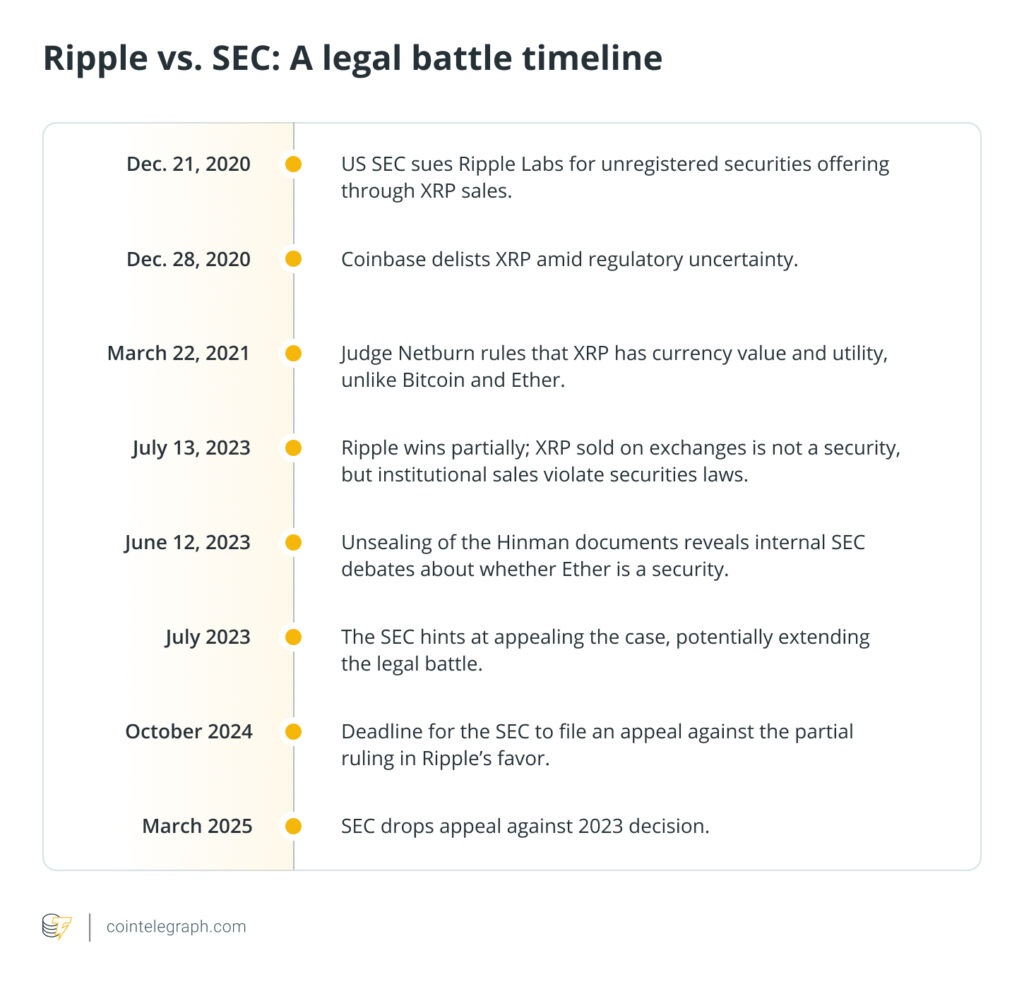

Ripple is marking a significant milestone in the cryptocurrency landscape, as the United States Securities and Exchange Commission (SEC) has decided not to pursue further legal action against the company. The SEC’s decision, announced during the Digital Asset Summit in New York, signals a turning point for Ripple, the firm behind the crypto asset XRP, which has long faced regulatory scrutiny.

Ripple’s CEO, Brad Garlinghouse, expressed optimism in light of the announcement, stating it “provides a lot of certainty” for the company and puts Ripple in a favorable position to determine its next steps. However, he also acknowledged that several loose ends remain to be resolved with the SEC. Stuart Alderoty, the company’s chief legal officer, echoed this sentiment on social media, viewing the development as a moment of strength for Ripple and a defining moment for the broader crypto industry.

Despite the celebratory atmosphere, experts caution that the SEC’s decision does not establish any binding legal precedent for other cryptocurrency firms. Legal professionals highlight that while the regulatory environment seems more welcoming, concrete guidelines and frameworks for the crypto sector are still pending. Lawyer Aaron Brogan noted that the SEC’s current policies might only be clarified after new leadership is appointed, emphasizing that ongoing uncertainty still looms over other firms in the industry.

“The Ripple decision is not binding legal precedent. It was a single district court judge’s ruling based on the facts of that case,” said Brian Grace, general counsel at the Metaplex Decentralized Autonomous Organization.

Moreover, the effects of this development extend beyond Ripple. The SEC’s decision does not address the pressing need for comprehensive legislation in the cryptocurrency market. Observers argue that Congress must take the lead in establishing legal frameworks that can provide clarity and protection for the industry. Ripple’s ongoing disputes—including potential cross-appeals regarding financial penalties imposed by a judge—highlight the complex legal landscape that both Ripple and the industry must navigate going forward.

As discussions surrounding stablecoins and broader crypto regulations continue in Congress, there is hope that new legislation will take shape soon. Some advocates within the community believe that with the right adjustments, meaningful progress could be achieved within the next few months, providing much-needed stability and guidance for the evolving cryptocurrency market.

Ripple Celebrates SEC Decision, Impact on Crypto Industry

The recent decision by the U.S. Securities and Exchange Commission (SEC) regarding Ripple has significant implications for the cryptocurrency industry, highlighting both achievements and ongoing challenges.

- SEC Drops Appeal Against Ripple:

- This decision is seen as a win for Ripple, providing some operational certainty.

- CEO Brad Garlinghouse stated, “We now are in the driver’s seat to determine how we want to proceed.”

- Unclear Legal Precedent for the Crypto Industry:

- Despite the victory for Ripple, legal experts emphasize that the case does not establish a binding precedent for other firms.

- Lawyer Aaron Brogan indicated that while the regulatory environment is more favorable, specific SEC policies remain ambiguous.

- Need for Legislative Clarity:

- Experts argue that real changes must come from Congress to provide a sustainable framework for the crypto industry.

- As stated by Brian Grace, “The U.S. crypto industry needs new legislation to provide clarity and protection.”

- Ongoing Legal and Regulatory Battles:

- Ripple is contemplating further legal actions, including a cross-appeal regarding previous rulings and fines imposed.

- The five-year “bad actor” prohibition may significantly impact Ripple’s operational capabilities.

- Potential Congressional Legislative Progress:

- Congress is currently working on a stablecoin bill that may set the stage for better regulatory frameworks.

- Optimistic lawmakers believe new bills may pass, potentially bringing clarity to the cryptocurrency landscape.

“A friendly SEC also does not change the fact that we need a crypto market structure law.” – Brian Grace

The implications of these developments resonate beyond just Ripple, impacting broader market sentiment and the potential future of cryptocurrency investments for readers, especially those involved in the crypto market. Understanding these dynamics can help investors navigate the evolving landscape more effectively.

Ripple’s SEC Victory: A Double-Edged Sword for the Crypto Industry

The recent decision by the SEC not to pursue further legal action against Ripple marks a pivotal moment for the cryptocurrency landscape. Ripple’s CEO, Brad Garlinghouse, conveyed optimism, stating that with this decision, the company is now “in the driver’s seat.” However, while celebrations abound within Ripple and the broader crypto sector, the reality is more nuanced. This seemingly positive ruling does not provide the robust legal framework that many stakeholders in the industry have been seeking.

Competitive Advantage: Ripple’s triumph over the SEC has indeed injected optimism into the market, reflected in the swift 9% rise in XRP’s price following the announcement. This positive sentiment could empower Ripple to attract more investors and partners, reinforcing its role as a leading figure in the cryptocurrency arena. Moreover, the perception of a friendlier regulatory environment could encourage other crypto firms to innovate without the looming threat of litigation. Historically, Ripple’s stance on compliance may position them favorably against competitors who have yet to navigate SEC regulations effectively.

Competitive Disadvantage: Despite this judicial reprieve, the SEC’s decision offers scant legal certainty for the entire industry. Legal experts, such as Aaron Brogan, assert that the Ripple verdict lacks sufficient precedent to safeguard other firms from analogous challenges. Critics argue that this scenario may lead to an uneven playing field, where companies without the means to engage in lengthy legal battles might find themselves at a disadvantage. The absence of explicit “guardrails” from the SEC means that ongoing ambiguity surrounding regulations persists, potentially hindering the development of essential legislative frameworks.

This uncertainty poses challenges, particularly for smaller firms and startups. These entities often lack the resources to combat regulatory scrutiny and may face higher risks in a landscape that remains unclear about compliance expectations. The implications could stifle innovation and deter new entrants into the cryptocurrency market.

Potential Beneficiaries: Established players, like Ripple, stand to gain significant advantages, leveraging their legal wins and public perception to attract investment. Additionally, the cryptocurrency lobby may find renewed strength, pushing for a Congressional framework that could reshape the regulatory landscape. Nevertheless, this victory could lead to an influx of litigation as other companies look to establish their positions in a still-fluid regulatory environment.

Potential Problems: On the flip side, the decision may engender complacency among legislators, limiting their motivation to enact comprehensive regulatory reforms. Legal experts emphasize the need for Congress to step up in defining a clear and lasting framework for cryptocurrency. Without legislative action, companies can expect to continue maneuvering through a regulatory maze wherein case law and district court decisions hold more sway than federal guidelines.

In summary, while Ripple’s recent victory against the SEC may signal a more favorable environment for certain participants, the broader industry remains in a precarious position, with many variables still at play. Stakeholders must navigate the dual realities of newfound optimism and ongoing uncertainty as they look to the future of cryptocurrency regulation in the United States.