In an exciting turn of events for the cryptocurrency world, Rootstock—the decentralized finance (DeFi) backbone of Bitcoin—reported a remarkable boost in network security and mining engagement in the first quarter of 2025. According to Messari’s inaugural “State of Rootstock” report, merged mining participation soared to an impressive 81%, climbing from 56.4% in the previous quarter. This surge was primarily fueled by key partnerships with major mining pools, Foundry and SpiderPool.

The increase in miner participation has significantly elevated Rootstock’s hash power to over 740 exahashes per second, surpassing the total Bitcoin network hashrate recorded as of October 2024. This milestone positions Rootstock in what analysts describe as a “mature phase” of merged mining growth, enhancing the overall security of the network.

“As BTCFi continues to grow, Rootstock is well-positioned for broader adoption through core upgrades like a 60% reduction in transaction fees,” said Messari analyst Andrew Yang.

Even as network activity has seen a cooldown, this uptick in engagement comes alongside a substantial 60% reduction in transaction fees, improving the user experience for participants and allowing Rootstock to compete more effectively within the Bitcoin layer-2 ecosystem.

Interestingly, the stablecoin market on Rootstock saw shifts as well, with USDT remaining the leading stablecoin but losing ground in market share from 41.3% to 27.5% over the quarter.

On the development front, Rootstock made strides by activating its Lovell 7.0.0 upgrade, which promises enhanced compatibility with the Ethereum Virtual Machine (EVM) and improved smart contract functionality. Additionally, collaborations with LayerZero and Meson Finance, along with developer-focused initiatives such as a new hackathon, signal a proactive approach to ecosystem growth.

“The first DeFi company to launch a user-friendly suite of products on Bitcoin will win the entire market,” noted Alexei Zamyatin, co-founder of Build on Bitcoin.

As the landscape of cryptocurrency continues to evolve, Rootstock is strategically positioning itself for a prominent role in the future of decentralized finance on Bitcoin, navigating both challenges and opportunities with resilience and innovation.

Rootstock’s Q1 2025 Developments and Impact on Bitcoin DeFi

Rootstock, as a significant player in decentralized finance (DeFi) on Bitcoin, has experienced notable changes in Q1 2025. Below are the key points regarding its performance and implications for users and investors:

- Merged Mining Participation Surge:

- Merged mining participation reached an all-time high of 81%, up from 56.4% in Q4 2024.

- Major mining pools, such as Foundry and SpiderPool, drove this engagement.

- Increased Network Security:

- Rootstock’s hash power surpassed 740 exahashes per second.

- Perceived maturity in merged mining growth enhances network reliability, offering users better security for their transactions.

- Reduction in Transaction Fees:

- Transaction fees decreased by 60%, making Rootstock more competitive within the Bitcoin layer-2 ecosystem.

- This reduction can improve user experience, as lower transaction costs can attract more users and developers.

- Decline in Total Value Locked (TVL):

- Bitcoin-denominated TVL dropped 7.2%, while USD-denominated TVL fell 20%. Current value stands at $179.9 million.

- The decline reflects broader market cooling, impacting investor confidence and potential adoption.

- Shifts in Stablecoin Market:

- USDt remained the leading stablecoin, but its market share fell from 41.3% to 27.5%.

- No single stablecoin surpassed 30% market share, indicating a diversification of stablecoin strategies among users.

- Development Enhancements:

- The activation of the Lovell 7.0.0 upgrade improved EVM compatibility and smart contract performance.

- Collaborations with LayerZero and Meson Finance, as well as new developer initiatives, could foster innovation and growth within the ecosystem.

“The first DeFi company to launch a user-friendly suite of products on Bitcoin will win the entire market.” – Alexei Zamyatin

Rootstock’s Rising Security Amidst DeFi Challenges: A Comparative Perspective

Rootstock’s recent developments paint a picture of both promise and pitfalls in the realm of decentralized finance (DeFi) on Bitcoin. With a significant uptick in mining participation, reaching 81% through partnerships with major players like Foundry and SpiderPool, the platform showcases remarkable strides in network security. This contrasts sharply with recent struggles in the broader DeFi landscape, where other platforms like Ethereum have faced a more severe decline in total value locked (TVL), dropping a staggering 27% in the same period due to macroeconomic pressures and scandals like the Bybit exploit.

Rootstock’s improved hash power, now exceeding 740 exahashes per second, positions it as a formidable competitor. This growth has notably enhanced its security, a crucial factor in the crypto space where trust is paramount. Yet, while Rootstock thrives on the security front, its DeFi ecosystem experienced a concerning downturn, with its BTC-denominated TVL dropping by 7.2% and a stark 20% reduction in US dollar-denominated TVL, bringing it down to $179.9 million. This decline raises questions about the sustainability of its growth amidst a cooling market, especially when juxtaposed with competitors that are equally feeling the strains of a tumultuous environment.

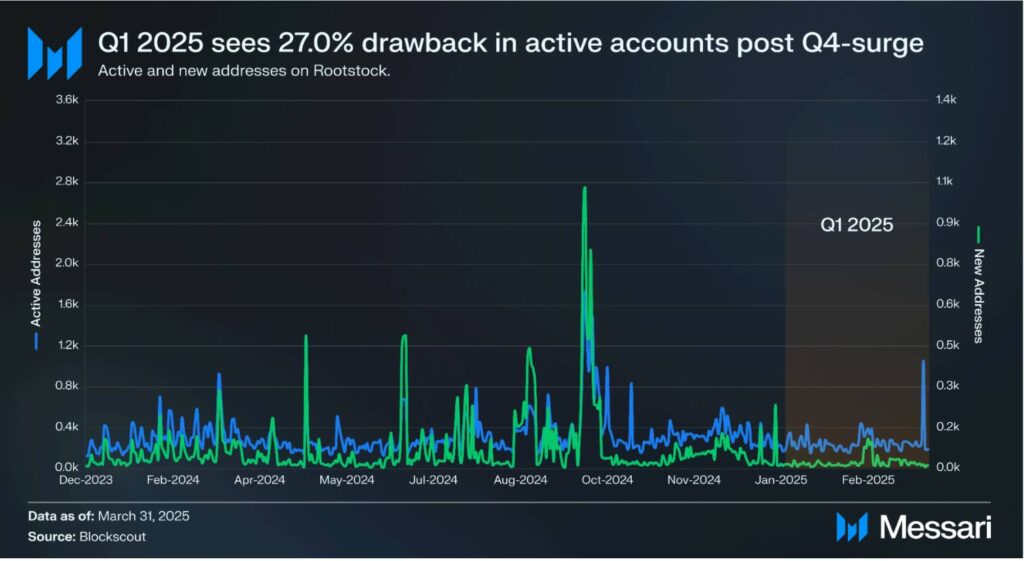

It’s important to highlight that while Rootstock aims for broader adoption by significantly slashing transaction fees by 60%, the drop in active addresses by 26.5% and a staggering 54.7% decline in new addresses may signal underlying user engagement issues. This contrasts with the performance of DeFi projects looking to recover from recent downturns, suggesting that while networks like Rootstock are gaining traction in security, they need to address user retention and attraction effectively. The emerging challenge is how to convert increased miner engagement into a revitalized user base that actively participates in the ecosystem.

This competitive landscape creates both opportunities and hurdles. The favorable circumstances for miners might appeal to institutional players looking to benefit from robust security and lower operational costs. However, for existing users and potential new entrants, the declining TVL and drop in active users signal a market that’s still fragile. The increasing integration with various platforms, including the newest Lovell 7.0.0 upgrade for enhanced EVM compatibility, showcases Rootstock’s commitment to innovation. Nevertheless, without revitalizing its DeFi engagement, the platform risks alienating users who may find better prospects in more stable or actively growing ecosystems.

As the crypto space evolves, Rootstock’s approach will likely attract attention from developers eager to leverage its technical advancements. However, if it cannot stabilize and grow its user engagement while contending with the external challenges of market sentiment and competition, it might struggle to maintain its newfound advantages. The race to capture the attention and loyalty of the expansive Bitcoin user base remains fiercely competitive, and how Rootstock navigates this landscape will determine its future within the DeFi sector.