This year is shaping up to be a pivotal one for the cryptocurrency market, with over 70 cryptocurrency exchange-traded funds (ETFs) awaiting review by the US Securities and Exchange Commission (SEC). According to Bloomberg analyst Eric Balchunas, this extensive list encompasses a diverse array of proposed ETFs, ranging from established digital currencies like XRP and Litecoin to the whimsically popular memecoins. In Balchunas’ words, the year ahead promises to be “wild.”

“Everything from XRP, Litecoin and Solana to Penguins, Doge and 2x Melania and everything in between.” — Eric Balchunas

The anticipated approval of these ETFs arrives at a time when institutional interest in cryptocurrencies appears to be on the rise. A recent report by Coinbase and EY-Parthenon indicates that up to 80% of institutional investors aim to boost their cryptocurrency allocations by 2025. Yet, experts caution against assuming that SEC approvals will lead to widespread acceptance, especially for funds tied to less mainstream cryptocurrencies.

“Having your coin get ETF-ized is like being in a band and getting your songs added to all the music streaming services.” — Eric Balchunas

While the music may be available, it doesn’t guarantee listeners. Research from Sygnum Bank highlights tepid demand for altcoin ETFs compared to their Bitcoin counterparts, which drew more than $100 billion in net assets last year. Expectations for altcoin ETFs suggest inflows ranging from several hundred million to $1 billion, substantially less than what Bitcoin-focused funds have achieved.

Interestingly, funds that incorporate options and derivatives might unlock new avenues for institutional investment. Analysts argue that structured products offering exposure to Bitcoin and Ether could see stronger demand, potentially driving significant price increases for these digital assets. Just recently, ARK Invest expanded its offerings, adding staked Solana (SOL) to two of its existing ETFs, marking a significant moment for US investors.

Upcoming Crypto ETFs and Their Impact on Investors

With over 70 cryptocurrency exchange-traded funds (ETFs) under review by the US SEC, significant developments in the crypto market are on the horizon. Here are the key points to consider:

- Diverse Range of Proposed ETFs:

- Proposed ETFs will include a variety of assets such as altcoins, memecoins, and derivatives.

- Notable cryptocurrencies mentioned include XRP, Litecoin, Solana, and popular memecoins like Doge.

- Institutional Interest in Crypto:

- Currently, over 80% of institutional investors plan to increase their crypto allocations by 2025.

- This growing interest could lead to more capital entering the cryptocurrency market, influencing prices and market stability.

- ETF Approval Does Not Guarantee Adoption:

- The approval of ETFs for obscure cryptocurrencies may not lead to widespread usage or investment.

- Analogy: Getting an ETF is similar to a band getting featured on streaming platforms; it increases visibility but does not ensure popularity.

- Anticipated Inflows for Altcoin ETFs:

- Expectations for altcoin ETFs suggest inflows could range from several hundred million to $1 billion – significantly less than Bitcoin funds.

- Historic data shows that Bitcoin-focused ETFs drew over $100 billion last year, indicating a disparity in demand.

- Potential of Derivatives in Crypto Investments:

- Structured exposure to cryptocurrencies, particularly Bitcoin and Ether, through options may have higher institutional appeal.

- Options can unlock diverse portfolio strategies and may lead to significant price appreciation for digital assets.

- Significance of Recent Developments:

- ARK Invest’s addition of staked Solana to two tech ETFs represents a pivotal moment for Solana’s accessibility in the US market.

- This could enhance investor interest in Solana and similar assets following their inclusion in ETFs.

“Having your coin get ETF-ized is like being in a band and getting your songs added to all the music streaming services. Doesn’t guarantee listens but it puts your music where the vast majority of the listeners are.” – Eric Balchunas

Understanding these elements is vital for investors as they navigate the evolving landscape of cryptocurrency investments, particularly with regards to diversification, institutional support, and the future of altcoins versus Bitcoin funds.

Analyzing the Landscape of Cryptocurrency ETFs: Opportunities and Challenges

The recent announcement of over 70 cryptocurrency exchange-traded funds (ETFs) under review by the US Securities and Exchange Commission (SEC) is generating significant buzz in the financial markets. As institutions prepare to pour more capital into digital assets in the coming years, this influx of ETFs could reshape the investment landscape. However, there’s a fascinating duality at play—while these offerings present exciting opportunities for mainstream adoption, they also come with a set of challenges that could limit their effectiveness, particularly for lesser-known altcoins.

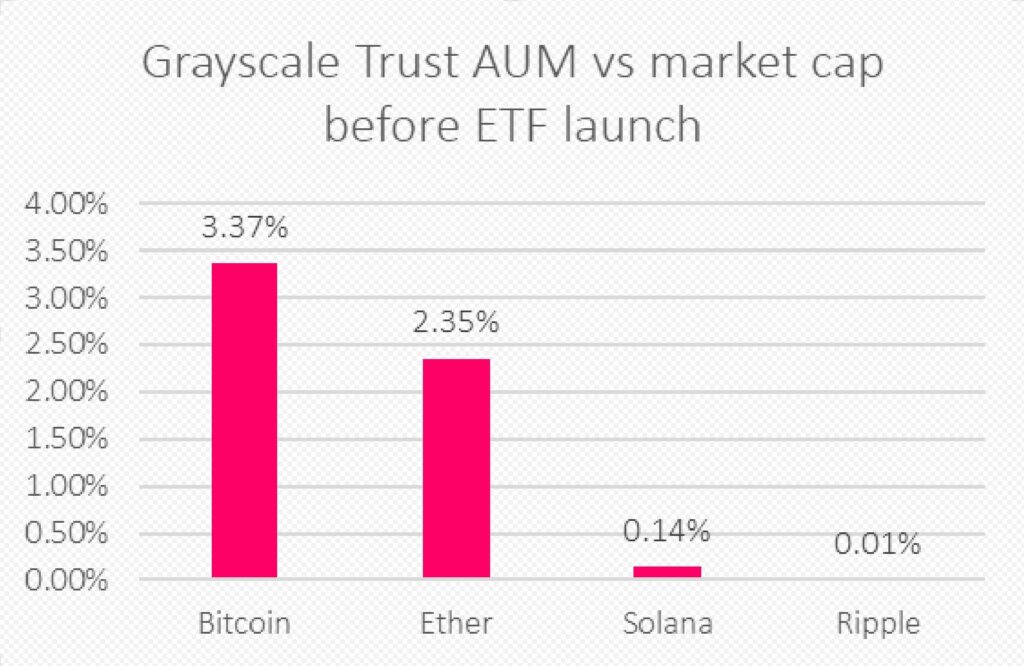

When comparing this news with other developments in the fintech space, the sheer variety of assets slated for ETF inclusion—from established cryptocurrencies like Bitcoin and Ethereum to more niche altcoins and even memecoins—underscores a compelling competitive advantage. Major asset managers like Grayscale have been instrumental in paving the way for Bitcoin ETFs, which garnered over $100 billion in net assets last year, suggesting a strong preference for established assets among institutional investors.

However, it’s essential to recognize the potential pitfalls. The projected inflow for altcoin ETFs could be substantially lower than Bitcoin-focused funds, with estimates ranging between $300 million and $1 billion. This disparity raises questions about the viability of less popular cryptocurrencies in ETF form. The challenges of consumer adoption become more evident; just because an altcoin is available in ETF format doesn’t ensure investor interest or capital inflow. This is particularly concerning for cryptos that lack a robust institutionalbase.

Institutional investors may find options and derivative instruments linked to assets like Bitcoin and Ether more appealing. These structured products allow for greater flexibility in portfolio strategies—offering a safety net by enabling hedging against volatility. For those savvy enough to leverage these derivatives, the potential for financial growth is vast. Yet, for the numerous altcoins proposed for ETF inclusion, the risk of underwhelming demand looms large, potentially stifling growth and leading to significant within-category competition.

Moreover, the landscape is ripe for disruption. With notable players like ARK Invest moving quickly to incorporate innovative assets like staked Solana into their ETFs, it illustrates a growing trend among asset managers to capitalize on unique investment strategies. However, this could spell trouble for traditional investments in cryptocurrencies that lack similar traction or novelty.

Investors enthusiastic about diversifying their portfolios with these new funds could benefit significantly from a well-informed approach. Conversely, newcomers who hastily allocate funds into marginal cryptocurrencies without understanding their market dynamics may face challenges that outweigh potential gains. Keeping an eye on industry trends and being discerning about which ETFs to choose will be crucial for success as this vibrant market evolves.