The dynamic world of cryptocurrency and digital collectibles has witnessed OpenSea reclaim its crown as the premier marketplace for non-fungible tokens (NFTs). As per insights from data tracker NFTScan, OpenSea has maintained the top position in trading volume for the last 30 days, capturing over 40% of the entire NFT market, while its closest rival, Blur, stands at 23%. This information highlights the stronghold OpenSea has over the digital collectible space, particularly during a period marked by a decline in overall NFT market activity.

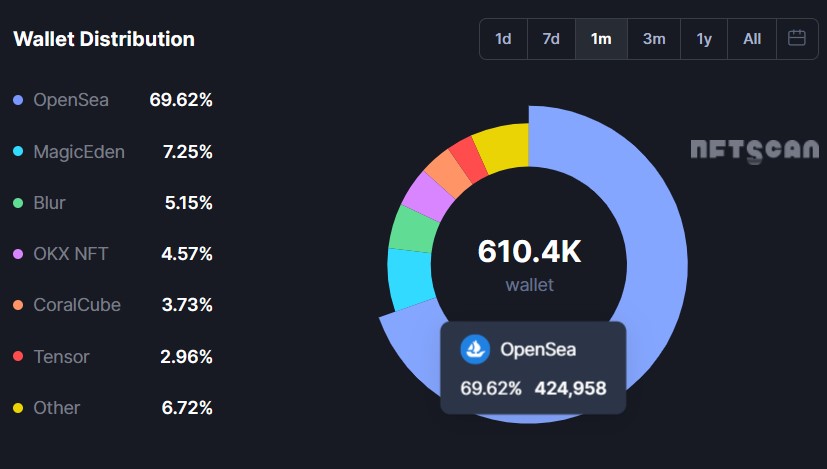

Recent statistics reveal that nearly 70% of wallets engaged in NFT transactions within the past month chose OpenSea, translating to over 610,000 unique wallets. In stark contrast, its competitors—Magic Eden and OKX NFTs—collectively accounted for just 17% of wallet activity, demonstrating OpenSea’s significant edge. The marketplace’s continued popularity is attributed not just to user engagement but also to several strategic enhancements rolled out by the company.

“We’re going to reimagine everything,” said Devin Finzer, co-founder and CEO of OpenSea, while discussing their upcoming platform update, OS2, scheduled for release in December.

The anticipation surrounding OS2 is matched by a shift in OpenSea’s operational strategy, which includes offers for trading Solana tokens, expanding its portfolio to include popular memecoins like Bonk and Ai16z. Additionally, on February 22, it was confirmed that the U.S. Securities and Exchange Commission (SEC) had ceased its investigation into the platform, providing a sense of regulatory relief that could bolster user confidence.

Despite OpenSea’s advancements, the NFT market has encountered challenges. Data from CryptoSlam indicates that NFT sales volumes have plummeted by 61% in Q1 2025, dropping to $1.5 billion from $4.1 billion during the same period in 2024. However, it’s not all doom and gloom; over 359,000 NFT buyers were active in the past week alone, marking a notable 52% increase week-over-week, indicating that interest in NFTs persists.

Interestingly, some collections like CryptoPunks have bucked the trend, seeing an impressive 82% surge in sales in just one week, totaling nearly $20 million in sales over the last month. While the NFT landscape continues to evolve, it’s clear that OpenSea is carving its path back to market dominance amid fluctuations in trading volumes.

OpenSea’s Dominance in the NFT Marketplace

OpenSea has reaffirmed its leading position in the NFT (non-fungible token) marketplace despite a general downturn in market activity. Here are the key points that highlight its significance:

- Market Leadership:

- OpenSea has captured over 40% of the NFT marketplace trading volume.

- Its nearest competitor, Blur, commands only 23% of the market share.

- Magic Eden and OKX NFTs hold 7.69% and 5% of the market share, respectively.

- Active Wallets:

- Nearly 70% of NFT wallets engaged in transactions interacted with OpenSea in the last month.

- OpenSea facilitated trades for more than 610,000 wallets in the past 30 days.

- In three months, OpenSea engaged over 2.1 million wallets, significantly outnumbering competitors.

- New Platform OS2:

- OpenSea is launching OS2 in December 2024, promising a reimagined platform for users.

- The platform is now in open beta, enhancing accessibility for the public.

- Introduction of SEA, the official token for the platform, is also on the horizon.

- Diversification and Features:

- OpenSea has expanded to include Solana trading, breaking traditional beta access limits.

- Users can now engage in trading Solana tokens, embracing popular memecoins.

- Regulatory Clarity:

- The SEC has ceased its investigation into OpenSea, providing relief from regulatory pressures.

- Market Trends:

- Despite a 61% decline in NFT sales volumes (down to $1.5 billion in Q1 2025), interest persists among traders.

- Significant increases in buyer engagement, with over 359,000 NFT buyers noted in just a week—a 52% increase.

- Certain collections, like CryptoPunks, saw substantial sales increases, indicating niche interests remain strong.

Understanding these developments in the NFT marketplace can help readers navigate their investments and interests in digital collectibles, as OpenSea’s innovations and market position may influence trends in the broader crypto environment.

OpenSea Reclaims NFT Market Supremacy Amidst Declining Sales

The NFT landscape has seen significant shifts recently, particularly with OpenSea reestablishing its dominance as the leading marketplace for digital collectibles. With a commanding share of over 40% in trading volume, OpenSea outpaces its closest rival, Blur, which holds only 23%. This resurgence comes in an environment marked by a disturbing 61% drop in overall NFT sales, emphasizing OpenSea’s resilience in a challenging market.

One of the critical advantages OpenSea possesses is its robust user engagement. Recent data reveals that approximately 70% of wallets involved in NFT transactions chose OpenSea, signaling a strong consumer preference. A staggering 610,000 unique wallets have utilized the platform, compared to a mere 103,000 across its competitors Magic Eden, Blur, and OKX. This high engagement can be attributed to OpenSea’s recent enhancements, such as the launch of its new platform OS2, and unrestricted access to Solana trading, broadening its appeal to a wider audience.

However, the competitive landscape remains fraught with challenges. The slump in overall NFT sales could be detrimental for platforms like OpenSea, as decreased market activity may compromise liquidity and buyer confidence. Moreover, initiatives from Blur and Magic Eden, aimed at capturing more market share through innovative features and strategies, could pose a threat. While OpenSea is currently basking in its success, the possibility of its competitors evolving and improving their offerings cannot be underestimated.

This shift in the NFT marketplace landscape could both benefit and complicate things for various stakeholders. Casual NFT traders might find solace in OpenSea’s stability and variety of offerings, making the platform a go-to option during uncertain times. However, serious collectors and investors may express concerns about fluctuating demands and the potential risk inherent in a declining market. With momentum growing for unique collections, like the sudden surge of CryptoPunks, there remains an essential balance to strike—navigating a declining sales volume while still creating opportunities for profit and engagement.

OpenSea’s recent developments have undoubtedly positioned it favorably in a tumultuous environment. Still, keeping a close eye on competitors and industry trends will be crucial in maintaining its lead in the evolving NFT marketplace.