The world of cryptocurrency is buzzing with excitement and promise, but as many seasoned investors know, not every project that captures the spotlight is destined for success. Recently, a guide has emerged that sheds light on how to spot the next big crypto opportunity before it makes waves. With so many projects clamoring for attention, discerning real potential from fleeting hype requires astute analysis and a keen understanding of several foundational elements.

This guide focuses on crucial aspects such as on-chain metrics, tokenomics, developer activity, and community engagement. By honing in on these critical signals, investors can navigate the often chaotic crypto landscape while avoiding common pitfalls associated with hype-driven investments. Notably, it highlights past success stories like Solana and Chainlink, providing valuable insights into the indicators that led to their surges in popularity and value.

“Investors who understood the fundamentals often reaped the rewards, while those who jumped on the hype train were left bewildered as the market shifted.”

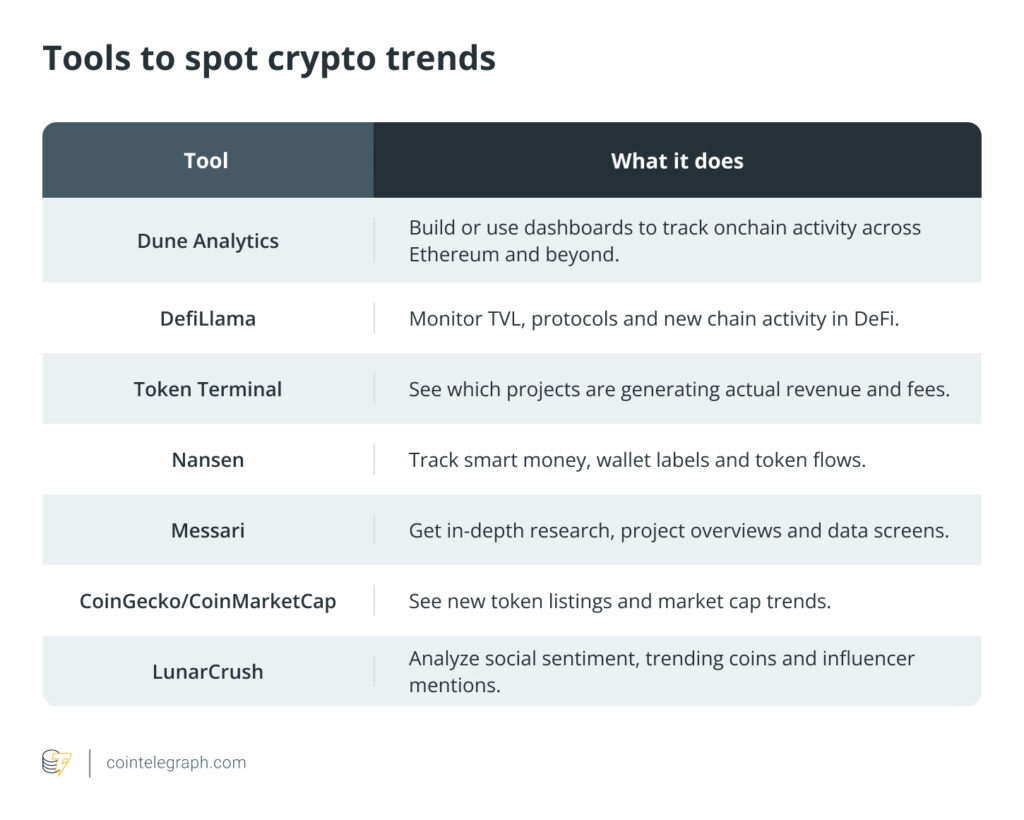

One key takeaway is the importance of monitoring real activity on public blockchains. Tools designed for crypto trendspotting, such as Dune Analytics and Nansen, allow users to track vital statistics like daily active wallets and transaction volumes, helping to identify whether a project is genuinely gaining traction. Furthermore, the guide delves into the significance of developer engagement; a lively GitHub page with frequent updates is a stark contrast to projects that stagnate—with the latter often signaling a lack of genuine progress.

Just as crucial is the analysis of community sentiment, which can be gauged through platforms like Discord and Twitter. Recognizing signs of authentic engagement versus hype-driven chatter is essential for staying ahead. The guide serves as a roadmap for those looking to refine their investment strategies by focusing on substance rather than mere speculation.

“The more you practice spotting early signals—the real ones, not the noise—the more second nature it becomes.”

In an industry characterized by rapid shifts and unexpected turnarounds, the ability to spot future winners comes down to education, research, and a bit of intuition. As investors navigate this intricate world, tools and insights from this guide could be pivotal in distinguishing between projects poised for significant growth and those destined to fade away.

Identifying Early Crypto Winners: A Practical Guide

Finding potential winners in the crowded and noisy crypto space requires an analytical approach. Here are key points to consider:

- Onchain Metrics:

- Monitor daily active wallets, transaction volumes, and liquidity on DEXs.

- Higher user activity and capital movement can indicate a promising project.

- Utilize tools like Dune Analytics and Nansen for insights.

- Understanding Tokenomics:

- Evaluate total supply, circulating supply, and token distribution.

- Tokens with capped supply and smart incentives typically perform better.

- Developer Activity:

- Check GitHub for code updates and active contributions.

- Regular commits signal a dedicated team building real products.

- Ecosystem Signals:

- Look for new DApps and increasing liquidity as signs of growth.

- A strong ecosystem indicates greater project sustainability.

- Community Engagement:

- Monitor platforms such as Discord and Reddit for community activity.

- Evaluate whether discussions are constructive or merely hype-driven.

Understanding these aspects can substantially impact your investment strategies, enabling you to make informed decisions and potentially avoid losses from overhyped projects.

Key Tools for Spotting Trends: Combine insights from multiple platforms to validate your findings.

- Signs of Real Traction:

- Consistent user growth and TVL over time.

- Active GitHub presence with ongoing development.

- Increasing number of token holders with diverse ownership.

- New integrations indicating solid technology.

- Slow and steady growth in liquidity and trading volume.

- Red Flags to Watch:

- High concentration of token holders indicating risk of price manipulation.

- Unverified token contracts which may mask malicious features.

- No liquidity lock or audit exposing you to rug pulls.

- Impending large token unlocks that could prompt sell-offs.

By diligently applying these strategies, readers can enhance their ability to spot emerging opportunities, thereby potentially maximizing their investment success in the evolving crypto landscape.

Spotting the Next Big Crypto Project: Strategies and Insights

In the ever-evolving landscape of cryptocurrencies, the quest for identifying the next potential breakout project can often feel overwhelming. Successful investors leverage a blend of analytics, trends, and intuition to pinpoint early-stage winners. The strategies laid out in this comprehensive guide highlight the importance of utilizing onchain metrics, tokenomics, developer activity, and community engagement, making it essential reading for those serious about investing. However, as we reflect on similar resources in the market, some competitive advantages and disadvantages come to light.

Competitive Advantages: The guide excels in its detailed approach by citing real-world examples from established projects like Solana and Chainlink. This not only illustrates the methodology but also offers genuine insights into how such projects flourished. The emphasis on tangible metrics, such as daily active wallets and transaction volumes, arms investors with the tools necessary to discern between genuine growth and fleeting trends. Moreover, the guide encourages a multifaceted approach, urging investors to use a variety of platforms for comprehensive analysis, thus producing well-rounded insights.

Additionally, the guide’s focus on tracking community sentiment across platforms like Discord and X (formerly Twitter) appeals to the modern investor who understands the power of grassroots engagement. This attention to social dynamics sets it apart from many traditional investment analyses, which often lack this contemporary perspective.

Disadvantages: However, despite its strengths, the guide may struggle under the weight of an increasingly saturated market. The emphasis on detailed analysis might intimidate newer investors who lack the technical expertise or data interpretation skills. Furthermore, as the crypto community continually evolves, trends can shift rapidly, making previously reliable indicators less effective. In such a volatile environment, strategies that worked for earlier successes may not guarantee similar outcomes in the future, potentially leading to misguided investments.

Target Audience and Potential Challenges: This guide is particularly beneficial for seasoned investors and those with a robust understanding of market dynamics. It empowers them to navigate complex analyses and identify crypto gems before they gain mainstream attention. On the flip side, novice investors who attempt to utilize these strategies without a foundational understanding of the market may find themselves lost or misled, which could result in financial setbacks. Additionally, by spotlighting specific projects, the guide runs the risk of attracting speculative trading behavior, ultimately leading to heightened volatility for those mentioned, as investors react to their potential rather than their inherent value.

In summary, the guide serves as a valuable resource filled with insights for crypto enthusiasts eager to uncover the next significant project. However, the lessons within are best suited for individuals who are prepared to engage deeply with the intricacies of the market while remaining cautious about the inherent risks characteristic of such investments.