The cryptocurrency market is buzzing with activity as analysts from Nansen report a promising yet cautious outlook. They estimate a 70% probability that prices will find their local bottom within the next two months. This stabilization could set the stage for the next significant upswing in the 2025 cycle. The prevailing sentiment among traders has been influenced by global uncertainties, particularly surrounding ongoing discussions about import tariffs that have affected both traditional and digital markets.

“Nansen data estimates a 70% probability that crypto prices will bottom between now and June,”

says Aurelie Barthere, principal research analyst at Nansen. With major players like Bitcoin and Ethereum currently trading well below their 2024 highs, traders are keeping a close eye on the outcomes of these negotiations.

“This OG spent only $2,184 to buy 1.5 trillion $PEPE ($43M at the peak)… with a total profit of $10.3 million (4,718x),”

reveals Lookonchain. This remarkable ROI showcases the power of market timing and the excitement—albeit risky—of trading in the ever-evolving realm of memecoins.

Crypto Market Update: Tariffs, Trading Strategies, and Memecoin Success

Here are the key points affecting the cryptocurrency market and potential investor sentiment:

- 70% Probability of Market Bottom

- The cryptocurrency market is predicted to find a local bottom in the next two months amid ongoing trade negotiations.

- This bottoming out may serve as a springboard for recovery as the market sets the stage for the next leg up in the 2025 cycle.

- Impact of Tariffs on Investor Sentiment

- The global uncertainty regarding import tariffs, announced by US President Trump, has put pressure on both traditional and digital markets.

- Future discussions may provide clarity and a more favorable environment for cryptocurrencies and other risk assets.

- Generational Wealth from Strategic Trading

- An unidentified trader turned an initial investment of $2,000 into over $43 million by trading the memecoin Pepe, demonstrating the potential for huge returns.

- Such high returns also underline the speculative nature of memecoins, highlighting both the opportunities and risks in trading

- Growth in Stablecoin Supply

- The stablecoin market may surge to $1 trillion by 2025, potentially driving broader cryptocurrency market growth.

- This expected growth comes amid increasing adoption and could enhance decentralized finance (DeFi) activity.

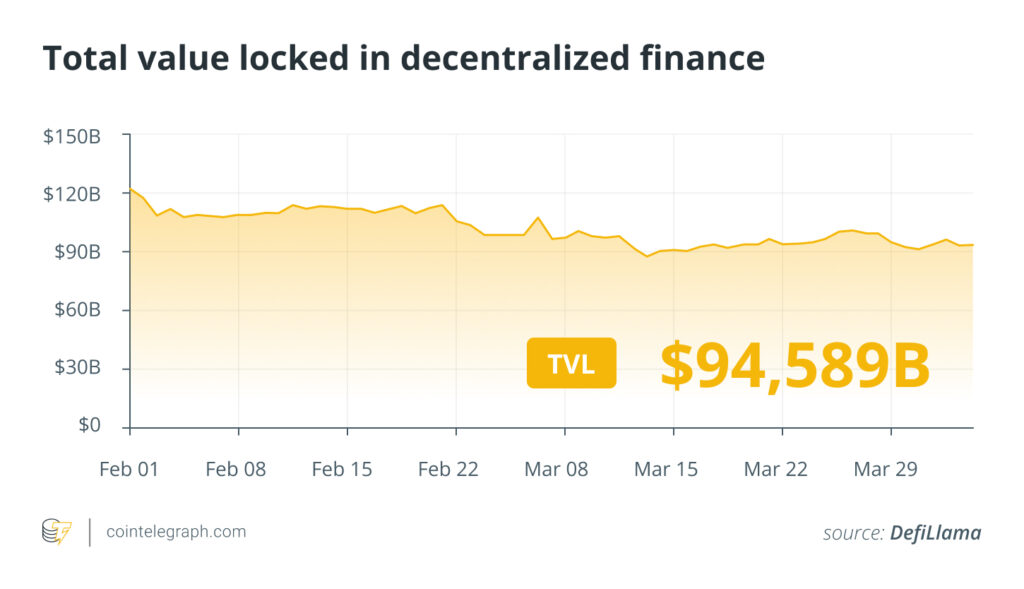

- Challenges in Decentralized Finance (DeFi)

- The total value locked (TVL) in DeFi protocols has dropped significantly, showing resilience challenges in the sector.

- Despite positive growth in certain areas, broader economic uncertainties are negatively impacting investor confidence in DeFi projects.

“The cryptocurrency market may see a local bottom in the next two months amid global uncertainty… Once the toughest part of the negotiation is behind us, we see a cleaner opportunity for crypto and risk assets.” – Aurelie Barthere, Nansen

The Current Crypto Landscape: Analyzing Opportunities and Threats Amidst Volatility

The latest insights from Nansen analysts reveal an optimistic prediction for the cryptocurrency markets, suggesting a 70% likelihood of finding a local bottom within the next two months. This forecast arrives amidst significant uncertainties linked to global tariff discussions, which have dampened investor enthusiasm not just in traditional markets but also in the crypto space.

Competitive Advantages: One of the most compelling aspects of the Nansen report is that savvy traders are still able to capitalize on immense opportunities, evidenced by an astonishing case of a trader converting a mere $2,000 investment into over $43 million through the memecoin Pepe. This kind of generational wealth creation amidst ongoing economic turbulence indicates that the crypto market continues to attract risk-takers who thrive on volatility. Nansen’s projections serve to uplift market sentiment at a time when uncertainty looms large, making it a useful tool for traders looking pragmatically at price action.

Competitive Disadvantages: However, it is crucial to note the inherent risks these predictions carry. Memecoins, like Pepe, can be extremely volatile and lack fundamental backing, which raises questions about the sustainability of such investments. While the potential for high returns is alluring, the reality that many cryptocurrencies can experience severe downturns—like Pepe’s 74% drop from its peak—serves as a stark reminder of the speculative nature of the crypto market. Tariff-related anxieties compounded by economic instability could deter conservative investors, potentially leading to a sharp decrease in market confidence.

Who Benefits and Who Faces Challenges: Experienced traders and those comfortable with high-risk investments are likely to benefit from this environment, as opportunities to capitalize on price movements abound. Meanwhile, entry-level investors or those with a lower risk appetite may find themselves in challenging situations, particularly if they enter the market during periods of high volatility without adequate market knowledge. The forecasted bottom could either solidify their positions or lead to significant losses depending on their timing and strategy. Moreover, stakeholders in traditional industries could feel the impact of crypto trading dynamics, as shifting capital flows might affect liquidity and resource allocation across sectors.

As the landscape remains fluid, staying updated and strategically informed will be key to navigating potential pitfalls and harnessing the lucrative prospects identified by experts in the field.