Pump.fun, a prominent player in the Solana ecosystem, is making waves with the launch of its new lending platform, Pump.Fi. This innovative service aims to enable users to purchase memecoins and non-fungible tokens (NFTs) using borrowed cryptocurrency. In a recent post on April 1, Pump.fun outlined that borrowers will only need to pay one-third of the purchase amount upfront, with the remaining balance due over a 60-day period. This unique offering is designed to provide “immediate financing for any digital asset,” although details on how repayment will be secured for these undercollateralized loans remain unclear.

“Pump.Fi allows users to borrow to buy memecoins,” the company stated in its announcement.

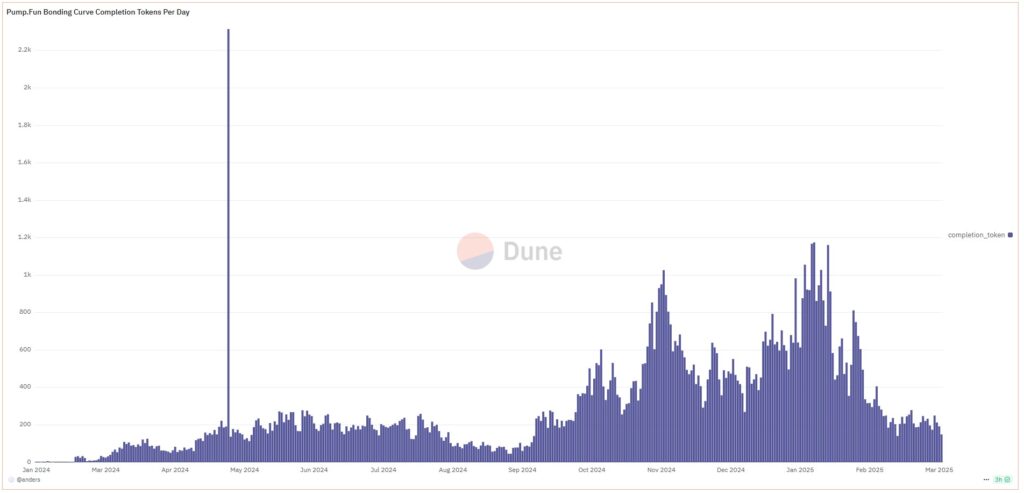

The rollout of Pump.Fi comes at a critical time, as the memecoin market on Solana has seen a notable decrease in trading activity following several controversial events that have shaken trader confidence. Following the ill-fated launch of the LIBRA token, many retail traders have become more cautious. Nevertheless, Pump.fun believes that the addition of on-chain lending could revitalize the market by introducing new liquidity at a time when trading volumes are beginning to stabilize, as reported by Dune Analytics.

In addition to the lending platform, Pump.fun has also been proactive in expanding its services to remain competitive amid a crowded landscape. Rival platforms such as Raydium, which is recognized as Solana’s largest decentralized exchange (DEX) by trading volume, are also launching their own memecoin initiatives, including a new project called LaunchLab. Competition is notably fierce, with other platforms like Daos.fun, GoFundMeme, and Pumpkin all competing for a slice of the Solana memecoin pie.

To enhance its offerings, Pump.fun recently introduced its own DEX, PumpSwap, on March 20. This new platform is intended to streamline the process for listing new tokens and reduce costs for users. Not only has PumpSwap garnered over a 10% share of Solana’s trading volumes, but it has also surpassed Raydium and other Solana applications in daily fees, generating nearly $4 million in fees on April 1 alone, according to data from Dune Analytics and DefiLlama.

“Switching to PumpSwap has streamlined PumpFun’s process for listing new tokens,” said Alon, co-founder of Pump.fun.

As Pump.fun and its offerings continue to evolve, the focus remains on driving innovation within the memecoin and NFT marketplace, positioning itself to attract both consumers and investors in the vibrant world of digital assets.

Pump.fun Launches Innovative Lending Platform

Pump.fun is introducing a new lending platform called Pump.Fi, which allows users to buy memecoins and NFTs with borrowed cryptocurrency. Here are the key points about this launch:

- Immediate Financing: The Pump.Fi lending protocol offers immediate financing for any digital asset.

- Upfront Payment Structure: Borrowers are required to pay one-third of the loan amount upfront and the remaining balance over a period of 60 days.

- No Credit Checks: The platform does not conduct credit checks, making it accessible to a broader range of users.

- Marketplace for Debt: Pump.Fi will create a marketplace where lenders can buy and trade debt, providing new opportunities in the lending space.

The impact of this innovative lending platform could be significant:

- Increased Accessibility: By not requiring credit checks, more users may be encouraged to participate in the memecoin market, potentially boosting adoption and trading volume.

- Enhanced Liquidity: The platform aims to attract more liquidity into the memecoin trading space, which may stabilize and revitalize the market.

- Competitive Edge: With multiple rival platforms emerging, Pump.Fi’s offerings could help the platform maintain a competitive edge in the evolving crypto market.

Pump.fun’s proactive measures could lead to a more vibrant ecosystem for memecoins, which may ultimately benefit users by offering diverse financial opportunities and bolstering market confidence.

Pump.fun’s Innovative Lending Platform: A Competitive Edge or New Challenges?

Pump.fun has made waves with the announcement of its latest venture, Pump.Fi, an on-chain lending protocol designed to facilitate the purchase of memecoins and non-fungible tokens (NFTs) using borrowed cryptocurrency. This move represents a significant pivot in Pump.fun’s strategy, especially in an ecosystem where memecoin trading has been shaken by recent scandals. By integrating an immediate financing model and a marketplace for lenders, Pump.Fi aims to reshape the borrowing landscape within the crypto space. However, as promising as this appears, there are both advantages and drawbacks to consider in this competitive environment.

One of Pump.Fi’s competitive advantages lies in its user-friendly approach. With the protocol not requiring credit checks and allowing borrowers to pay just a third up front, it opens the door for retail traders to engage in memecoin transactions without the barriers typically associated with traditional lending. This aspect is particularly appealing in a market where accessibility can significantly influence user participation. Moreover, the introduction of a marketplace for buying debt adds an innovative layer to the lending model, potentially attracting liquidity from other crypto enthusiasts looking to capitalize on low-entry financial opportunities.

However, the lack of clear repayment mechanisms for undercollateralized loans raises questions about the long-term sustainability of this model. While it might attract users initially, the absence of safeguards could lead to a high rate of defaults, ultimately jeopardizing the platform’s reputation and user trust if not managed effectively. This predicament not only poses a risk to borrowers but could also have adverse effects for lenders if the repayment rates do not align with expectations.

Furthermore, Pump.fun’s expansion into lending comes amidst fierce competition from other platforms like Raydium and newcomers like Daos.fun and Pumpkin, all of which are vying for the burgeoning Solana memecoin market. While Pump.fun has already captured over 10% of Solana’s trading volumes with its new DEX, it must continue to innovate to stay ahead of rapidly evolving competitors. Failure to differentiate its offerings further could diminish its market position, even with the launch of Pump.Fi.

This new lending feature could particularly benefit investors who are bullish on memecoins and NFTs but may lack the upfront capital. It provides a unique opportunity for speculative trading but also poses risks as the volatility in these assets can result in substantial losses. As such, inexperienced traders could find themselves ill-prepared for the financial repercussions of such high-stakes borrowing.

In conclusion, while Pump.Fi introduces a promising avenue for engaging with the memecoin market, both borrowers and lenders must navigate the associated risks carefully. As they grapple with potential pitfalls, all stakeholders in the crypto industry should remain vigilant in an ever-changing landscape.