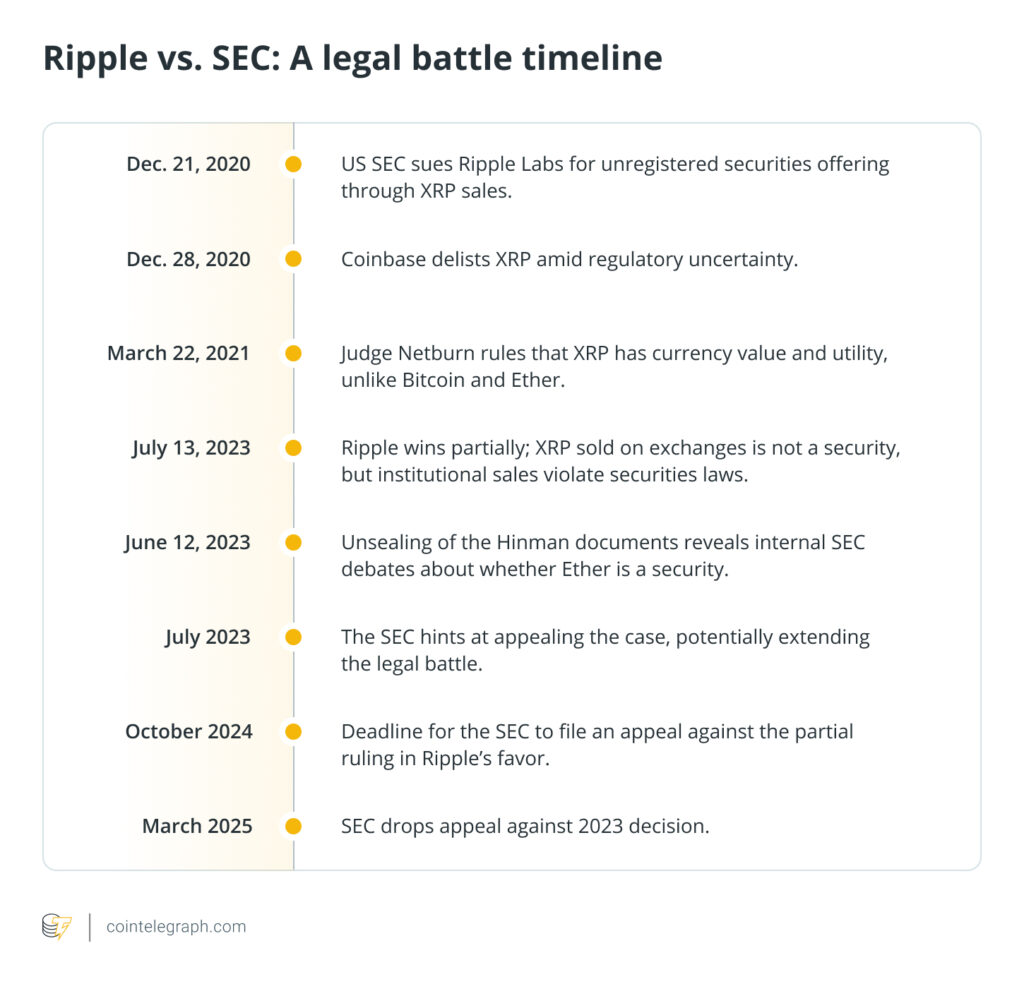

Ripple is in celebratory spirits following the United States Securities and Exchange Commission’s (SEC) recent decision not to pursue an appeal against the firm. This move marks a pivotal moment for Ripple, creators of the cryptocurrency XRP, and is considered a significant victory within the broader crypto community. According to Ripple’s CEO, Brad Garlinghouse, this ruling enhances Ripple’s strategic position, indicating that the firm can dictate how it wishes to navigate the remaining complexities with the SEC.

“We now are in the driver’s seat to determine how we want to proceed,” remarked Garlinghouse in response to the SEC’s announcement.

Despite this apparent win, the ruling does not provide the broader legal assurance many in the cryptocurrency sector are seeking. Legal experts are cautious, suggesting that the decision does not establish a binding precedent for other crypto firms. As lawyer Aaron Brogan explained, while the regulatory environment appears more favorable for crypto businesses, the SEC’s long-term policies remain uncertain, with significant reliance on Congress to enact further legal clarifications.

The cryptocurrency sector celebrated the SEC’s decision at the Digital Asset Summit in New York, where XRP’s value surged by 9% shortly after the announcement. However, observers in the legal field have highlighted that the ruling, made by a single district court judge, does not serve as a definitive legal standard for future cases. The call for a comprehensive framework for cryptocurrency regulation continues, with experts like Brian Grace emphasizing that lasting change must come from legislative action, not just SEC rulings.

“We need a crypto market structure law,” Grace stated, stressing the industry’s need for clarity and protection.

Looking ahead, Ripple aims to resolve outstanding issues with the SEC, including potential appeals concerning a hefty 5 million fine related to prior token sales. While Garlinghouse acknowledges the legal advances made, he also sees the possibility for further negotiations or appeals as part of Ripple’s ongoing effort to solidify its standing.

Simultaneously, Congress is working on advancing legislation regarding stablecoins, with expectations of progress in the coming months. Although recent crypto-related bills have faced setbacks, optimism remains about the potential for new regulations to be enacted by the end of the year. As the industry transitions through these significant events, the push for clear guidelines and a stable regulatory environment persists as a central theme moving forward.

Ripple’s Victory and Its Impact on the Crypto Industry

Ripple has celebrated a significant decision from the SEC that could affect the future of the cryptocurrency industry. Here are the key points:

- SEC Drops Appeal Against Ripple: The SEC has chosen not to pursue further legal action against Ripple, signaling a potential shift in the regulatory landscape for crypto assets.

- Ripple’s Assertion of Control: CEO Brad Garlinghouse stated that Ripple is now in a position to determine its future actions, providing a sense of empowerment and stability for the firm.

- Legal Uncertainty Remains: Despite the victory, the case does not set a binding legal precedent, leaving the overall regulatory environment ambiguous for other crypto firms.

- Market Reaction: Following the SEC decision, XRP’s price increased by 9%, reflecting a positive sentiment among investors.

- Congressional Responsibility: Legal experts emphasize that lasting regulation must come from Congress, not the SEC, to provide clarity and protection for the cryptocurrency sector.

- Ongoing Legal Battles: Ripple’s legal challenges regarding a previous ruling and financial penalties (e.g., the 5 million fine) may continue, as the firm seeks to resolve outstanding issues with the SEC.

- Future Legislation: There are hopes for new legislation, including a stablecoin bill and crypto framework law, which could provide a more structured environment for the crypto industry in the US.

“The U.S. crypto industry needs new legislation to provide clarity and protection.” – Brian Grace

The implications of Ripple’s situation can directly affect readers involved in cryptocurrency investment or businesses. As the regulatory landscape evolves, understanding these developments is crucial for making informed decisions in a potentially favorable environment for crypto-related activities.

Ripple’s SEC Victory: A Double-Edged Sword for the Crypto Landscape

Ripple’s recent celebration over the SEC’s decision to abandon its appeal presents a compelling case of triumph accompanied by potential pitfalls for the broader cryptocurrency industry. While Ripple CEO Brad Garlinghouse lauds the decision as a leap forward in clarity and regulatory favor, it simultaneously leaves many unanswered questions hanging over the crypto market. This nuance is crucial for both industry players and investors.

Competitive Advantages: The major victory for Ripple signals a slight thawing in the historically stringent regulatory environment. The SEC’s choice not to pursue further legal action grants Ripple greater operational flexibility. This newfound breathing room allows the company to explore avenues for growth, and Garlinghouse feels that they’re in a position of strength. Other crypto companies may attempt to leverage Ripple’s situation as a model for their dealings with regulators, potentially encouraging innovation as firms aim to follow Ripple’s lead in establishing clearer, self-advocating positions.

Competitive Disadvantages: However, the SEC’s lack of clarity means that the slate is far from clean. Legal experts warn that this decision does not create a binding precedent, leaving the door open for future regulatory confusion and scrutiny. For companies within the crypto sphere, the ambiguity persists; as pointed out by legal observers, the favorable environment may very well be temporary. Additionally, Ripple’s own obligations, including a hefty fine and potential fundraising prohibitions, introduce complexities that could hinder its capacity to fully capitalize on the current regulatory atmosphere.

This situation could be a double-edged sword for varying factions within the industry. On one hand, companies seeking to innovate and launch new products may find inspiration in Ripple’s assertive course of action, effectively galvanizing the sector to push back against regulatory obstacles. On the other hand, firms without the resources or legal support that Ripple enjoys may find themselves increasingly vulnerable to litigation and regulatory scrutiny as the industry grapples with ambiguous legal definitions.

In summary, while Ripple’s celebration reflects an uplift for its own fortunes, the lack of broader legal groundwork could sow further confusion in an already tumultuous regulatory landscape. For savvy investors and companies, staying informed about evolving laws and regulations will be critical. Ripple’s victory might serve as a beacon of hope, but it could also mask deeper truths about the uncertain terrain ahead for cryptocurrency in the U.S.