The cryptocurrency landscape is buzzing with excitement as Nasdaq, a prominent US exchange, seeks regulatory approval to list a groundbreaking exchange-traded fund (ETF) centered around Dogecoin (DOGE), the popular memecoin that has captured the imaginations of many investors. This move follows 21Shares’ recent application to launch the ETF, which adds to a wave of similar requests from competitors like Bitwise and Grayscale. According to regulatory filings, the proposed Dogecoin ETF could broaden access to this digital asset for a wider range of investors, pending the green light from the Securities and Exchange Commission (SEC).

Notably, 21Shares isn’t stopping with Dogecoin; they have also filed for ETFs linked to other cryptocurrencies, including notable players like Solana (SOL), XRP (XRP), and Polkadot (DOT). The rush to establish crypto ETFs highlights a significant trend in the market, especially since more than 70 such products are currently awaiting SEC review. This proliferation of altcoin ETFs has been encouraged partially by a recent call for the SEC to adopt a more favorable regulatory stance towards cryptocurrencies.

As public interest in digital assets continues to rise, Nasdaq and other exchanges are advocating for stricter regulatory measures, which could lead to greater legitimacy for the cryptocurrency market. An April 25 letter from Nasdaq urged the SEC to treat digital assets with the same scrutiny as traditional securities.

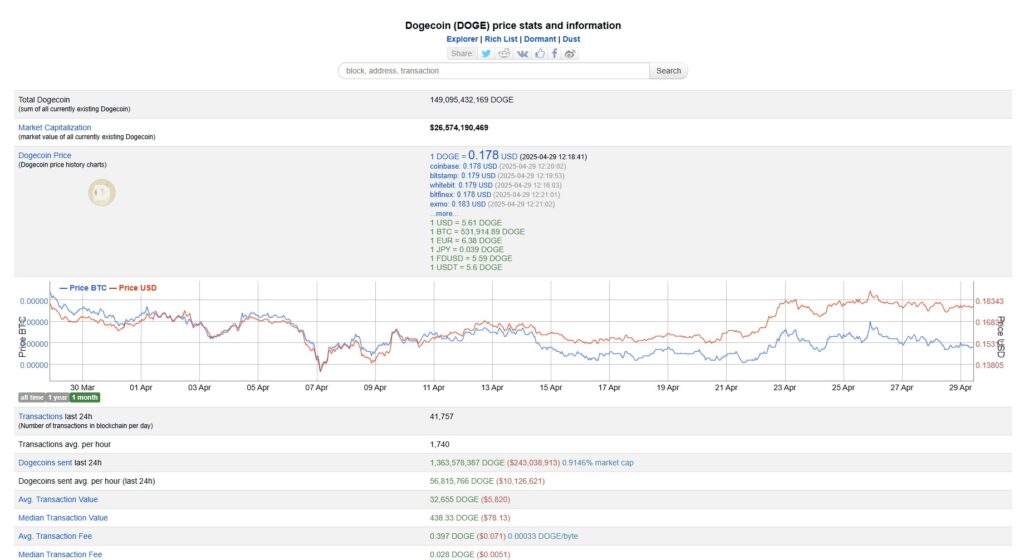

At the heart of this growing interest is Dogecoin itself, boasting a market capitalization nearing $26 billion. Unlike many other memecoins, Dogecoin is built on a proof-of-work blockchain designed for fast and inexpensive peer-to-peer payments, having processed over 40,000 transactions in the last day alone. Exciting developments are on the horizon as well; plans are in motion for a layer-2 scaling solution aimed at bringing smart contracts to the Dogecoin network.

As the SEC navigates this evolving regulatory landscape, the fate of Dogecoin ETFs—and the future of cryptocurrency investment—hangs in the balance.

Nasdaq’s Move to List Dogecoin ETF

The recent request by Nasdaq to list a Dogecoin exchange-traded fund (ETF) showcases the evolving landscape of cryptocurrency investment options in the United States. Here are the key points surrounding this development:

- Regulatory Approval Needed: Nasdaq’s request requires approval from the Securities and Exchange Commission (SEC), influencing the future accessibility of Dogecoin for a broader range of investors.

- Growing Interest in Crypto ETFs: Following a shift in regulatory sentiment, more than 70 crypto ETFs are currently awaiting SEC review, indicating increasing investor interest in alternative cryptocurrencies.

- 21Shares’ Initiative: 21Shares has filed to launch a Dogecoin ETF along with other cryptocurrencies like Solana (SOL) and Polkadot (DOT), positioning itself as a key player in the crypto ETF market.

- Nasdaq’s Call for Regulation: Nasdaq is advocating for a firmer regulatory framework for digital assets, which could lead to more stability in the crypto market if enacted.

- Dogecoin’s Growing Utility: Despite its memecoin status, Dogecoin serves as a fast and affordable means for peer-to-peer payments, with significant daily transaction volumes.

- Future Innovations: Plans for a layer-2 scaling solution to introduce smart contracts to Dogecoin suggest potential for further utility and adoption of the cryptocurrency.

This development may impact everyday investors by potentially providing a more regulated and accessible avenue to invest in cryptocurrencies without directly holding the tokens.

Nasdaq’s Bold Move: The Potential of a Dogecoin ETF

The recent pursuit by the United States exchange Nasdaq to list a Dogecoin exchange-traded fund (ETF) marks a notable development in the rapidly evolving cryptocurrency landscape. This initiative follows in the footsteps of other prominent applications for crypto ETFs, notably by competitors like Bitwise and Grayscale. Not only does this amplify the visibility of Dogecoin—a memecoin that has captured significant attention in the market—but it could also create a more structured avenue for retail and institutional investors alike to access digital assets.

Competitive Advantages

One of the standout benefits of a Dogecoin ETF lies in its potential to democratize investment in altcoins. With a market cap of nearly $26 billion, Dogecoin has risen from its roots as a meme-inspired token to become a legitimate player in the cryptocurrency arena. The ETF structure would allow a broader audience to gain exposure to Dogecoin without the complexities tied to direct cryptocurrency purchases. Additionally, with Nasdaq advocating for a stricter regulatory framework for digital assets, this ETF could be perceived as having a legitimacy that further attracts risk-averse investors.

Moreover, the anticipated approval process with the SEC may set a significant precedent for other memecoins and altcoin ETFs. If successful, it could boost market confidence and prompt more financial institutions to recognize digital currencies as viable assets for investment portfolios.

Competitive Disadvantages

On the flip side, this move is not without its challenges and potential drawbacks. The regulatory landscape surrounding cryptocurrencies remains uncertain. The SEC’s approval process might introduce delays, and any unexpected regulatory hurdles could dampen enthusiasm for not only the Dogecoin ETF but for related altcoin ETFs as well. With more than 70 crypto ETFs currently awaiting SEC review, there’s a significant backlog that could impact timelines and investor sentiment.

Additionally, while Nasdaq is eager to embrace Dogecoin, any adverse regulatory feedback could deter less experienced investors from venturing into the ETF space, potentially leading to market volatility. The mixed perceptions surrounding altcoins and memecoins might create a stigma, causing some traditional investors to shy away.

Who Stands to Benefit or Suffer?

This development stands to benefit a range of players in the cryptocurrency sector. Retail investors looking for diversified exposure to the crypto market without the burden of managing wallets will find ETFs, especially one featuring Dogecoin, particularly appealing. Blockchain developers and other associated projects might also gain increased interest and investment if the ETF garners significant attention.

Conversely, traditional financial advisors and institutions that remain skeptical about cryptocurrencies may find themselves in a tricky position; they could miss opportunities in this evolving financial landscape. Furthermore, should the regulatory review yield unfavorable outcomes, existing investors in Dogecoin and other cryptocurrencies could face declines in confidence and capital. The ripple effects of Nasdaq’s ETF ambitions will certainly reverberate through the broader financial ecosystem as stakeholders navigate this dynamic environment.