In a significant move that underscores the evolving landscape of digital finance, PayPal has announced an expansion of its cryptocurrency offerings, welcoming two notable tokens: Chainlink (LINK) and Solana (SOL). As of April 4th, US-based users on the platform will soon have the opportunity to buy, sell, and transfer these popular digital assets, along with other cryptocurrencies. This move is not just a win for cryptocurrency enthusiasts; it reflects a growing demand for more flexibility in the digital currency market, according to May Zabaneh, an executive at PayPal’s crypto division.

PayPal’s crypto services, available exclusively to US residents, already feature a span of seven digital assets, including its stablecoin, PayPal USD (PYUSD). This increase in options is aimed at enhancing user experience across both PayPal and its subsidiary Venmo, which boasts approximately 83 million active users as of 2023. With a global user base of around 428 million accounts, the addition of LINK and SOL could significantly boost cryptocurrency engagement among newcomers and seasoned users alike.

“Offering more tokens on PayPal and Venmo provides users with greater flexibility, choice, and access to digital currencies,” stated Zabaneh.

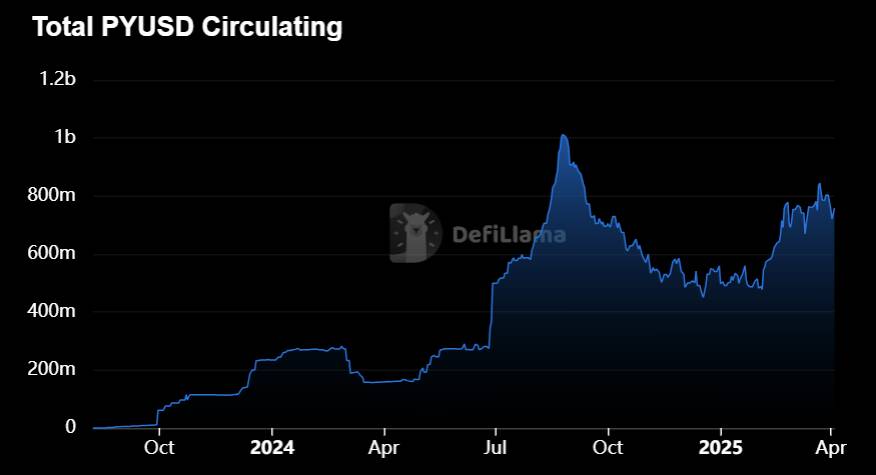

The launch of PayPal’s stablecoin, PYUSD, in 2023 marked its initial foray into the cryptocurrency sector, allowing it to capture a market cap that briefly surpassed $1 billion in August 2024. Although its current circulating supply has decreased to approximately $760 million, PYUSD is seen as an innovative tool for payments, especially in enterprise settings. Notably, PayPal previously showcased this functionality by settling an invoice with the consulting giant Ernst & Young.

PayPal’s advancements in the crypto realm have positioned it as a key player at a time when regulatory frameworks remain uncertain. Experts in the industry, such as Polygon Labs CEO Marc Boiron, highlight the role of major companies like PayPal in leading the charge for stablecoin adoption, making digital currencies more accessible to the broader public.

PayPal Expands Cryptocurrency Offerings: Impact on Users

PayPal has recently broadened its cryptocurrency offerings, allowing users greater access to diverse digital assets. Here are the key points:

- Introduction of New Tokens:

- PayPal has added Chainlink (LINK) and Solana (SOL) to its cryptocurrency offerings.

- Support will roll out over the next few weeks, including for users of Venmo.

- Growing User Base:

- Approximately 83 million people utilized Venmo at least once in 2023.

- PayPal boasts around 428 million accounts globally, primarily in the U.S.

- Response to Demand:

- Expansion of crypto offerings is a response to increasing consumer demand.

- Users now have access to seven digital assets, including PayPal’s stablecoin PYUSD.

- Stablecoin Development:

- PayPal’s PYUSD aims to bolster its presence in the cryptocurrency market.

- PYUSD reached a market cap of over $1 billion shortly after launch.

- Increased Utility:

- PYUSD has been utilized for business transactions, demonstrating its viability.

- PayPal’s role is considered pivotal in promoting stablecoin adoption amidst regulatory uncertainty.

“Offering more tokens on PayPal and Venmo provides users with greater flexibility, choice, and access to digital currencies.” – May Zabaneh, PayPal Executive

PayPal’s Crypto Expansion: A Game-Changer or a Double-Edged Sword?

The recent move by PayPal to integrate Chainlink (LINK) and Solana (SOL) into its cryptocurrency services is shaking up the digital finance landscape. With strong user engagement highlighted by over 83 million Venmo users, the platform appears poised to harness its extensive base for crypto transactions. Such a wide-reaching adoption could offer significant competitive advantages, especially when compared to other platforms like Coinbase and Binance, which have long dominated the crypto trading space.

Competitive Advantages: PayPal’s established reputation as a trusted financial service provider gives it a leg up in attracting everyday consumers who may be hesitant to venture into the often volatile world of cryptocurrencies. The addition of LINK and SOL diversifies PayPal’s offerings, joining its existing lineup which includes its own stablecoin, PYUSD. This not only enhances user flexibility but also positions PayPal as a comprehensive digital financial hub. Moreover, rolling out these features on Venmo could further engage younger audiences, who are increasingly looking for user-friendly ways to participate in the crypto market.

Another noteworthy advantage is PayPal’s massive existing infrastructure, which allows for relatively quick adaptation and a seamless user experience. This stands in stark contrast to exchanges that require users to create new accounts and comply with extensive verification processes. By allowing users to manage crypto alongside traditional payments, PayPal simplifies the transition for novice traders and casual users alike.

Potential Disadvantages: However, with growth comes risk. As PayPal’s cryptocurrency services are downscaled to the U.S., the company must ensure it meets strict regulatory standards to avoid potential backlash, especially as regulators globally are increasingly scrutinizing crypto exchanges and platforms. Furthermore, PayPal’s focus on a limited selection of tokens only may alienate crypto enthusiasts who typically look to trade a broader range of assets.

This expansion could also pose challenges for smaller platforms that rely on niche markets or unique features to capture users. Start-ups in the crypto space might find it difficult to compete with PayPal’s extensive resources and marketing prowess, potentially leading to a monopoly in the U.S. consumer market for crypto payments.

Impact on Stakeholders: The news could particularly benefit everyday consumers and small businesses that are keen to experiment with cryptocurrencies without the intimidation of complex interfaces. However, traditional exchanges and smaller crypto firms may face difficulties attracting users, potentially leading to market consolidation where larger players dominate and smaller competitors struggle to survive.