In a strategic move to strengthen its foothold in the enterprise stablecoin sector, MoonPay, a prominent cryptocurrency payments provider, has announced its acquisition of Iron, a developer specializing in API-driven stablecoin infrastructure, for an undisclosed sum. This acquisition, revealed on March 13, aims to enhance MoonPay’s offerings, enabling businesses to accept stablecoin payments instantly and economically. The integration of Iron’s technology will allow enterprises to manage their stablecoin treasuries effectively, with the added flexibility to invest in yield-generating assets like US Treasury bonds.

“With Iron’s technology, we’re putting the power of instant, programmable payments into the hands of enterprises, fintechs, and global merchants,” said Ivan Soto-Wright, CEO of MoonPay.

This latest acquisition marks MoonPay’s second significant purchase this year, following its 5 million acquisition of Helio, a Solana-based blockchain payment processor, in January. The addition of Helio, which enjoys integrations with widely used platforms like Shopify and Discord, positions MoonPay to broaden its crypto on-ramp capabilities and payment solutions.

MoonPay is not navigating this space alone. Other companies, like Tether-backed fintech Mansa, are also making strides in enhancing stablecoin payment infrastructures, having recently secured million for its expansion efforts. This concerted push comes as the demand for stablecoins surges, currently boasting over 0 billion in circulation, according to industry reports.

Marc Boiron, CEO of Polygon Labs, commented on this growth, stating, “Companies like Stripe and PayPal integrating stablecoins is likely the primary catalyst for their growth.”

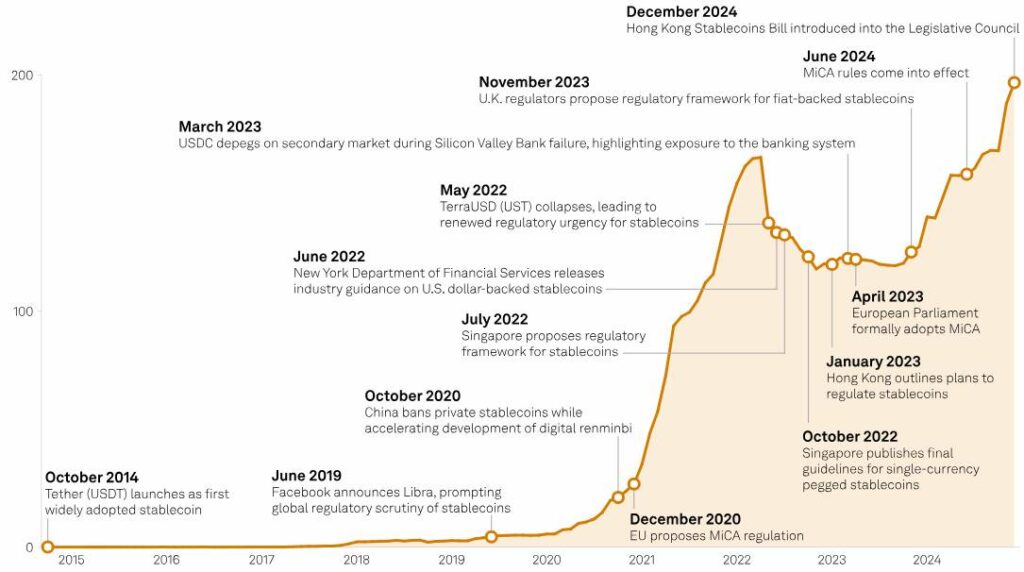

As we see increased regulatory focus and evolving market dynamics since 2020, the landscape for stablecoins continues to transform. A notable development is the rise of yield-bearing stablecoins, allowing holders to earn returns through traditional collateralization. This innovation received a boost when the US Securities and Exchange Commission approved the first yield-bearing stablecoin security in February, signaling a potential turning point in regulatory clarity for stablecoins in the United States.

MoonPay Expands Enterprise Stablecoin Market

Cryptocurrency payments company MoonPay is enhancing its capabilities in the stablecoin sector through strategic acquisitions, impacting enterprises and traditional finance.

- Acquisition of Iron: MoonPay has acquired Iron, an API-focused stablecoin infrastructure developer, allowing enterprise customers to process stablecoin payments instantly and at a low cost.

- Real-time Treasury Management: The integration with Iron enables companies to manage their stablecoin treasuries in real time, providing the ability to utilize funds more effectively.

- Yield-bearing Assets: Companies can leverage their stablecoin reserves to acquire yield-bearing assets like US Treasury bonds, potentially increasing their financial returns.

- Growth in Stablecoin Usage: With over 0 billion in stablecoins in circulation, their adoption is driven by integrations from major fintech providers like Stripe and PayPal.

- Regulatory Developments: The approval of the first yield-bearing stablecoin security by the SEC is indicative of a maturing regulatory landscape, which could enhance trust and encourage wider adoption.

- Impacts on Enterprises: The shift towards stablecoin adoption facilitates lower transaction costs and instant payments, which can significantly streamline business operations and reduce reliance on traditional banking systems.

“With Iron’s technology, we’re putting the power of instant, programmable payments into the hands of enterprises, fintechs, and global merchants.”

— Ivan Soto-Wright, CEO of MoonPay

These developments illustrate the growing intersection of cryptocurrency with traditional finance. For readers involved in enterprise finance or technology sectors, understanding these shifts could provide opportunities for innovative payment systems and investment strategies.

MoonPay’s Strategic Move: Analyzing the Iron Acquisition

MoonPay is making headlines with its ambitious acquisition of Iron, aiming to solidify its foothold in the enterprise stablecoin sector. This move places it in direct competition with established players, but what does this really mean for market dynamics?

Competitive Advantages: MoonPay’s acquisition opens the door for businesses to handle stablecoin transactions not just swiftly but also at reduced costs. By integrating Iron’s cutting-edge API technology, MoonPay enhances its service offerings, allowing enterprise clients to manage treasury operations and invest in yield-generating assets seamlessly. Furthermore, this acquisition follows MoonPay’s strategic move to purchase Helio, suggesting a well-thought-out approach to expand its ecosystem and customer base across various platforms like Shopify and Discord. Such integrations position MoonPay as a forward-thinking contender, catering to the growing demand for faster and affordable cryptocurrency payments.

Market Disadvantages: While MoonPay is gearing up for success, it isn’t without its challenges. As it thrusts itself into the already competitive landscape of stablecoin integrations, it faces formidable rivals like Tether-backed Mansa, which has recently raised significant capital to enhance its own offerings. The market for stablecoins is crowded, and MoonPay’s endeavor could lead to dilution of resources as it strives to distinguish itself amidst aggressive competition. Additionally, regulatory scrutiny remains an ongoing challenge, potentially affecting user trust and adoption rates across the board.

This acquisition could serve various stakeholders, primarily enterprises looking to harness the benefits of cryptocurrency payments. Companies that are currently sitting on the sidelines due to complex, cost-prohibitive payment processes might find MoonPay’s enhanced services beneficial. Conversely, the expansion could disrupt smaller payment processors or financial platforms that cannot compete with the speed and efficiency MoonPay aims to deliver. As larger players strengthen their grip on the market, smaller entities may struggle to retain relevance.

The stablecoin market’s ongoing evolution signals a shift toward more streamlined integrations and yield-generating opportunities. As MoonPay forges ahead, its focus will likely influence the direction of stablecoin adoption, giving rise to exciting possibilities for both enterprise clients and end-users in the evolving landscape of digital finance.