On March 19, Ripple CEO Brad Garlinghouse announced that Ripple had received a green light from the U.S. Securities and Exchange Commission (SEC) regarding an alleged .3 billion unregistered securities offering. This news initially sent the price of XRP soaring to .59; however, the excitement proved short-lived as the cryptocurrency underwent a sharp 22% correction, settling at .02 by March 31. Investors are now apprehensive about the potential for an even steeper decline, particularly as XRP is currently trading 39% below its peak of .40, reached on January 16.

The market sentiment surrounding XRP has been notably bearish as reflected in the increasing demand for leveraged bearish bets. A thriving trend in futures markets shows that traders are paying for leverage, which is often interpreted as a lack of confidence in the asset’s future performance. Currently, the XRP funding rate is at -0.14% per eight hours, signaling a weekly cost of approximately 0.3% and illustrating the prevailing bearish attitude among traders.

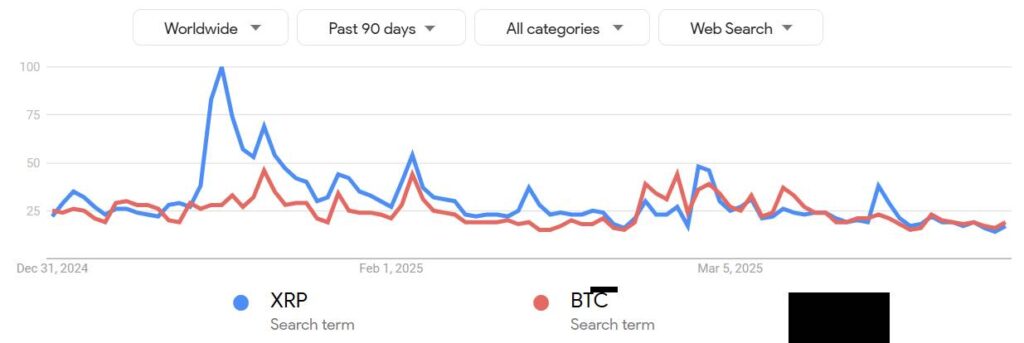

In comparison, the long-to-short margin ratio for XRP at OKX is hovering around 2x in favor of long positions, a figure that has plummeted to its lowest levels in over six months. Historically, a metric above 40x signifies strong confidence among buyers, whereas readings below 5x are viewed as bearish indicators. The ongoing shift in market dynamics is further complicated by the wave of attention XRP received after former President Donald Trump cited the cryptocurrency as a potential candidate for the United States’ digital asset strategic reserves. This mention temporarily boosted XRP’s visibility, evidenced by Google search trends momentarily outpacing those of Bitcoin.

Despite the bearish signals from derivative and margin markets, XRP is increasingly catching the eye of traditional finance platforms. On March 26, Interactive Brokers expanded its cryptocurrency offerings to include Ripple’s XRP, alongside Solana and Cardano, providing further legitimacy to the cryptocurrency landscape. As the third-largest cryptocurrency by market capitalization (excluding stablecoins), XRP continues to capture interest due to its early adoption and liquidity, setting the stage for potential inflows as market conditions stabilize and investors look towards promising altcoins.

Key Points on Ripple and XRP Market Trends

The following points summarize key developments regarding Ripple and XRP’s market dynamics, which could impact investor decisions and future opportunities:

- SEC Clearance Announcement:

Ripple CEO Brad Garlinghouse announced that the company was cleared by the SEC regarding a .3 billion unregistered securities offering.

- Market Volatility:

XRP surged to .59 post-announcement but experienced a 22% correction, dropping to .02 by March 31, raising concerns about future price stability.

- Investor Sentiment:

- Negative funding rates in XRP perpetual futures indicate strong bearish sentiment among investors.

- The current XRP funding rate stands at -0.14% per eight hours, signaling weak investor confidence.

- Margin Markets Insight:

XRP’s long-to-short margin ratio at OKX is at its lowest in over six months, indicating cautious sentiment among buyers.

- Increased Public Awareness:

Former President Trump mentioned XRP in a digital asset context, boosting its visibility and potential for future price gains.

- Mainstream Adoption:

- Interactive Brokers expanded its cryptocurrency offerings to include XRP, enhancing its legitimacy as an investment asset.

- Rising Google search trends suggest growing public interest, which could lead to increased investment inflows.

“This article is for general information purposes and is not intended to be legal or investment advice.”

Understanding these points may help readers make informed decisions regarding their investments in XRP and navigate the rapidly changing cryptocurrency landscape.

Ripple’s XRP: A Beacon Amidst Bearish Trends and Market Dynamics

The recent announcement by Ripple’s CEO, Brad Garlinghouse, regarding the SEC’s clearance has undoubtedly positioned XRP at the forefront of cryptocurrency news. This development created a notable surge in XRP’s value, which initially soared to .59. However, the subsequent correction, pushing it down by 22% to .02, has sparked concern among investors, signaling a potentially deeper bearish trend. This volatility within XRP’s market offers both advantages and disadvantages when compared to similar altcoins like Solana (SOL) and Cardano (ADA).

Competitive Advantages: The primary advantage for XRP lies in its recent recognition from President Trump, which not only increased public interest but also garnered attention from institutional investors. The high liquidity associated with XRP, being the third-largest cryptocurrency by market capitalization, positions it favorably compared to other altcoins. Moreover, the backing of traditional finance platforms, such as Interactive Brokers enhancing their crypto offerings, signals a growing acceptance and potential for inflows in XRP.

Competitive Disadvantages: On the flip side, the current bearish sentiment in XRP’s derivatives and margin markets cannot be overlooked. The negative funding rate and the low long-to-short margin ratio suggest a lack of confidence among investors, which could deter new bullish investors from entering the market. Additionally, this bearish momentum can overshadow the seemingly positive developments, as seen with XRP’s price volatility stemming from speculative trading.

Who Stands to Benefit? Institutional investors and those engaging in high-risk trading practices may find opportunities amidst this volatility. As traditional firms expand their crypto offerings, XRP could benefit from institutional inflows, especially during bullish phases. Furthermore, retail traders who thrive in rapidly changing markets might capitalize on price fluctuations, provided they can navigate the associated risks effectively.

Potential Problems for Investors: However, this scenario also presents challenges for less risk-tolerant investors. The ongoing bearish momentum and market corrections can lead to considerable losses for those unprepared for sudden dips. Moreover, excessive media focus and speculative trading may create unrealistic expectations about XRP’s price trajectory, potentially leading to disappointment when reality sets in.

In summary, while XRP stands at a crossroads with promising institutional interest and increased public awareness, the prevailing bearish trends and market anxieties could pose significant challenges. Investors need to tread carefully, evaluating both the opportunities and inherent risks within this dynamic financial landscape.