In a recent turn of events, Polymarket, the leading decentralized prediction market, is facing scrutiny following a contentious decision regarding a high-stakes political wager. Users had placed bets on whether former U.S. President Donald Trump would accept a deal involving rare earth minerals with Ukraine before April. Much to the surprise of many, the market was settled in favor of “Yes,” despite no such deal occurring— igniting a storm of backlash from frustrated users and industry watchers.

“The tycoon cast 5 million tokens through three accounts, accounting for 25% of the total votes,” said crypto threat researcher Vladimir S.

Vladimir S. has raised alarm about what he describes as a potential “governance attack.” He claims that a whale within the UMA Protocol manipulated the voting process by leveraging substantial voting power, which allowed them to influence the oracle and settle the market inaccurately for profit. Polymarket uses UMA Protocol’s blockchain oracles to verify real-world events, and the weight of this vote significantly altered the market’s outcome, which reportedly amassed over million in trading volume before closing on March 25.

“There is no ‘tycoon’ who ‘manipulated the oracle,’” argued a pseudonymous user known as Tenadome, providing a differing perspective.

Counterarguments suggest that the outcome stemmed from negligence rather than manipulation, with Tenadome asserting that the voters involved were familiar with the UMA system and opted to disregard instructions to avoid penalties. The response from Polymarket has been resolute, indicating that no refunds will be issued, as it was deemed that the market did not fail even though many users felt let down by the resolution. Polymarket’s moderator confirmed that they are aware of the discontent and are committed to improving their monitoring systems to prevent similar incidents in the future.

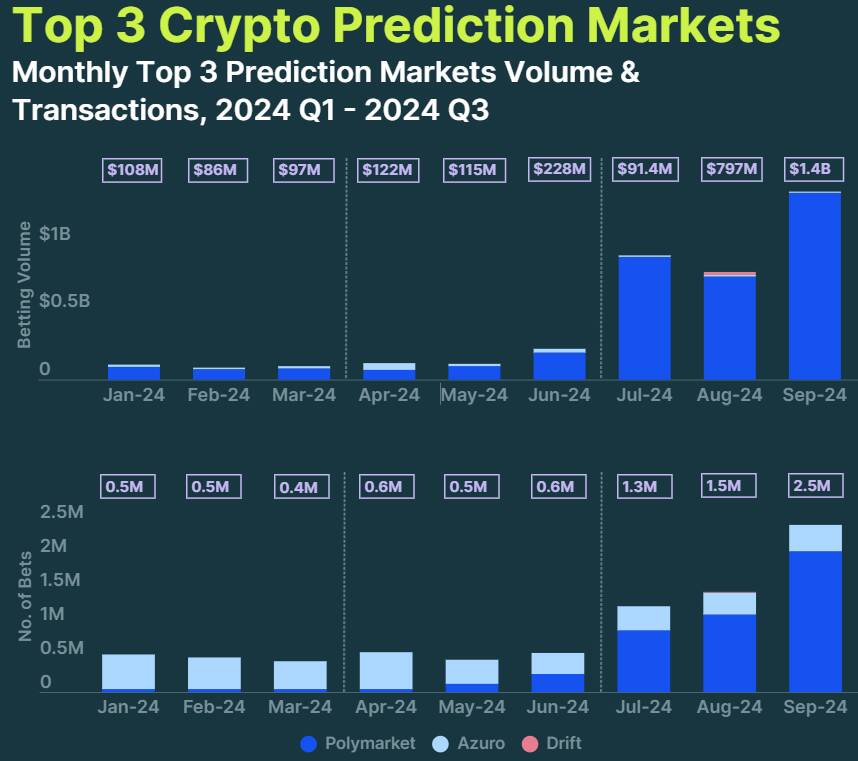

Despite these controversies, the realm of prediction markets has seen notable growth recently. In the third quarter of 2024, the trading volume surged 565%, largely fueled by bets surrounding the U.S. presidential election, with Polymarket capturing an impressive 99% share of the market. As this unfolding story highlights the challenges and complexities involved in decentralized platforms, many are left questioning how governance will adapt in the fast-evolving landscape of cryptocurrency betting.

Polymarket Controversy and Its Implications

The recent issues surrounding Polymarket highlight significant concerns in the decentralized prediction market space. Here are the key points that may impact users and investors alike:

- Controversial Market Outcome:

- Polymarket settled a bet on whether US President Donald Trump would accept a mineral deal with Ukraine as “Yes” despite no such event occurring.

- This action triggered backlash from users who felt misled by the outcome.

- Governance Manipulation Concerns:

- A large voter, identified as a “whale,” reportedly influenced market results, raising alarms about possible governance attacks.

- The whale cast votes amounting to 25% of the total votes, indicating significant power concentration.

- User Discontent:

- Moderators indicated they would not issue refunds despite user frustration over the misleading market resolution.

- This decision marks a significant governance challenge for the platform in maintaining user trust.

- Future Monitoring Systems:

- Polymarket plans to develop new monitoring systems to prevent such disputes in the future.

- This could enhance user confidence in the integrity of market settlements.

- Rapid Growth of Prediction Markets:

- The prediction markets experienced a surge in trading volume, growing over 565% in the third quarter of 2024.

- This boom was largely fueled by interest in the upcoming US presidential elections, suggesting a strong public appetite for political betting.

The unfolding situation at Polymarket not only reshapes perceptions of individual bets and outcomes but could also influence broader market behavior and regulatory scrutiny within decentralized finance (DeFi). Users considering participation in prediction markets should be cognizant of these dynamics to mitigate risks and enhance their betting strategies.

Polymarket Under Scrutiny Amid Governance Manipulation Allegations

The recent incident involving Polymarket, the leading decentralized prediction market, has raised serious questions about governance integrity within the platform. A controversial outcome concerning a sought-after deal between the U.S. and Ukraine has sparked accusations of manipulation, particularly from the crypto community, which is already on high alert for governance issues. With a self-authenticated vote leading to an outcome that seemingly defied reality, this event serves as a cautionary tale for decentralized markets and their reliance on external oracles, especially from protocols like UMA.

Competitive Advantages: Even in the wake of this controversy, Polymarket boasts the largest market share among prediction platforms, capturing over 99% of trading volume in recent months. This dominance highlights user trust and the platform’s widespread usage. With a trading volume surpassing million before the controversial settlement, it’s evident that demand remains robust, especially leading up to major events such as the U.S. elections, which saw an explosive 565% growth in the prediction market space in Q3.

Disadvantages: However, the lack of accountability following the disputed outcome has left many users feeling vulnerable and dissatisfied. The refusal to issue refunds has aggravated the situation, revealing potential weaknesses in Polymarket’s governance framework and risk management protocols. Such circumstances could alienate users, particularly those who feel their investments are at the mercy of centralized decision-making, despite the platform’s decentralized branding. The broader crypto community might see this as a stark warning against using platforms that rely on oracles without stringent checks and balances.

This scenario could benefit savvy traders looking to capitalize on the volatility and uncertainty that follows a governance issue, as they may find opportunities in fluctuating market sentiments. However, it presents significant challenges for the average user, who may be deterred by the fear of manipulation or mismanagement in future betting scenarios. If Polymarket cannot swiftly implement new monitoring systems and improve user trust, it risks not only losing current users but also potential new entrants who are increasingly cautious about the platforms they engage with.