In the ever-evolving world of cryptocurrency, analysts are gearing up for a potential resurgence of altcoins, often dubbed as “the other coins” besides Bitcoin. Jamie Coutts, the chief crypto analyst at Real Vision, expressed his belief that altcoins might experience one last rally in this market cycle. Speaking with Raoul Pal on a recent livestream, Coutts underscored the importance of network activity, which he referred to as the “north star” for traders. He indicated that quality altcoins—those with genuine utility and higher user engagement—are most likely to benefit from this anticipated crypto upswing, potentially spanning six to twelve months.

As the crypto landscape grows, it’s crucial to note the sheer number of altcoins available. According to Cointelegraph, there are over 36 million altcoins in existence today. Yet, despite this overwhelming figure, Ethereum continues to dominate the sphere, holding a substantial 55.56% of the total value locked in crypto assets. Other notable players include Solana, Bitcoin, BNB Smart Chain, and Tron, though their shares are significantly smaller.

“At this stage, I am not too sure, but I do believe that quality altcoins where activity returns, activity drives prices … we will definitely see a recovery in some of these more high-quality names,” Jamie Coutts remarked.

Looking ahead, Coutts predicts that altcoins could regain momentum as early as June, potentially coinciding with Bitcoin reaching new all-time highs. This optimism comes on the heels of a recent downturn, with the total crypto market cap reportedly down about 8% in the past month, as highlighted by CoinMarketCap. Notably, blockchain network activity has seen sharp declines, exemplified by Solana’s active addresses dropping significantly.

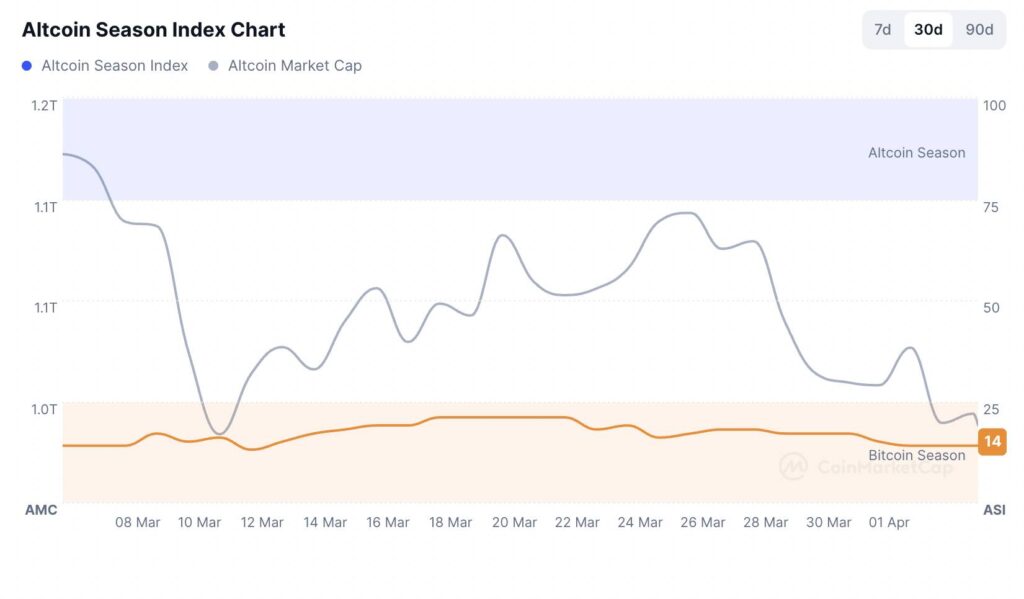

However, indicators surrounding a possible altcoin season tell a different story, revealing that the environment remains challenging. Metrics from Capriole Investments show that the Altcoin Speculation Index has plummeted to 12%, marking a 53% decrease since late December. Additionally, the Altcoin Season Index, which gauges the performance of the top cryptocurrencies against Bitcoin, currently sits at a mere 14 out of 100, suggesting that Bitcoin continues to dominate the market.

“Bitcoin Dominance no longer defines altseason—trading volume does,” asserted CryptoQuant CEO Ki Young Yu.

As traders navigate these uncertain waters, the chatter around altcoins and their capabilities reflects a blend of hope and caution in this volatile market. While many anticipate a rally, the underlying network activity and real-world utility of these digital currencies will play pivotal roles in shaping the future of cryptocurrency investment.

Altcoins: Potential Last Rally and Key Trading Insights

According to crypto analyst Jamie Coutts, there may be an upcoming rally for altcoins, influenced significantly by real utility and network activity. Here are the key points derived from the recent analysis:

- Upcoming Altcoin Rally:

- Analyst Jamie Coutts predicts one last rally for altcoins.

- The timing of the rally is uncertain but could begin in the next two months.

- Importance of Network Activity:

- Network activity is seen as the ‘north star’ for trading decisions in crypto.

- Quality altcoins with increasing activity are expected to see price recoveries.

- Market Dynamics:

- Bitcoin’s performance may influence the altcoin market, with an anticipated rise to all-time highs.

- The total crypto market cap has decreased by approximately 8% over the last month.

- Current Market Indicators:

- Key indicators for an altcoin season have not reached positive levels.

- Capriole Investments’ Altcoin Speculation Index has dropped to 12%.

- Bitcoin Dominance and Trading Volume:

- Bitcoin’s market dominance is at 62.84%, suggesting a lesser focus on altcoins for now.

- Some analysts argue that trading volume might be a more relevant factor for defining altcoin seasons than Bitcoin dominance.

This analysis emphasizes the importance of network activity and quality assets in making informed trading decisions within the crypto landscape, impacting potential investment strategies for readers.

The Last Rally: Altcoins in the Spotlight

The cryptocurrency realm is buzzing with the possibility of a final rally for altcoins, backed by insights from Jamie Coutts, a prominent analyst at Real Vision. This speculation revolves around the notion that only those altcoins exhibiting genuine utility and robust network activity are poised for price gains. Notably, Coutts suggests a keen observation of network activity as the guiding principle for trading strategies, positioning it as the ‘north star’ for crypto enthusiasts.

In a comparative context, altcoins are not operating in a vacuum. Recent news from within the cryptocurrency sector underscores the stark differences in performance dynamics among various projects. For instance, Bitcoin continues to dominate, holding an impressive 62.84% market share despite its own fluctuations, which can limit opportunities for altcoins. This trend raises a significant competitive disadvantage for altcoins that fail to distinguish themselves with compelling use cases or vibrant community engagement.

The competitive advantage here lies in the predicted upswing of select high-quality altcoins that increase their network activity. Coutts’ optimism for burgeoning altcoin values in June could serve as a catalyst for traders who are discerning enough to identify these potential winners. However, the current landscape suggests caution, as indicators such as the Altcoin Speculation Index and Capital Market data reflect a lack of momentum for altcoins at this moment, making it a risky endeavor for amateur traders.

Those actively engaged in the crypto market, particularly speculative traders and investors, stand to benefit from a well-timed entry into altcoins with proven utility. Conversely, those who overextend themselves or invest without rigorous research could face significant challenges, as the market cap for altcoins has recently taken a hit, reflecting broader market sentiment and volatility. As Bitcoin maintains its lead, it may inadvertently sideline many altcoins unless they can manage to recapture and retain user interest and transactions.

In summary, while there is potential for an altcoin renaissance, the reality of the current market environment creates both opportunities and pitfalls. Traders need to remain vigilant and informed, navigating the crypto waters with a clear strategy focused on network activity and core utility.