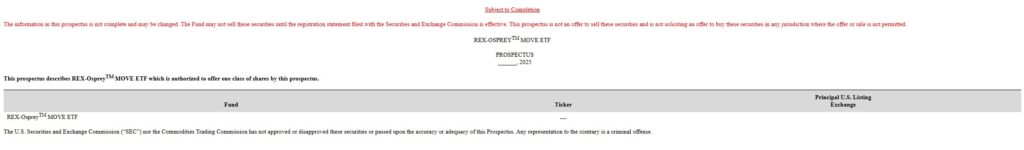

In a significant move within the cryptocurrency sector, asset manager REX-Osprey has announced plans to introduce an exchange-traded fund (ETF) that will specifically target the MOVE token, the native currency of the Movement Network. This news comes as Movement prepares to launch its public mainnet beta, indicating a growing interest in alternative cryptocurrencies, often referred to as “altcoins.”

According to Cooper Scanlon, co-founder of Movement Labs, the demand for regulated investment avenues into emerging blockchain technologies is on the rise among traditional investors. He emphasized that many are looking for ways to gain exposure without the complexities of managing tokens directly. As an Ethereum Layer-2 network, Movement is built using Move, a programming language developed by Meta. The network currently boasts a total value locked (TVL) close to 0 million, suggesting a robust interest in its growing ecosystem.

Despite recent approvals for Bitcoin and Ether ETFs by the US Securities and Exchange Commission (SEC) slated for 2024, the agency has yet to green-light any altcoin ETFs. This gap presents an opportunity for REX-Osprey and others in the industry, with Rushi Manche, another co-founder of Movement Labs, pointing out that diversifying ETF offerings to include altcoins could enable fresh institutional capital to flow into innovative blockchain projects.

“Breaking the pattern of ETFs limited to long-established cryptocurrencies opens doors for institutional capital to support next-generation blockchain innovation,” said Manche.

The push toward altcoin ETFs extends beyond REX-Osprey. Just days before this announcement, Bitwise put forward a filing for a spot Aptos ETF, while Nasdaq showed intent to list a Grayscale ETF holding the Polkadot network’s DOT token. With multiple asset managers vying for SEC approval on various altcoins, including Litecoin and Solana, the interest in altcoin ETFs is becoming increasingly pronounced.

In a broader context, the regulatory landscape appears to be shifting, particularly under the current administration, which has expressed a desire for the U.S. to emerge as a leader in the global cryptocurrency arena. With key regulatory figures advocating for a more welcoming approach to digital assets, the anticipation surrounding altcoin ETF approvals grows stronger each day.

REX-Osprey’s MOVE ETF Proposal: Impact on Investors and Cryptocurrency Landscape

The recent announcement regarding REX-Osprey’s proposal to launch an ETF for the MOVE token marks significant developments in the cryptocurrency and investment spheres. Here are the key points to consider:

- Launch of MOVE ETF: REX-Osprey is seeking to launch an ETF aimed at holding the MOVE token, reflecting growing interest in regulated cryptocurrency investments.

- Emergence of Movement Network: Movement, a layer-2 blockchain network, is launching its public mainnet beta. With approximately 0 million in total value locked (TVL), this suggests a strong foundation for growth.

- Institutional Interest: The move signals that traditional investors are looking for ways to gain regulated exposure to emerging blockchain technologies without directly managing tokens.

- SEC Approval for ETFs: While the SEC has approved ETFs for Bitcoin and Ether, altcoin ETFs are still awaiting approval. This could impact investor sentiment and market dynamics significantly.

- Broadened Opportunities: Rushi Manche’s statement highlights that diversifying ETF options to include altcoins can bring institutional capital into next-generation blockchain innovations.

- Competitive Landscape: Other asset managers, such as Bitwise and Nasdaq, are also filing for ETFs that hold various altcoins, increasing competition and choices for investors.

- Pro-Crypto Regulatory Environment: With the US government aiming to position itself as a “crypto capital,” favorable policies might further encourage institutional investment in blockchain technologies.

- Market Potential: The MOVE token’s fully diluted value of around billion indicates its potential attractiveness to both retail and institutional investors.

“Breaking the pattern of ETFs limited to long-established cryptocurrencies opens doors for institutional capital to support next-generation blockchain innovation.” – Rushi Manche, Movement Labs’ co-founder

REX-Osprey’s MOVE ETF: Pioneering Altcoin Investments Amid Growing Interest

The proposed launch of REX-Osprey’s exchange-traded fund (ETF) focused on the MOVE token highlights a burgeoning trend in the investment landscape: the growing acceptance of altcoins by traditional investors. This initiative places REX-Osprey at the forefront of a movement where asset managers are increasingly aiming to provide structured investment opportunities in less established digital currencies. Unlike the BTC and ETH ETFs already greenlit by the SEC, REX-Osprey’s filing signifies noteworthy progress into uncharted territory for ETFs, representing both a potential competitive advantage and a venture fraught with challenges.

Competitive Advantages: A significant advantage of REX-Osprey’s MOVE ETF is its alignment with the Movement Network’s burgeoning platform, which boasts a solid total value locked (TVL) of approximately 0 million. This positions the ETF as a potentially appealing option for investors wishing to capitalize on Ethereum’s growing ecosystem without the hurdles of directly managing digital tokens. Furthermore, Cooper Scanlon’s insights indicate a keen interest from traditional investors in secure and regulated exposures to blockchain technology, hinting at a strong market demand for the fund. Given its innovative structure and the credibility gained from the Movement Network’s beta launch, REX-Osprey can leverage increasing institutional interest in altcoin assets.

However, the contest for approval and traction in the market isn’t without difficulties. Unlike more mainstream cryptocurrencies, altcoins like MOVE may encounter skepticism from both investors and regulators. The SEC’s previous reluctance to approve altcoin ETFs underscores a landscape that remains cautious. Moreover, with other asset managers like Bitwise and Nasdaq aggressively pursuing similar filings for different altcoins, REX-Osprey must distinguish itself to avoid diluting investor interest in a crowded market.

Potential Beneficiaries and Challenges: This ETF could prove advantageous for risk-tolerant investors searching for exposure to emerging blockchain technologies without the direct ownership burdens of crypto trading. Institutional investors looking for avenues to diversify their portfolios with next-generation blockchain solutions might find REX-Osprey’s offering particularly attractive. Conversely, the fund’s existence could create challenges for traditional investment firms that have focused solely on BTC and ETH, as the introduction of altcoin ETFs may shift the landscape and redefine benchmarks for cryptocurrency investments.

Moreover, with the recent statements from previous US President Donald Trump advocating for a pro-crypto agenda, acceptance of such innovative financial products may gain momentum. However, the inherent volatility and regulatory uncertainties associated with altcoins like MOVE could deter conservative investors from participating, creating a challenging dichotomy where the ETF is both an opportunity and a risk in today’s evolving financial ecosystem.