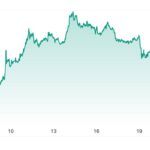

In recent days, the cryptocurrency market has witnessed a notable shift in the fortunes of Monero (XMR), a privacy-centric digital currency. After experiencing a remarkable rally that saw its price surge from $165 to $420 over seven weeks, Monero has encountered a sharp sell-off, dropping to $325 on Kraken. This significant dip marks a stark turnaround that has captured the attention of traders and analysts alike.

The sell-off, attributed to various factors including a favorable regulatory environment in the U.S. and anticipation surrounding the upcoming FCMP++ upgrade aimed at enhancing Monero’s quantum resistance, has also fueled increased activity in the futures market. Open positions in Monero futures have climbed to 161.37K XMR, a level not seen since December 2022. This 20% rise in open interest over the past three days indicates heightened market engagement, though it may suggest a bearish sentiment among some traders as more positions are opened in anticipation of further price declines.

“An increase in open interest alongside a price drop is typically interpreted as representing a bearish sentiment.”

However, the story isn’t entirely negative for Monero. Despite the price drop, perpetual funding rates have remained positive, indicating a prevailing inclination towards long positions. This metric, which reflects the cost associated with holding leveraged futures positions, suggests that many traders may be adopting a “buy the dip” strategy, expecting the cryptocurrency to rebound swiftly.

As these dynamics unfold, Monero continues to be at the center of discussions within the cryptocurrency community, highlighted by its unique characteristics and the ongoing evolution of market sentiment.

Monero (XMR) Price Dynamics and Market Sentiment

The recent changes in Monero’s price and market activity have significant implications for traders and investors.

- Price Decline: Monero’s price dropped sharply from $420 to $325 in three days.

- High Open Positions: Open positions in futures reached 161.37K XMR, the highest since December.

- Market Sentiment: Increased open interest during a price drop suggests bearish sentiment, as traders anticipate further declines.

- Positive Funding Rates: Despite the price drop, funding rates remain positive, indicating bullish sentiment among traders.

- “Buy the Dip” Mentality: The rise in open interest may reflect a strategy of buying on the dip, hinting at optimism for a price recovery.

- Regulatory Environment: The surge in Monero’s value prior to the decline was attributed to favorable U.S. regulatory outlooks.

- FCMP++ Upgrade: Upcoming upgrades to enhance Monero’s security may impact future price movements.

The fluctuations in Monero’s market may affect investor strategies, emphasizing the importance of staying informed on regulatory changes and technological upgrades.

Monero’s Price Dynamics: Navigating the Current Market Landscape

In recent days, Monero (XMR) has experienced a notable price tumble, dropping to $325 after reaching $420, reflecting a volatile shift in trader sentiment. This trend, however, isn’t occurring in isolation; it mirrors similar phenomena in the cryptocurrency market, where privacy-focused coins are contending with both opportunities and challenges. One significant competitive advantage for Monero remains its robust privacy features, which continue to attract users who prioritize anonymity in their transactions. Such features, especially with the upcoming FCMP++ upgrade promising enhanced quantum resistance, position Monero favorably against rivals like Zcash and Dash, which often lag in privacy enhancements.

On the other hand, the recent spike in open positions within the futures market could signal caution. While an increase in open interest typically correlates with a bearish outlook, the persistent positive funding rates for Monero suggest a more complex trader psychology. This contrast indicates that many are viewing the downturn as a “buy the dip” opportunity, which could benefit long-term investors betting on Monero’s potential rebound. However, the rising open interest amidst falling prices may create vulnerabilities as traders navigate these turbulent waters. More conservative investors may find themselves at a crossroads, pondering whether to enter the fray or take a step back amid uncertain conditions.

As the dust settles, it’s clear that both potential investors and current holders of Monero must weigh the possible ramifications of this market turbulence. Those looking for a secure haven for privacy-centric transactions may still find merit in XMR, yet the market’s inherent volatility and bearish undertones could pose a challenge for risk-averse stakeholders. Overall, the interplay of positive funding rates and increasing open interest suggests a dynamic scenario where both opportunity and risk await, appealing to a diverse range of crypto enthusiasts and traders.