In an exciting development within the cryptocurrency landscape, RedStone has launched a push-based oracle designed specifically to enhance the efficiency of on-chain trading on MegaETH, an Ethereum layer-2 network. This innovative oracle addresses significant latency challenges that have plagued traders and applications by delivering new price data directly to smart contracts every 2.4 milliseconds. Such rapid updates promise to transform the way decentralized finance (DeFi) applications interact with market data, making trading and other transactions more responsive.

RedStone’s approach involves sourcing prices from centralized exchanges and utilizing nodes that natively operate on the MegaETH chain. This method, referred to as “co-location,” effectively reduces delays usually caused by the physical distance between servers. Additionally, there are plans to expand this service to include price feeds from decentralized exchanges in the future. With the oracle market currently valued at $10.2 billion, and interest in oracles compatible with the Ethereum Virtual Machine (EVM) escalating, RedStone is positioning itself in a fast-evolving sector. As reported by Alchemy, there are already 12 decentralized oracle networks functioning on Ethereum.

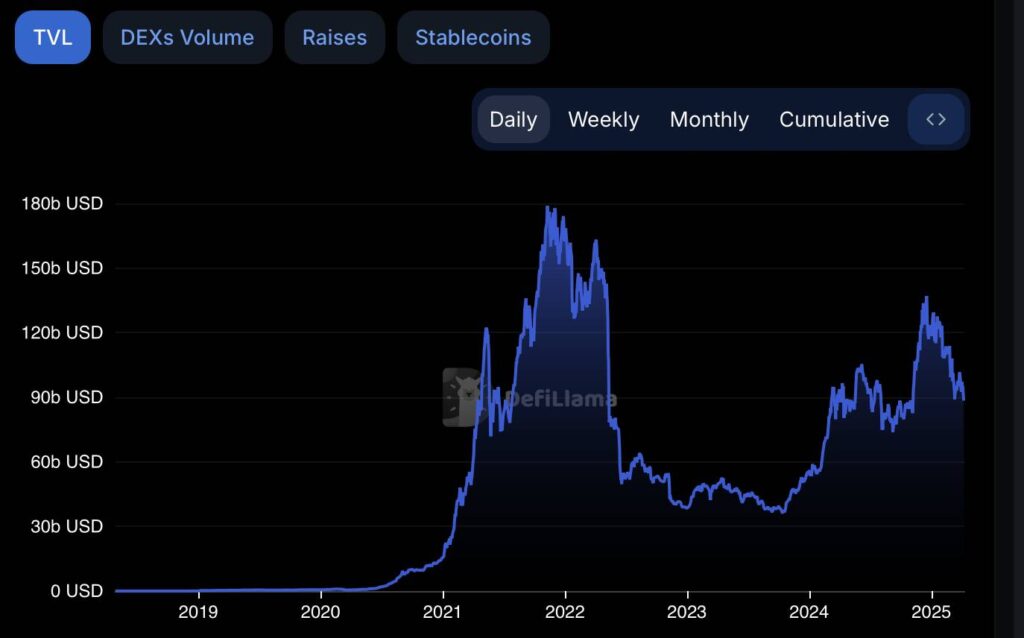

“The rise of decentralized finance, which has seen its total value locked on-chain soar to nearly $88 billion this year alone, is creating an increased demand for efficient oracle solutions,”

noted analysts.

Ethereum remains the dominant blockchain in this space with approximately $47.8 billion locked in DeFi applications. The robust growth in DeFi has intensified competition among oracle providers, who serve as crucial links between real-world data and blockchain functionalities.

Noteworthy competitors in the oracle sector include Chainlink and Pyth Network. Interestingly, Pyth recently surpassed Chainlink in 30-day transaction volume in October 2024, achieving $36 billion, showcasing a shift in market dynamics driven by various operational models. As the DeFi landscape continues to evolve, the role of oracles becomes ever more critical, marking an exhilarating time for innovation in this thriving industry.

RedStone Introduces Push-Based Oracle to Mitigate Latency in Onchain Trading

RedStone’s innovative approach in blockchain oracles could significantly impact the efficiency of decentralized finance (DeFi) applications.

- Introduction of Push-Based Oracle: RedStone has launched a push-based oracle for MegaETH, capable of delivering price updates onchain every 2.4 milliseconds.

- Minimizing Latency: The “co-location” strategy of sourcing prices directly from centralized exchanges minimizes delays by reducing physical distance between servers.

- Future Expansion: RedStone intends to expand its oracle service to other blockchain networks and incorporate price feeds from decentralized exchanges.

This innovative solution is crucial for traders and decentralized applications, as reduced latency can lead to more timely and informed trading decisions.

- Growing Popularity of EVM-Compatible Oracles: There are currently 12 decentralized oracle networks operating on Ethereum, with their usage expanding due to the demand for real-time market data.

- Financial Opportunities: Oracles can generate revenue through various means like data usage fees, licenses, staking rewards, and node incentives.

- Market Growth: The overall market capitalization for oracle tokens is around $10.2 billion, reflecting the financial potential in this space.

The scalability and functionality of oracles can greatly influence the success of DeFi projects, ultimately benefiting investors and developers alike.

- DeFi Market Expansion: The total value locked (TVL) in decentralized finance is nearing $88 billion, highlighting the rapid growth and demand for reliable oracle solutions.

- Competition Among Oracles: The rise of DeFi has intensified competition among oracles, as they are essential for the functioning of decentralized applications.

- Notable Players: Chainlink, Pyth Network, and others are key competitors in the oracle space, each offering unique models to cater to high-volume activities.

“The demand for accurate and timely data in DeFi is skyrocketing, making advancements in oracle technology critical for both traders and developers.”

As the DeFi landscape continues to evolve, understanding and leveraging the capabilities of advanced oracle networks will be critical for anyone involved in blockchain-based trading and applications.

RedStone Push-Based Oracle: Revolutionizing the Blockchain Oracle Landscape

RedStone’s recent launch of its push-based oracle on MegaETH represents a significant breakthrough in the blockchain oracle sector, particularly in addressing latency issues that have long plagued onchain trading activities. This innovation positions RedStone favorably among its competitors, particularly given the oracle’s ability to deliver real-time price updates every 2.4 milliseconds. By utilizing a co-location strategy that sources prices from centralized exchanges, the company has effectively minimized the delays caused by server distances—a robust advantage in the fast-paced world of decentralized finance (DeFi).

Other notable players in the oracle market, such as Chainlink and Pyth Network, have traditionally employed a pull-based model, which requires applications to request data, potentially leading to longer waiting times under high-volume conditions. While Pyth recently demonstrated impressive growth by surpassing Chainlink in transaction volume, the shift to a push-based strategy by RedStone might attract users looking for speed and efficiency in their trading operations, particularly those on Ethereum’s layer-2 networks.

However, RedStone’s focus on centralized exchanges for its initial price feeds could be seen as a double-edged sword. While this ensures quick access to reliable data, it raises questions regarding decentralization—a core principle cherished by many within the blockchain community. Additionally, if RedStone faces challenges in integrating decentralized exchange prices in the future, this could create operational hindrances and affect user trust.

The onboarding of new users, particularly developers focused on DeFi and decentralized applications, could witness a positive impact due to RedStone’s innovative oracle solution. Core benefits include reduced transaction costs associated with latency and improved overall user experience. Conversely, existing oracle solutions like Chainlink, which already benefit from a loyal user base, may experience friction as users weigh the benefits of RedStone’s speed against the risks of relying on a centralized model.

Ultimately, as competition in the oracle market intensifies alongside the rapid growth of the DeFi sector—evidenced by the total value locked approaching $88 billion—RedStone’s strategic offerings may be crucial in determining how blockchain applications integrate real-time data moving forward. Developers looking for a competitive edge while building on MegaETH could find themselves drawn to RedStone’s innovative solutions, whereas traditional, pull-based oracle frameworks might struggle to maintain their relevance amid evolving user demands.