions on Bitcoin Mining Stocks

The recent developments in Microsoft’s investment strategy have significant implications for Bitcoin mining stocks and the broader cryptocurrency market. Here are the key points to consider:

- Microsoft Scraps AI Data Center Investments:

- Microsoft has reportedly abandoned plans to invest in new AI data centers in the US and Europe, citing potential oversupply.

- This decision has drawn attention from the cryptocurrency community as it may affect Bitcoin mining operations that are diversifying towards AI.

- Stock Price Declines:

- Shares of notable crypto miners such as Bitfarms, CleanSpark, Core Scientific, Hut 8, Marathon Digital, and Riot saw declines between 4% and 12% following the news.

- The downturn reflects the interconnected fate of cryptocurrency mining and emerging tech industries.

- Dependence on AI for Revenue:

- Cryptocurrency miners are becoming increasingly reliant on AI data-center hosting as a strategy to boost revenues, especially post-Bitcoin halving.

- Example: Core Scientific committed 200 megawatts of capacity for AI workloads, aiming to leverage their mining infrastructure.

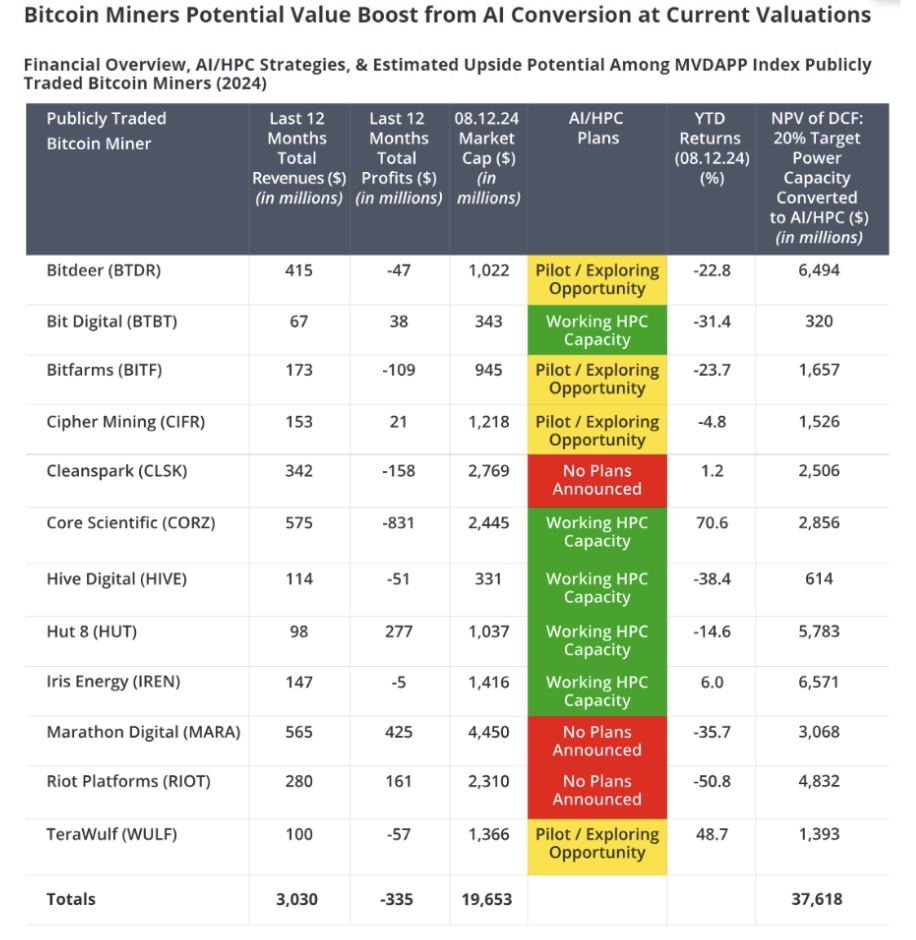

- Market Capitalization Potential:

- Analysts suggest that Bitcoin mining stocks could see a billion increase in market capitalizations if they invest in AI.

- This highlights the potential financial benefits for miners who adapt to the changing technological landscape.

- Challenges Persist:

- Miners are facing ongoing struggles due to declining cryptocurrency prices and the effects of the April 2024 halving on revenues.

- Waning demand for AI data centers could exacerbate this situation, complicating the transition for miners already under pressure.

- Future Outlook:

- Microsoft’s decision to slow data center investments may lead to a more competitive environment, affecting both AI and Bitcoin mining sectors.

- The reliance on AI could be a double-edged sword, presenting opportunities for growth while simultaneously introducing new risks.

Understanding these dynamics is essential for investors and stakeholders in the Bitcoin mining space, as shifts in technology investments can have cascading effects on market valuations and business viability.

The Ripple Effect of Microsoft’s AI Data Center Decisions on Bitcoin Mining Stocks

The recent announcement from Microsoft regarding its withdrawal from further investments in artificial intelligence (AI) data centers has sent shockwaves through the cryptocurrency mining sector. Stocks of major Bitcoin mining companies, such as Bitfarms, CleanSpark, and Marathon Digital, witnessed declines of up to 12%, reflecting the fragility of these firms’ revenue streams which have increasingly become tied to AI development. This trend underscores a compelling competitive landscape where miners must navigate the dual challenges of crypto market volatilities and emerging AI infrastructure demands.

Competitive Advantages: The proliferation of AI-related opportunities for Bitcoin miners initially appeared advantageous, as these firms sought to diversify their revenue avenues beyond traditional cryptocurrency mining. Core Scientific’s commitment to providing hardware support for AI workloads exemplifies this shift. Analysts from asset management firms like VanEck even anticipate a substantial market capitalization increase for Bitcoin miners should they effectively align with the AI boom. By leveraging existing infrastructure for high-performance computing, these miners can push back against downturns in crypto prices, demonstrating innovation and adaptation in a fluctuating market.

Competitive Disadvantages: However, the recent pullback from a tech giant like Microsoft raises pivotal concerns. The perceived oversupply of computing capacity for AI applications brings inherent risks. With Microsoft’s cancellation of plans to build out new data centers and delay of other critical collaborations, the anticipated demand that Bitcoin miners hoped to capture may not materialize. This presents a double-edged sword: while miners are diversifying, they may find themselves overly reliant on a sector that’s currently slowing down, potentially jeopardizing their financial stability just as the impending Bitcoin “halving” threatens their core operational revenues.

Implications for Stakeholders: For investors, this landscape could be quite volatile. Those backing Bitcoin mining stocks might face heightened uncertainty as external factors like Microsoft’s decisions influence market trends. Conversely, technological companies looking for AI computing power may benefit from the decreasing demand for data center capacity, thereby lowering operational costs. Overall, Bitcoin miners could either face dire straits or redefine their business models by pivoting toward AI more strategically, a process that will require both careful planning and significant investment.