The world of cryptocurrency recently faced a seismic event as North Korea-affiliated hackers were implicated in what is now recorded as the largest crypto heist in history. On February 21, the exchange Bybit suffered a staggering loss of over .4 billion to the notorious Lazarus Group, highlighting the ongoing threats posed by state-sponsored hacking operations.

New insights from blockchain analytics firm Chainalysis suggest that North Korean hacking activities saw a noteworthy decline in the latter half of 2024, preceding this monumental attack. Eric Jardine, Chainalysis’s cybercrimes research lead, indicated that a significant pivot occurred around July 1. This lull in cybercrime was speculated to be due to a realignment of North Korean resources, particularly following a summit between North Korea and Russia, which drew attention and personnel to the ongoing conflict in Ukraine.

“The slowdown we observed could have been a regrouping to select new targets, probe infrastructure, or could have been linked to those geopolitical events,” Jardine articulated during a recent discussion, casting intrigue on the underlying motivations behind the hackers’ strategic shifts.

This unexpected reduction in cyber activity raised eyebrows in the security community, especially preceding the massive Bybit breach. Despite the challenge of tracing stolen funds in the complex world of cryptocurrency, analysts noted that over 80% of the .4 billion taken remained followable, thanks to ongoing investigations aimed at freezing and recovering the stolen assets. This highlights a glimmer of hope in what many considered a bleak scenario for centralized exchanges which, despite robust security measures, proved vulnerable to sophisticated attacks.

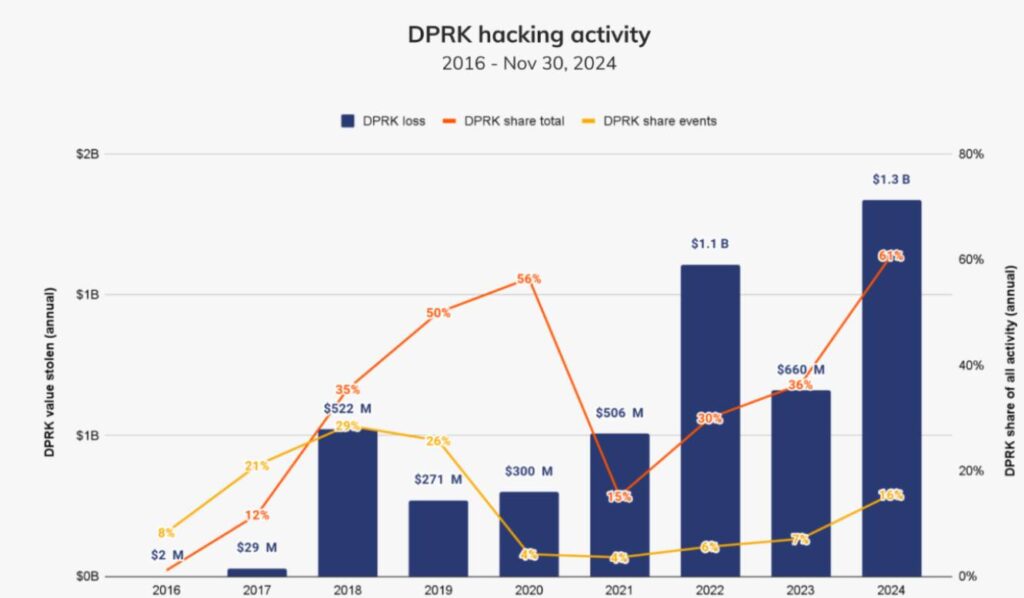

The hack not only stands as a harrowing reminder of the risks associated with digital assets but also demonstrates the evolution of cyber threats in an increasingly interconnected financial landscape. Throughout 2024, North Korean hackers were responsible for seizing more than .34 billion from 47 separate incidents, marking a dramatic 102% rise compared to the previous year, a chilling wake-up call for stakeholders in the crypto community.

Impact of North Korea’s Hacking Operations on the Crypto Industry

The recent developments regarding North Korean-affiliated hackers and their operations pose significant implications for individuals engaged in the cryptocurrency space. Understanding these trends can help readers better navigate their own involvement in the crypto market.

- Largest Crypto Hack in History:

- The Bybit hack on February 21 resulted in a loss of over .4 billion.

- This event marks one of the most significant threats to the integrity of the crypto market.

- Decline in Illicit Activity:

- North Korean cyber activities decreased sharply after July 1, 2024, suggesting a potential reallocation of resources.

- This may reflect a strategic shift in how North Korea utilizes its cyber capabilities.

- Geopolitical Influences:

- The perceived slowdown in hacking activities may relate to geopolitical events, such as North Korea’s summit with Russia.

- Shifts in focus towards military engagements may temporarily alter cyber operations from targeting financial systems.

- Escalating Risks for Crypto Users:

- The Bybit attack underscores vulnerabilities of even highly secured centralized exchanges.

- Cybersecurity is a critical consideration for anyone involved in cryptocurrency trading or investing.

- High Volume of Stolen Assets:

- In 2024, North Korean hackers stole over .34 billion worth of digital assets over 47 incidents.

- This amounted to 61% of the total cryptocurrency stolen globally in that year, indicating a severe risk for the crypto industry.

- Recovery Efforts:

- Efforts are ongoing to trace and potentially recover stolen funds, with 80% of the .4 billion still identifiable on the blockchain.

- This situation highlights the importance of blockchain transparency and the ongoing relevance of cybersecurity measures.

“Even centralized exchanges with strong security measures remain vulnerable to sophisticated cyberattacks.” – Meir Dolev, CTO at Cyvers

The Rising Threat of North Korean Cybercrime in the Crypto Sphere

The recent explosive hack on Bybit, attributed to the North Korean Lazarus Group, has unveiled a startling reality for the cryptocurrency industry. While the latter half of 2024 saw a slow down in cyber activities, leading experts speculate this was a strategic pause ahead of a meticulously planned attack. Comparatively, such a pattern of hit-and-diss cyber activity has been observed with various threat actors; however, North Korea’s approach reveals unique tactical advantages and disadvantages.

Competitive Advantages: The Lazarus Group enjoys a distinct advantage due to its state sponsorship, granting it access to resources and intelligence that non-state actors often lack. This was highlighted during the Bybit breach, where their meticulous planning allowed them to execute the largest crypto hack in history effectively. By reallocating resources following geopolitical events, they can focus their efforts strategically, as seen with their recent operational changes linked to the war in Ukraine. This adaptability may make it challenging for targeted firms to prepare defenses against such sophisticated adversaries.

Competitive Disadvantages: Despite their prowess, North Korean hackers are not invincible. The noticeable decrease in illicit activity after July 1, 2024, indicates possible vulnerabilities, particularly when geopolitical dynamics shift resource allocations. Furthermore, the sheer scale of their operations attracts intense scrutiny from international cybersecurity forces, which may hinder their long-term capabilities.

This landscape primarily benefits cryptocurrency firms that maintain robust security protocols, safeguarding them against potential threats. However, the fallout from incidents like the Bybit hack can create panic among investors and users, significantly impacting market confidence. Conversely, exchanges with less fortified systems may find themselves vulnerable, resulting in costly breaches that could tarnish their reputations and lead to substantial financial losses.

Ultimately, this alarming trend raises critical questions about the resilience of centralized exchanges. As the industry grapples with this evolving risk, it becomes imperative for companies to keep vigilant. Continuous investment in cybersecurity measures will be key to protecting digital assets and maintaining consumer trust amid these unpredictable cyber threats.