Cryptocurrency continues to shift the landscape of digital finance, with notable advancements emerging from Asia. Recently, Hong Kong-based payment platform RedotPay made waves by securing million in a Series A funding round, led by Lightspeed and joined by investors like HSG and Galaxy Ventures. The focus of RedotPay is to integrate cryptocurrency into everyday transactions, making it as straightforward to use as traditional money.

In a bid to enhance user accessibility, RedotPay rolled out its own Visa cards in November 2023, allowing for seamless ATM cash withdrawals and compatibility with digital payment services, such as Apple Pay and Google Pay. Moreover, the platform has expanded its blockchain capabilities with recent integrations of Solana and Ethereum’s layer 2 solution, Arbitrum, aiming to streamline transactions further.

“While RedotPay is pushing forward with innovative features, it faces hurdles with cross-border services, limiting access for users outside Hong Kong.”

This theme of growing crypto payment options is not unique to RedotPay. Across Asia, initiatives are multiplying, notably with Singaporean digital asset firm Crypto.com partnering with Triple-A to allow direct cryptocurrency payments without the hassle of fiat conversion. However, competition remains fierce as companies like Infini face challenges, including a significant exploit that drained million from its reserves.

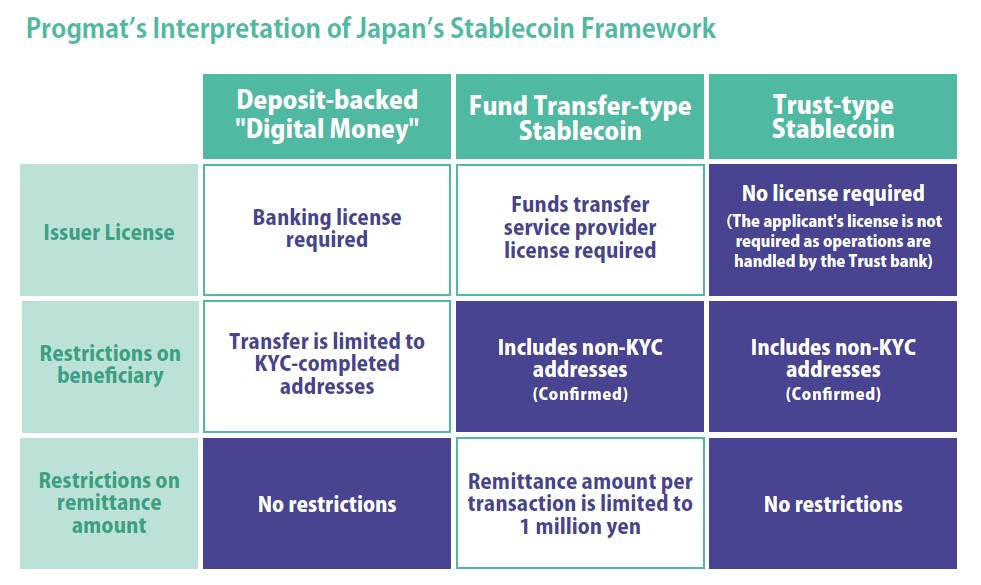

Stability in the volatile world of cryptocurrencies is increasingly found in the realm of stablecoins, which are pegged to traditional currencies and offer a more stable alternative for transactions. Japan, in particular, is making strides in this area. A report from Tokyo-based research firm Yuri Group indicates that the Japanese government is looking to leverage stablecoins to tap into an estimated trillion in household savings. With major backing from Mitsubishi UFJ, Progmat is positioning itself as a key player by adhering to strict regulatory standards, ensuring a solid foundation for digital asset offerings.

In contrast, China’s strict stance on cryptocurrency trades highlights the divergent regulatory landscapes across Asia. While Japan and Singapore embrace digital innovations, including stablecoins, China maintains a crackdown, designating the renminbi as the singular legal tender. This environment underscores the complex dynamics at play within the region’s evolving cryptocurrency market.

RedotPay and the Rise of Crypto Payments in Asia

The recent developments in cryptocurrency payment solutions highlight a growing trend in Asia, particularly with the advent of platforms like RedotPay. Here are the key points that could impact your understanding and engagement with cryptocurrency transactions:

- Million Series A Funding: RedotPay secured significant investment led by Lightspeed, indicating strong confidence in the potential of crypto payment solutions.

- Everyday Cryptocurrency Transactions: The aim of RedotPay to simplify blockchain transactions for users makes it easier for everyday consumers to adopt cryptocurrencies.

- Launch of Visa Cards: The introduction of RedotPay’s physical and virtual Visa cards could facilitate broader acceptance of cryptocurrency in day-to-day spending.

- Blockchain Integration:

- Added support for Solana and Ethereum layer 2 Arbitrum to enhance transaction capabilities.

- Partnership with StraitX and Visa to promote retail crypto payments demonstrates increasing institutional acceptance.

- Cross-Border Service Restrictions: Limitations for users outside Hong Kong could affect the accessibility and growth potential of the platform, emphasizing potential barriers to widespread adoption.

In light of these developments, consider the following implications for your life:

- Increased Accessibility to Cryptocurrencies: As services like RedotPay simplify transactions, individuals may find it easier to integrate cryptocurrencies into their financial habits, potentially influencing how they manage money.

- Stability of Stablecoins: With the mention of stablecoins, users have a consistent option for payments that can mitigate the volatility often associated with cryptocurrencies like Bitcoin and Ether.

- Government Interests in Digital Assets:

- Japan’s potential regulatory support could lead to more innovations and less risk for users engaging in stablecoin transactions.

- Understanding the regulatory landscape across Asia is crucial for safe engagement in the cryptocurrency market.

- Competitive Landscape: The presence of competitors like Infini highlights the need for functionality and security in cryptocurrency services, encouraging users to stay informed about which platforms are best suited for their needs.

These key points underline the transformative potential of cryptocurrency payment solutions in daily transactions, as well as the necessary vigilance regarding security and accessibility in this rapidly evolving landscape.

RedotPay Ramps Up Crypto Adoption in Asia Amidst Competitive Landscape

RedotPay, the Hong Kong-based crypto payment platform, has successfully secured million in Series A funding, a significant leap towards enhancing cryptocurrency usability in everyday transactions. With major backing from Lightspeed, along with participation from HSG and Galaxy Ventures, RedotPay is positioning itself as a formidable player in the burgeoning market of crypto payments. However, its journey is shared with an assortment of competitors, notably within Asia, where rapid developments abound.

While RedotPay aims to simplify blockchain transactions akin to traditional fiat systems, it faces stiff competition from other platforms. For instance, Crypto.com, a Singapore-based trading platform, is also enhancing user experiences by partnering with Triple-A to facilitate direct crypto payments, effectively removing the need for fiat conversion. This strategy could enable Crypto.com to draw users looking for seamless transaction experiences. The appeal of this model lies in its immediate transaction capability, which could position Crypto.com more favorably compared to RedotPay, especially for users outside Hong Kong where RedotPay’s cross-border service limitations may deter potential adopters.

On the other hand, Infini, another local contender, provides stablecoin-focused payment services but has recently faced significant challenges, such as a million exploit that raised concerns around its security measures. This incident highlights a potential vulnerability in the crypto payment space, potentially steering customers towards platforms like RedotPay that prioritize robust integration with established entities like Visa for added reliability. Such strategic partnerships could be a crucial competitive advantage for RedotPay, especially in markets like Singapore where regulatory compliance and safety are paramount.

As for RedotPay’s recent rollout of physical Visa cards and partnerships supporting retail crypto payments, this accessibility could cater specifically to merchants and consumers seeking broader adoption. However, its limited geographical service offering could hinder international expansion and limit its user base to Hong Kong residents. This presents a unique set of challenges; while the physical card feature is attractive, it might struggle to gain traction against more universally available services like Progmat in Japan, which operates under stringent compliance measures and is backed by the largest bank in the nation, enhancing user confidence.

The competitive landscape of crypto payments in Asia is accelerating, with each player vying for market dominance. RedotPay’s strategic initiatives could very well bridge gaps in user experience, providing substantial benefits for consumers and merchants in Hong Kong. Yet, as competition tightens with solutions like stablecoin adoption gaining momentum in Japan and the advancements from other regional players, RedotPay must navigate these waters carefully to mitigate the risks associated with its constrained operational range.