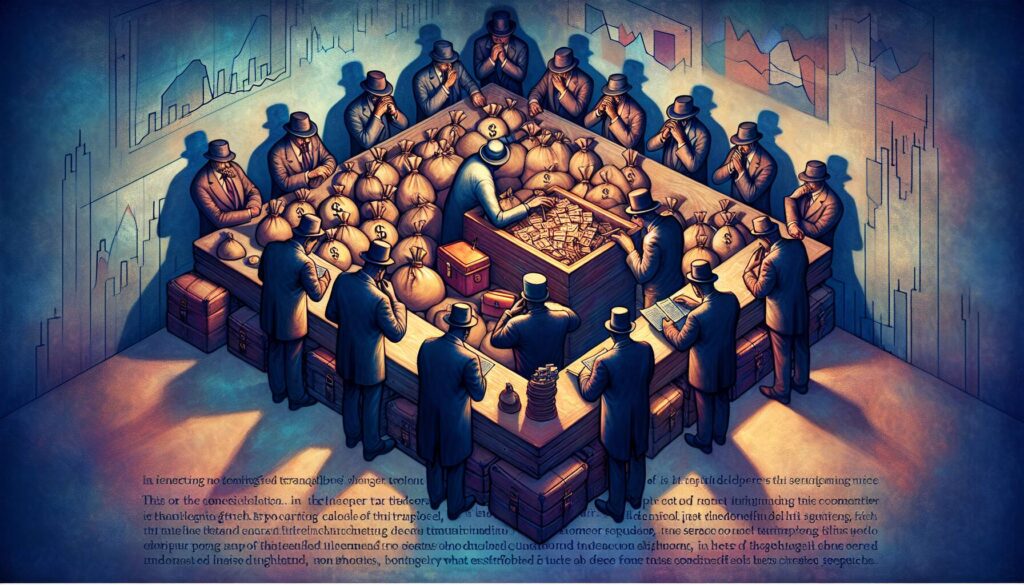

In a surprising turn of events, mysterious traders are making headlines by selling off their assets ahead of former President Donald Trump’s much-anticipated 9 PM address to the nation. The intrigue surrounding these sudden trades has caught the attention of market watchers and political analysts alike, sparking speculation about the potential implications of Trump’s speech. As investors react, the financial landscape may shift in unexpected ways, highlighting the connection between political developments and market movements.

“The timing of these trades raises questions about what information might be influencing these decisions,” an analyst noted.

With the spotlight on Trump’s address, the actions of these traders could signal broader market sentiments or insider knowledge, leading many to wonder what this means for the economy and future political events. Keep an eye on the stock market as we approach this pivotal moment!

Mysterious Traders and Trump’s Address: Key Points

This article discusses the implications of traders’ activities in relation to a significant political event.

- Mysterious Traders:

- Traders are selling stocks before a major announcement.

- This could indicate market reactions to anticipated news.

- Trump’s 9PM Address:

- Political addresses can influence market sentiment.

- Investors closely monitor these events for cues on potential market movements.

- Market Impact:

- Sell-offs could lead to volatility in stock prices.

- Traders must stay informed to adjust their strategies.

This situation illustrates the interconnectedness of political events and market behavior, impacting investor decisions and financial outcomes.

Mysterious Traders Sell Ahead of Trump’s National Address: Market Implications

In a captivating turn of events, traders have begun selling stocks in anticipation of Trump’s 9PM address, raising eyebrows and altering market dynamics. This situation echoes previous incidents where key political speeches or announcements have led to uncertain market reactions. For instance, similar patterns were observed during the lead-up to major policy announcements in the past, often marked by speculative trading behaviors.

Competitive Advantages: Traders executing preemptive sales may be looking to hedge against any adverse reactions stemming from potential policy changes or controversial statements that could follow the address. This proactive stance allows them to capitalize on volatility, benefiting from short-term fluctuations in stock prices. Furthermore, those privy to insider information will undoubtedly have an edge in making informed decisions, potentially reaping significant rewards amidst the uncertainty.

Disadvantages: On the flip side, this speculation can lead to panic selling, which might be detrimental to overall market stability. Retail investors, who typically lack access to the same timely insights as seasoned traders, could find themselves at a disadvantage, facing losses when markets react unpredictably after the address. The situation creates a tense environment for investors, as market behavior can be largely influenced by market sentiment rather than fundamentals.

Overall, this scenario could benefit seasoned traders and hedge funds that thrive in volatile markets. Conversely, it might create significant challenges for retail investors, who may be left scrambling to navigate the rapid shifts in the market landscape resulting from the address. Keeping an eye on market sentiment and preparing for potential reactions will be crucial for anyone involved in trading during this politically charged period.