The cryptocurrency market begins the new week with a mix of volatility and cautious optimism, as Bitcoin seeks to solidify its position above an important trendline after a challenging weekend. Prices hovered around $86K, which is becoming a noted resistance level. Meanwhile, several altcoins such as FLR, TRX, and SOL outperformed the wider market, while the OM token from the RWA-focused project Mantra suffered a staggering 90% crash, leading to significant turmoil and speculation regarding its implications for the sector.

The massive decline in the OM token has drawn attention, with Mantra attributing the collapse to forced liquidations and unusual trading activities, prompting a heightened sense of scrutiny and distrust among investors. OKX’s CEO has labeled the incident a significant scandal for the entire crypto industry.

In other developments, data from IntoTheBlock indicates a resurgence in transaction volumes for Virtuals Protocol, a project that enables the development and management of AI agents. Additionally, significant investments are being noted, including Mechanism’s Capital’s $200 million bullish position on Bitcoin. On the macroeconomic front, the market remains anxious as ongoing U.S.-China trade tensions loom, exacerbating fears of a prolonged range-bound trading pattern for Bitcoin.

New York Digital Investment Group (NYDIG) commented on the relatively stable behavior of the crypto market amidst recent turbulence in traditional financial markets, suggesting this might contribute to a “self-reinforcing virtuous cycle,” while analysts call for vigilance given the potential for market volatility.

The sentiment among traders is mixed, as highlighted in a recent Telegram dispatch from QCP Capital, reflecting a “wait and see” attitude toward the evolving tariff situation. Notably, concerns over waning demand for Bitcoin spot ETFs, which experienced substantial outflows last week, might influence market dynamics significantly. The upcoming week will see critical economic indicators and speeches from influential financial leaders, which could further shape market expectations.

Investors are bracing for potential shifts in sentiment, with a focus on how global economic actors respond to tariff negotiations and their impact on risk assets.

Key Insights from the Latest Crypto Market Developments

Here are some of the most significant points from the recent crypto market update, highlighting crucial developments in Bitcoin and other tokens, as well as broader market implications:

- Bitcoin Market Stability:

- Bitcoin is attempting to maintain its position above the $80k-$90k range amidst U.S.-China trade tensions.

- The potential shift in the tariff situation may influence investor sentiment and market behavior.

- OM Token Crash:

- Mantra’s OM token experienced a dramatic 90% crash attributed to forced liquidations on exchanges.

- This incident raises concerns about market manipulations and could damage the credibility of projects in the RWA sector.

- Increased Transaction Volumes:

- Virtuals Protocol noted an uptick in transaction activity, indicating a growing interest in blockchain-based AI agents.

- ETF Demand Weakness:

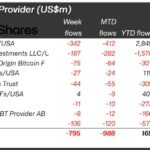

- Spot Bitcoin ETF saw a significant outflow of over $700 million, raising alarms about institutional selling.

- Declining demand for Bitcoin ETFs could impact market dynamics and institutional investor interest.

- Impending Economic Events:

- Market participants are advised to observe key upcoming events, including Fed Chair Powell’s speech and U.S. retail sales data.

- These events may influence stock market volatility and the sentiment around crypto assets.

- Technological Upgrades:

- Significant upgrades planned for various tokens, such as Filecoin and HashKey Chain, may enhance their utility and stability.

- Market Sentiment:

- There is a prevailing sentiment of skepticism regarding market recovery due to tariff uncertainties and potential economic slowdowns.

Impact: The developments mentioned may lead to increased caution among investors, heightened scrutiny of market practices, and a potential reassessment of investment strategies. Staying informed about market trends and economic indicators can help readers make better financial decisions.

Comparative Analysis of Cryptocurrency Developments This Week

This week’s cryptocurrency landscape showcases distinct movements and sentiments across various projects, reflecting a mix of instability and opportunity. The recent turbulence surrounding the OM token from Mantra stands out dramatically, inciting both concern and scrutiny. This incident, in which the token experienced a staggering 90% crash, highlights significant vulnerabilities in the market, especially tied to forced liquidations on exchanges. While Mantra attributes the collapse to external factors and moves of significant token volumes before the incident, their claims raise red flags regarding transparency and trust within the crypto space.

Competitive Advantages: Despite the rough patch, the broader blockchain ecosystem is witnessing developments that suggest some resilience. For instance, Virtuals Protocol reported a rebound in transaction volumes, signaling a potential uptick in user engagement for projects focused on AI solutions. Additionally, bullish sentiments for Bitcoin persist, with notable investors repositioning their stakes, furthering narratives of investor confidence amidst uncertain market conditions. Companies like New York Digital Investment Group have recognized the crypto market’s unique ability to remain fairly stable compared to traditional assets during times of turmoil.

Disadvantages: However, major concerns loom large. Bitcoin’s ongoing struggle to maintain its price within the $80k-$90k range indicates a cautious market, with many viewing the current climate as ripe for a range-bound trading strategy rather than explosive growth. Moreover, the skepticism surrounding recent ETF inflows—reporting a staggering $700 million outflow last week—highlights broader concerns regarding institutional sentiment toward cryptocurrencies, potentially dissuading new investors from entering the arena.

Both developments create a mixed bag of outcomes for differing factions in the market. For instance, upcoming major token events, such as the SmarDEX halving, present opportunities for existing holders and can bolster market confidence. Yet, the fallout from the OM token collapse could undermine interest from potential retail investors, particularly if they perceive the risk and volatility as outweighing potential rewards. Additionally, high-profile incidents like Mantra’s may lead larger institutional players to reassess their strategies, impacting the overall market’s growth trajectory.

As the crypto community watches these shifts unfold, it remains to be seen whether the lingering impacts will foster further innovation or serve as a cautionary tale against speculative investments. Predictably, both optimism and skepticism will continue to shape the narratives of investors and stakeholders navigating this complex landscape.