In a significant move to bolster the use of its stablecoin, PayPal has announced plans to offer a 3.7% yield on balances held in its PayPal USD stablecoin, PYUSD. This initiative, reported by Bloomberg on April 23, is set to launch this summer and aims to incentivize users to adopt the stablecoin more widely. As users earn rewards in PYUSD, they will have the flexibility to exchange it for traditional currency, spend it, or transfer it to others.

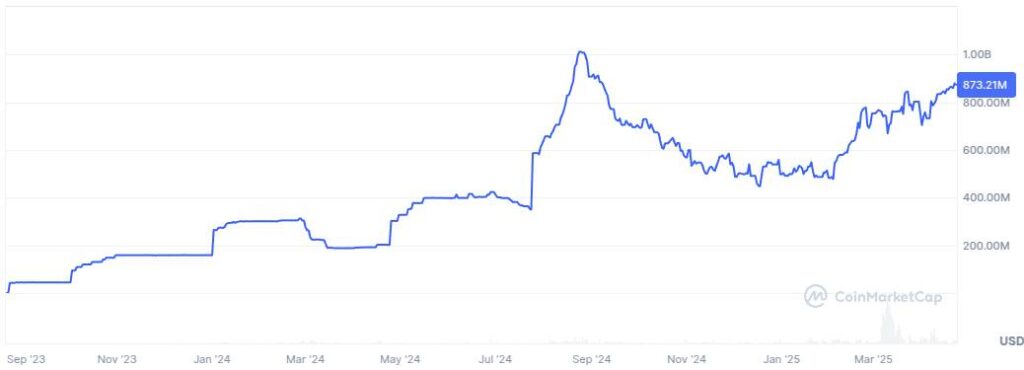

The backdrop of this decision highlights the growing importance of stablecoins in the cryptocurrency landscape. PayPal USD, which managed to reach a market cap of $1 billion by summer 2024, recently saw its value drop to around $873.3 million. This fluctuation emphasizes the competitive nature of the digital currency market, particularly as stablecoins face intense scrutiny concerning their classifications and regulatory standings.

“From a regulatory standpoint, PayPal must ensure that offering interest doesn’t cause its stablecoin to be classified as a security,” noted Tzahi Kanza, CEO of Syndika. He added that the primary risk for users lies in losing the stablecoin’s peg to the dollar, rather than issues related to interest earnings.

Beyond increasing usage of PYUSD, this strategy reflects PayPal’s broader ambitions in the cryptocurrency sector. The company has recently expanded its offerings by allowing users to buy, sell, and transfer notable tokens such as Chainlink and Solana. Marc Boiron, CEO of Polygon Labs, highlighted that the integration of stablecoins by major entities like PayPal and Stripe has been pivotal in the growth of the stablecoin market.

Launched in August 2023, PayPal USD is the first major stablecoin introduced by a payment network, with its operations overseen by the Paxos Trust Company. While the stablecoin’s market cap still lags significantly behind Tether (USDT), currently standing at $145.3 billion, experts suggest that enhancing compliance, transparency, and potential user returns could be key strategies for PayPal to strengthen its foothold in this dynamic market.

PayPal’s New Stablecoin Initiative: Key Points

PayPal is launching a new initiative for its PayPal USD (PYUSD) stablecoin, aiming to enhance user engagement and provide financial incentives. Here are the most critical aspects of this announcement:

- 3.7% Yield on Balances: PayPal plans to offer a 3.7% yield on balances held in its stablecoin, PYUSD.

- Encouraging Stablecoin Use: The measure is intended to drive more users towards utilizing the PayPal USD stablecoin.

- Rewards Structure:

- Rewards will accumulate daily and be paid monthly.

- Users will receive rewards in PayPal USD (PYUSD).

- Market Impact:

- The initiative aims to increase the prevalence of stablecoin and crypto payments on PayPal’s platform, potentially changing how users transact online.

- PayPal USD’s market cap reached approximately $1 billion, but is currently lower at $873.3 million.

- Regulatory Considerations:

- PayPal must navigate regulatory concerns to ensure that offering interest doesn’t classify PYUSD as a security.

- Concerns revolve around the risk of losing the peg to the dollar rather than interest-related issues.

- Expansion of Cryptocurrency Offerings: PayPal has recently expanded its crypto offerings, introducing users to new tokens such as Chainlink (LINK) and Solana (SOL).

- Market Competition: PYUSD is competing against larger stablecoins like Tether (USDT), which has a market cap of $145.3 billion, highlighting the challenges PayPal faces in gaining market traction.

This initiative could impact users’ financial decisions by offering an attractive yield on stablecoin holdings, presenting an alternative to traditional saving methods. Additionally, with PayPal integrating more cryptocurrencies into its services, users may become more inclined to participate in the digital economy.

PayPal’s Bold Move in the Stablecoin Space: Opportunity or Risk?

PayPal’s recent announcement about offering a 3.7% yield on its PayPal USD stablecoin marks a significant strategy shift in the rapidly evolving landscape of digital payments. By incentivizing users to hold their balances in PYUSD, PayPal aims to boost the adoption of stablecoins on its platform, a move that could potentially reshape the competitive dynamics of the market.

Competitive Advantages: One of PayPal’s standout features is its robust brand trust and vast user base, which can lend immediate credibility to its stablecoin initiative. Unlike smaller competitors, PayPal’s established ecosystem allows for seamless integration of PYUSD into everyday transactions. Additionally, the prospect of earning returns on stablecoin holdings directly appeals to users who have traditionally viewed cryptocurrencies as volatile investments. This yield incentive could attract more conservative investors, thus expanding PayPal’s market influence beyond just payments into wealth management.

Moreover, by launching this yield-bearing product, PayPal may set a new industry standard. Other notable players in the sector, like Coinbase and Binance, have begun to explore similar offerings but have yet to perfect the regulatory compliance, which is crucial for user trust. PayPal’s efforts to ensure compliance with regulations surrounding yield-bearing products could position it favorably as a leader in trustworthy crypto solutions.

Competitive Disadvantages: However, alongside these advantages, PayPal faces significant challenges. The regulatory scrutiny surrounding yield-bearing stablecoins poses a risk that could classify PYUSD as a security, a potential hurdle that could limit its functionality and user base. This classification could deter traditional investors or institutions wary of compliance issues, making them less likely to engage with its offerings.

Additionally, PayPal’s current market cap of approximately $873.3 million pales in comparison to Tether’s dominance of over $145 billion, which raises concerns about its long-term viability against established competitors. If PayPal cannot rapidly grow its market share, it risks being overshadowed, undermining its yield strategy.

Who Benefits and Who Faces Risks? On the one hand, cryptocurrency enthusiasts and existing PayPal users stand to gain significantly from these new features. The opportunity to earn interest appeals not only to avid traders but also to everyday users who may be inclined to store their funds in a digital currency that offers some returns. Furthermore, businesses looking to make payments in stablecoins could leverage this yield to optimize their cash flow management.

On the other hand, potential regulatory hurdles could create substantial issues for PayPal if governments decide to impose stricter regulations on yield-bearing products. This could make it more challenging for the company to operate effectively in various jurisdictions, limiting its global reach. Moreover, if existing users experience instability in their investments or feel the platform’s benefits are overstated due to regulatory pressures, it may lead to a loss of trust and user engagement.