It’s easy to feel overwhelmed by the sheer amount of data in Web3 – especially if you’re trying to determine which blockchain ecosystems are truly thriving. Beneath the noise of transaction counts and token prices lies something far more fundamental: how users engage on these chains and what their activity signals about long-term potential. If you’ve been wondering what all those charts and statistics actually tell us about blockchains like Solana, Ethereum, and others, you’re definitely not alone. Let’s break it down together.

User engagement is a lot more than just how many transactions are happening or how high the total value locked (TVL) is. What really counts is how and why users are active. Are they dipping their toes in for a single transaction, or are they exploring deeper, diverse interactions that point to meaningful, sustained involvement? By analyzing user activity across several key dimensions, we can start to paint a clearer picture of which chains are successfully retaining quality users and building ecosystems that actually deliver value over time.

For instance, chains like Solana and Ethereum often make headlines for their transaction volumes, but an overly narrow focus on this metric ignores a critical truth: transactions alone don’t indicate true engagement. What if most of those transactions stem from bots or repetitive actions that don’t contribute to broader adoption? To get to the heart of user behavior, we need to look at factors like their participation in decentralized finance (DeFi), governance voting, and contributions to non-fungible token (NFT) ecosystems. Each of these activities reflects not just presence, but purpose.

Consider Solana. It has periodically seen spikes in activity coinciding with price rallies or cultural moments (such as the rise of memecoins or particular NFT trends). When these surges occur, they’re undeniably exciting – they bring energy, attention, and growth potential. But zooming in, the real question is this: Are most users sticking around once the hype fades? And more importantly, are those users venturing across a wide range of ecosystem areas, from smart contracts to staking and beyond? Chains that depend too heavily on one or two activities risk stagnation, even during moments of apparent success.

Ethereum, on the other hand, faces its own dynamics. While the mainnet continues to attract some of the most significant DeFi and NFT projects, the broader ecosystem has fragmented as users and developers flock to Layer 2 solutions for faster, cheaper interactions. This can make mainnet activity look deceptively quiet, even as underlying engagement remains robust across Ethereum’s extended ecosystem. The challenge here isn’t a lack of users but rather identifying meaningful signals while factoring in this multi-layered structure. It’s a puzzle many chains will grapple with more in coming years.

What about the more niche players? Chains like Axelar are showing that quality user engagement doesn’t always mean having the largest number of wallets or the flashiest price performances. Instead, what makes Axelar stand out is the diversity and sustainability of its user activity. Wallets on Axelar tend to demonstrate a balanced mix of behaviors, from DeFi participation to governance contributions, signaling a mature and invested user base. For these smaller chains, cultivating this kind of activity early is key to scaling without losing the core values of their communities.

When you evaluate these chains side by side, what becomes clear is that no two ecosystems are quite the same – and that’s a good thing. Instead of trying to crown a single “winner,” it’s more constructive to focus on how each chain is evolving to meet the needs of its users. It’s not about which one does more transactions or reaches a particular TVL milestone first; it’s about which ones are building a foundation for meaningful, long-term growth. That kind of clarity is empowering for all of us navigating this space.

So, how do we make sense of all this complexity and redefine success in the on-chain world? It starts with shifting our mindset. Instead of treating blockchain metrics like a high-score competition, we need to view them as puzzle pieces that, when combined, reveal the bigger picture. At their core, these metrics should reflect what the chain stands for, who its users are, and whether its ecosystem is truly flourishing over time. It’s not just about raw numbers; it’s about the story those numbers tell.

Think about user activity like a balanced diet. Sure, a chain with high transaction counts might look “healthy” on the surface, but if those transactions are limited to repetitive tasks, that’s like eating nothing but empty calories. To truly thrive, a blockchain ecosystem requires a mix of diverse “nutrients” — whether it’s DeFi interactions, governance participation, or engagement with NFTs. The healthiest chains are those where users aren’t just showing up for one thing but are actively exploring and participating in multiple parts of the ecosystem.

Aggregated metrics give us the tools to capture this nuanced view. Rather than focusing on one area (like TVL or daily active wallets) in isolation, they combine multiple components of user activity to form an overarching “health score.” For example, a wallet that sporadically executes token swaps might boost a chain’s transaction count, but it wouldn’t score high on a quality metric. On the other hand, a wallet that stakes tokens, votes in governance, and participates in DeFi yields a much richer picture of engagement. By weighting these activities appropriately, we can move closer to identifying the true value a user is bringing to their blockchain ecosystem.

But what’s most exciting is how this approach allows us to look beyond surface-level data. Consider the role of governance participation, for instance. While it may not generate headlines or massive transaction counts, governance activity signals deep involvement — it shows that users see themselves as stakeholders in a network’s future. Similarly, NFT interactions might seem like a niche use case, but when tied to meaningful utilities like gaming, real-world asset tokenization, or memberships, they can indicate a vibrant and innovative community.

This aggregated approach isn’t just theoretical; it’s already exposing fascinating insights. Take, for example, the contrast between older chains like Ethereum and newer entrants like Axelar. Ethereum’s sprawling ecosystem — spread across mainnet, Layer 2s, and beyond — captures enormous user diversity, but much of its richest activity is now happening off-chain or on its L2 solutions. Meanwhile, Axelar’s users show balanced participation in several on-chain sectors, offering a rare glimpse of an ecosystem that, though smaller, looks poised for sustainable growth. This is a reminder that long-term success looks different depending on the network in question.

What’s also worth noting here is that aggregated metrics can help mitigate biases inherent in traditional data analysis. Static benchmarks (like a threshold for the “number of wallets”) don’t account for the unique traits of different chains. For example, the user activity required to sustain a heavily DeFi-focused chain like Ethereum might look entirely different from a consumer-friendly NFT-heavy ecosystem like Solana. That’s why context matters — a chain’s score should reflect how well it’s meeting its own objectives, not someone else’s.

It’s natural to feel hesitant when considering this approach. After all, diving into aggregated metrics may seem complex or even intimidating at first. But think of it like using a roadmap: once you understand how all the pieces fit together, it becomes much easier to navigate. And the benefits are enormous. For industry builders, these metrics provide a clearer understanding of where to focus efforts to improve engagement or patch weaknesses. For investors and enthusiasts, they offer a grounded perspective to distinguish between fleeting hype and ecosystems with enduring value.

Ultimately, aggregated metrics are more than just numbers; they’re a way to connect with the heart of what each blockchain represents. They represent a shift from chasing shiny headlines to building deeper stories of innovation and resilience. And that kind of shift? It’s what will reshape Web3 into something truly transformative, one ecosystem at a time.

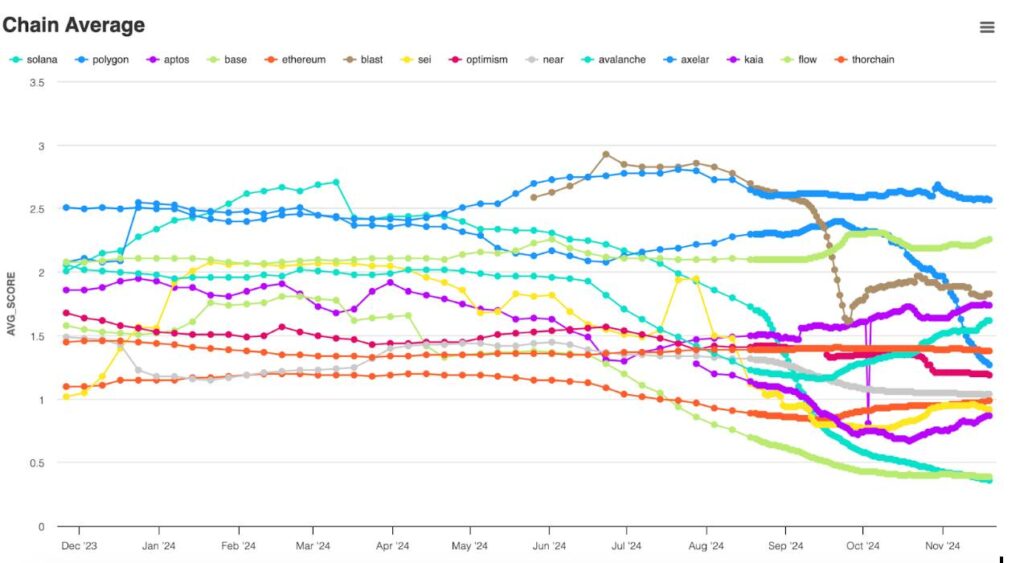

When we dive into the data from 2024, a fascinating and sometimes unexpected story of user activity begins to emerge. You’ve likely wondered which chains are thriving and which ones are falling short, especially in a fast-evolving environment where conventional metrics often fail to paint the full picture. The good news is that by analyzing aggregated data — rather than isolated statistics — we begin to see patterns that reveal much more about the health of these ecosystems and what the future may hold for them.

Take Solana, for example. As one of the more high-profile blockchains, Solana burst onto the scene with eye-catching transaction speeds and low fees, attracting communities that sparkled with energy. But 2024 added another layer of nuance to its story. While early in the year Solana saw spikes in unique wallet activity and transaction volumes, these highs coincided with trends like memecoin frenzies and speculative trading rather than sustainable, diverse user behaviors. When the dust settled after these surges, something became clear: while total transaction counts were climbing, meaningful user participation across different sectors like staking, governance, or ecosystem-generated utility was not keeping pace. This creates a challenge: can the chain convert these fleeting moments of excitement into something more lasting?

Contrast this with Ethereum, a network that has historically been seen as the “backbone” of blockchain innovation. One might expect Ethereum to dominate in every category — it’s home to some of the largest DeFi protocols, NFT marketplaces, and DAO structures in the space, after all. But the 2024 data told a more complex tale. While Ethereum’s mainnet user engagement remained steady, significant activity gravitated toward its Layer 2 solutions, like Arbitrum and Optimism. Much of the innovation and user-centric development unfolded in these faster, cost-effective layers, creating a paradox where the mainnet sometimes appeared less engaged despite its foundational importance within the broader ecosystem. What this tells us is that Ethereum is shifting into a role as more of a settlement layer, central to the most serious DeFi positions and governance participation but less likely to attract the everyday user making small-scale transactions or interacting with dApps. This multilayered web of activity can be challenging to quantify but speaks to a maturing ecosystem with more specialized roles for different infrastructure layers.

Now let’s look at smaller chains like Axelar — one of the striking outliers of 2024. While its user base may be smaller compared to juggernauts like Ethereum or Solana, Axelar’s data reveals something impressive: its wallets show balanced participation. Users aren’t just interacting with one sector (e.g., token swaps or staking); they’re voting in governance, engaging with cross-chain activities, and participating in DeFi initiatives. This suggests Axelar has already cultivated a base of engaged users deeply connected to the ecosystem, a promising sign for scaling without losing quality. These diversified behaviors paint Axelar as a chain less reliant on hype or temporary trends, and more focused on steady, long-term engagement—something that many larger chains struggle to sustain over time.

And then there’s the broader picture: the tendency of newer entrants to experiment with cutting-edge use cases. Chains focused on interoperability, zero-knowledge proofs, or niche verticals like gaming often show concentrated pockets of high-quality activity. These ecosystems remind us that while they might not have the massive transaction counts of Solana or the vast community reach of Ethereum, they’re fostering innovation in ways that lay the groundwork for unique growth paths. It’s worth watching how these chains evolve their niches into tangible applications that go beyond speculation and meet real-world needs.

Interestingly, the aggregated metrics from 2024 also surfaced an important revelation: the ecosystem is increasingly becoming heterogeneous. Each chain is evolving to serve its strengths rather than trying to be everything to everyone. Ethereum’s gravitational pull makes it the glue of the blockchain world, supporting diverse interactions across its layers. Solana thrives among retail users that demand speed but now faces challenges in expanding use-case diversity. Meanwhile, Axelar and other smaller chains appeal to targeted scenarios, offering a chance to stand out in an overcrowded space.

Looking at the data through this holistic lens also helps us dispel the myth that a single metric — whether it’s TVL, wallet count, or transaction volume — can tell us everything we need to know about a chain’s health. Instead, robust ecosystems are defined by balance, nuance, and adaptability. Chains that build mature, multi-faceted communities are showing us what’s possible when metrics are seen as tools for growth rather than trophies to be displayed.

Ultimately, 2024 was a pivotal year in redefining what quality engagement looks like in Web3. The chains that rose to the top weren’t necessarily the ones with the flashiest headlines. Instead, they were the ones cultivating diverse, meaningful on-chain experiences that went beyond speculation and built toward long-term sustainability. Whether it’s Solana’s attempt to convert short-term excitement into deeper engagement, Ethereum’s transition to a layered, specialized system, or Axelar’s focus on cultivating an invested core user base, the trends emerging from this year give us plenty to reflect on — and plenty to watch as we head into 2025.

As we step into 2025, the evolving blockchain landscape presents both significant challenges and abundant opportunities for top chains like Solana, Ethereum, and smaller players such as Axelar. The context for these dynamics hinges on shifting user behaviors, market expectations, and technological advancements, all of which are pushing networks to refine how they attract, engage, and retain users in increasingly competitive ecosystems.

For Solana, sustaining its position as a fast and affordable chain will require more than just transaction speed or flashy memecoin cycles. The data from 2024 highlights a crucial issue: while waves of new users flocked to Solana during moments of price-driven activity, many stayed within narrow pockets of the ecosystem, like simple token swaps or NFT minting. To truly scale, Solana must broaden its user base beyond these casual or speculative patterns and encourage diverse participation across functions like staking, DeFi, and governance. The network also faces the task of combating activity bottlenecks caused by a heavy concentration of high-frequency, low-quality interactions. As the memecoin trend inevitably moderates, Solana’s survival depends on its ability to capitalize on its strengths — low fees and a vibrant developer base — to build out tools and dApps that inspire long-term engagement.

Ethereum, on the other hand, is navigating its transformation into a multi-layered ecosystem, anchored by Layer 2 solutions such as Optimism and Arbitrum. While this progression has expanded Ethereum’s capacity to support everyday transactions and affordable dApp interactions, it has sparked questions around engagement on the Layer 1 mainnet. The fragmented nature of activity makes aggregated metrics tricky to evaluate. But perhaps this is Ethereum’s natural maturation process; the mainnet is evolving into a hub for “serious” operations like protocol governance, high-value DeFi strategies, and enterprise-grade use cases. In turn, Layer 2 solutions have become testing grounds for retail adoption and experimentation. Moving forward, Ethereum’s success will depend on how seamlessly it can align these layers to create a cohesive, user-friendly experience that appeals to both heavyweights and newcomers alike. There’s still untapped opportunity in creating bridges between its layers that foster a sense of unity rather than division.

Where smaller chains like Axelar have a unique advantage is in their ability to architect ecosystems from the ground up, learning from the successes and missteps of larger players. Axelar’s key strength lies in fostering balanced and varied user interaction, driven by activities ranging from governance participation to cross-chain transactions and DeFi engagement. As the chain seeks to grow, however, scaling will present its own challenges. Maintaining the quality of user behavior while expanding the ecosystem requires deliberate strategies, such as incentivizing mission-aligned developers and creating accessible onboarding paths for new participants. Additionally, Axelar’s focus on interoperability places it in a pivotal position to solve cross-chain challenges that older networks are still grappling with. If executed thoughtfully, these innovations could become the cornerstone of its value proposition in 2025 and beyond.

The challenges aren’t exclusive to these chains. Across the ecosystem, Web3 projects will need to wrestle with user attrition caused by market fatigue and competition for attention. Chains and protocols that leaned heavily on speculative interest or single-use cases may face a reckoning if they fail to pivot toward sustainable models of engagement. Networks thriving on hype rather than innovation could find themselves at risk of irrelevance, no matter how large their market caps appear today. Meanwhile, chains demonstrating meaningful adoption — driven by clear use cases in DeFi, gaming, real-world asset tokenization, and beyond — are likely to attract not only users but also the institutional and infrastructure support necessary to scale further.

At its heart, the story of 2025 will be one of differentiation and resilience. It’s a time when blockchain ecosystems must clearly define their identities. Will a chain focus on being the fastest transactional layer? The most secure settlement system? The user-friendliest network for retail adoption? So many of the industry’s current struggles — from fragmented user bases to fleeting hype cycles — emerge from trying to be everything to everyone. The chains that succeed will be those that prioritize depth over breadth, nurturing the kind of committed user communities that can weather market changes and continue to innovate together.

And let’s not forget the role of builders in shaping this vision. Developers and project teams are at the forefront of this transformation. Chains that invest in their dev communities — providing robust infrastructure, grants, and clear documentation — will stand a better chance of inspiring innovative applications that align with their long-term missions. Similarly, cross-chain collaboration will likely accelerate in 2025, breaking down old silos and facilitating the birth of new interoperable ecosystems. Chains that embrace this openness, rather than competing in isolation, will benefit from access to shared liquidity, user bases, and technology advancements.

The good news? The industry itself is becoming more self-aware. During the early years of blockchain adoption, growth was often measured by raw numbers: transaction counts, TVL, or token prices. Today, chains are shifting their focus inward, asking tougher but more constructive questions: What do our users want? What kinds of activity actually drive value rather than inflate metrics? By prioritizing quality over quantity, blockchain networks will move closer to building ecosystems that don’t just survive market cycles — they thrive through them.

Ultimately, 2025 offers a chance to rewrite the playbook. Chains like Solana, Ethereum, and Axelar — as well as their smaller but equally ambitious peers — have the opportunity to redefine success by fostering ecosystems rooted in purpose-driven user engagement. It’s an exciting prospect, filled with both hard work and immense possibility. Let’s see which chains rise to the task and build the kind of lasting innovation that will shape the next decade of blockchain technology.

As we move deeper into the evolving Web3 landscape, an important question emerges: how do we foster the kind of sustainable growth that balances innovation, user needs, and long-term viability? It’s a challenge that requires both creators and users to think beyond short-term metrics and instead focus on building ecosystems that thrive through meaningful connections and activities. While the narrative around raw growth data like transaction counts or TVL can seem daunting, the path forward is, in fact, more empowering and collaborative than it first appears.

Sustainable growth isn’t just about ramping up the number of wallets or speeding up transaction throughput. It’s about creating ecosystems that people want to return to — not because of hype, but because those ecosystems provide genuine value. Whether a chain focuses on DeFi, NFTs, governance, gaming, or something entirely new, its long-term health will boil down to one key factor: cultivating a user base that feels invested, not just financially but also emotionally and experientially.

One critical piece of the puzzle is ensuring that user onboarding feels seamless and intuitive. Think about it: Web3 tools have historically earned a reputation for being notoriously hard to use, often leaving new users overwhelmed while navigating wallets, gas fees, and unfamiliar terms. For sustainable engagement to flourish, chains must prioritize lowering these barriers. For instance:

- Improving User Interfaces: Just as critical as the underlying technology is how accessible it feels to the average person. Wallet interfaces, dApps, and staking processes need to be intuitive enough for non-technical users to understand without hours of research.

- Education Efforts: Robust educational content that guides users step-by-step can turn Web3 skeptics into loyal community members. This might include tutorials, interactive demos, or even partnerships with universities to teach blockchain fundamentals.

- Onboarding Incentives: Chains that create welcoming entry points — whether through free transactions for new wallets, simplified onboarding wizards, or starter NFTs — are far more likely to retain first-time users than those that expect users to figure it all out on their own.

Another vital element of sustainable growth lies in cultivating diverse use cases within a chain’s ecosystem. It’s no longer enough to lean on a single sector like DeFi or NFTs as the primary driver of activity. Instead, ecosystems with diverse user activities will have the resilience to weather market cycles and shifting global trends. Moreover, by offering multiple avenues for interaction — whether staking, participating in governance, trading NFTs, or exploring decentralized social media — chains can deepen users’ engagement without relying exclusively on speculative trading. This not only encourages users to stay, but also helps build ecosystems that are capable of cross-pollinating innovation between their various sectors.

Interoperability will also play a major role in enabling sustainable growth across the entire Web3 space. For years, chains operated in fierce competition, trying to carve out their share of the market. But 2025 feels different. The industry is increasingly embracing collaboration between networks, especially where bridging technologies or multi-chain user flows can unlock enhanced value. Chains that position themselves to integrate smoothly with others will benefit from shared liquidity, larger user bases, and a broader range of applications. Users, for their part, will gain access to interconnected functionality without constantly being bound to a single network — a win-win scenario that encourages engagement across the board.

Let’s also consider the role of governance. Though it doesn’t always grab the same flashy headlines as DeFi or NFT activity, user participation in governance is one of the most telling indicators of a healthy and sustainable blockchain ecosystem. It signals that users see themselves not just as participants but as stakeholders. This kind of community-driven involvement is a hallmark of decentralized systems that aren’t just “being used” but are actively co-evolving with their user base. Networks that make governance accessible — both technically and socially — are far more likely to thrive in the long run. For instance, ensuring governance participation isn’t dominated by whales, or creating voting mechanisms that are simple enough for newcomers to follow, shows a network’s commitment to equitable collaboration.

Yet, even with these strategies in mind, sustaining an engaged user base requires networks to adapt continually. The pace of innovation in Web3 ensures that no chain can rest on its laurels. Developer incentives, grant programs, and hackathons will remain crucial for encouraging the long-term creation of tools and dApps that meet evolving user needs. Chains that keep their creative ecosystems vibrant ensure they stay competitive, no matter how crowded the space becomes.

Perhaps most important of all is recognition of the human element behind these numbers and strategies. Growth isn’t just about building faster, cheaper, or bigger chains — it’s about uplifting the people within Web3 communities. It means encouraging builders, engaging newcomers with kindness and patience, and offering empowering experiences to seasoned participants. In a field often reduced to speculative narratives or technical jargon, it’s worth remembering that every transaction, dApp, and DAO decision represents a real user, making a real choice, about how they spend their time and resources. That connection is what grounds sustainable growth in authenticity rather than in showmanship.

The road ahead is full of challenges, but clarity lies in focusing on what really matters: user empowerment, innovation, and the creation of ecosystems people are proud to stand behind. By prioritizing quality-focused metrics, fostering inclusivity, and embracing collaboration, blockchain networks are better positioned not just to survive market trends but to help redefine digital engagement for generations to come. Whatever 2025 holds, the work being done now to build resilient ecosystems will set the blueprint for a more inclusive and impactful future. The journey may not be simple, but it’s one worth investing in.