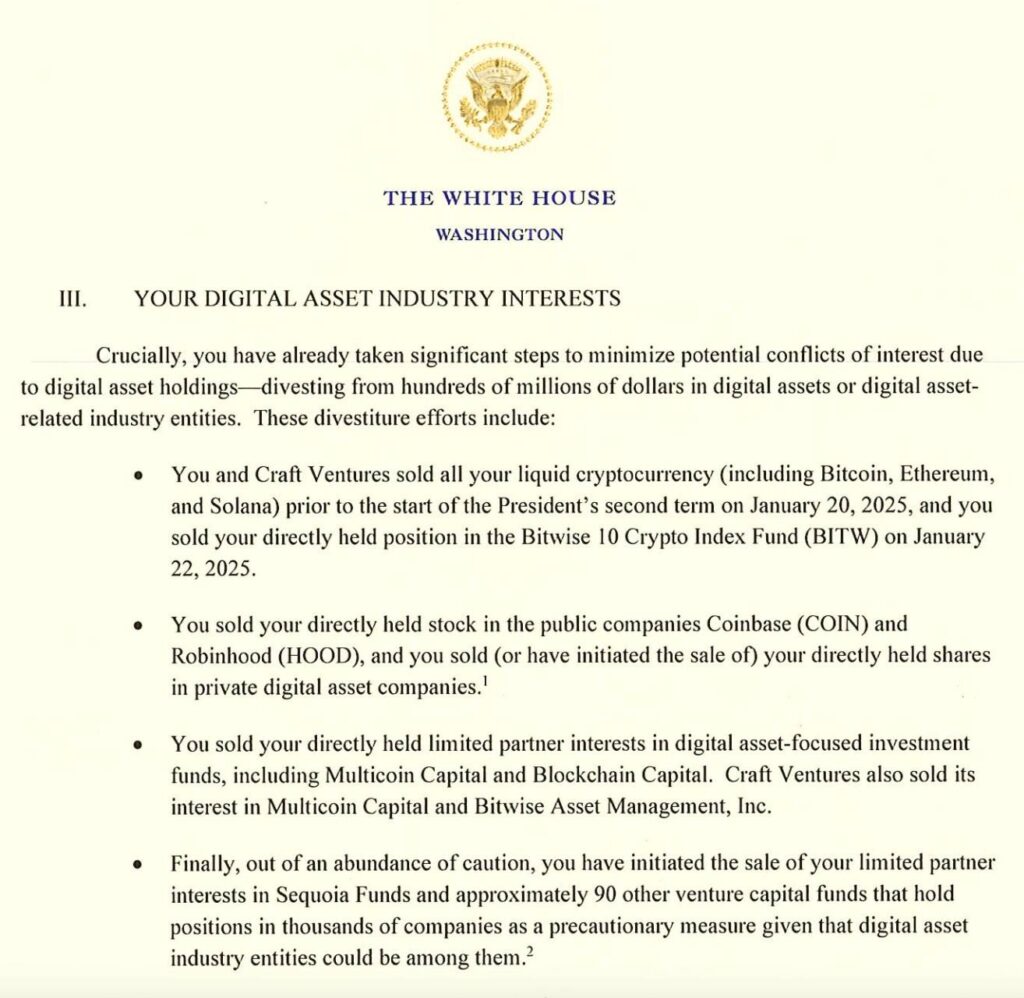

In a significant development within the cryptocurrency landscape, David Sacks, co-founder of Craft Ventures and newly appointed White House AI and crypto czar, has divested over 0 million from crypto assets and related stocks. This decision, revealed in a memorandum dated March 5, was undertaken as a precautionary measure to minimize potential conflicts of interest as Sacks embarks on his government role, which involves shaping the regulatory framework for the digital asset industry.

“You and Craft Ventures have divested over 0 million of positions related to the digital asset industry, of which million is directly attributable to you,” the memorandum states.

Specifically, Sacks liquidated his holdings in well-known cryptocurrencies such as Bitcoin (BTC), Ether (ETH), and Solana (SOL), alongside shares in notable firms like Coinbase (COIN) and Robinhood (HOOD), prior to former President Trump’s inauguration on January 20. The sell-off also included his interests in private ventures focused on digital assets, which Sacks and Craft Ventures executed to clear any doubts regarding his financial participation in the crypto market as he undertakes new responsibilities.

This divestment comes amid ongoing scrutiny from lawmakers. Senator Elizabeth Warren, in a March 6 letter, challenged Sacks to clarify the timeline of his asset sales and ensure he no longer holds any cryptocurrencies. The selling spree follows Sacks’ earlier public assertions on X (formerly Twitter), indicating he had completely exited from crypto holdings, a claim Warren questioned by prompting for detailed confirmation of those transactions.

Since assuming his position, Sacks has emerged as a prominent voice on crypto-related issues, advocating against excessive taxation within the industry and highlighting the strategic importance of maintaining a Bitcoin reserve. His stance against taxing crypto transactions was echoed in a recent episode of the All In Podcast, where he expressed concerns about the slippery slope of initial modest taxes eventually burdening everyday consumers.

This development not only underscores the intricate relationship between venture capital and government roles but also highlights the ongoing conversation around regulatory policies in the rapidly evolving world of cryptocurrency.

David Sacks’ Crypto Divestment and Its Implications

David Sacks, recently appointed as the White House AI and crypto czar, took significant actions to divest from cryptocurrencies and related assets, raising questions about the intersection of public service and private investment.

- Sell-off Details:

- David Sacks and Craft Ventures sold over 0 million in crypto assets.

- Sacks personally sold million worth of these assets.

- Liquid cryptocurrencies, including Bitcoin (BTC), Ether (ETH), and Solana (SOL), were sold off.

- Avoiding Conflicts of Interest:

- The divestment was aimed at preventing conflicts of interest in his new role.

- It included exiting investments in firms like Coinbase and Robinhood.

- Political Scrutiny:

- Senator Elizabeth Warren requested confirmation of Sacks’ divestments, highlighting the need for transparency.

- Concerns were raised about timing and the potential for insider information affecting sales.

- Regulatory Advocacy:

- Sacks has become a vocal advocate for creating a legal framework in the crypto industry.

- He opposes high taxation on crypto transactions and warns against gradual increases in tax rates.

“That’s always how taxes start. They are described as being very modest,” Sacks commented on proposed crypto transaction taxes.

These developments illustrate the evolving relationship between public policy and private investments in the rapidly changing cryptocurrency landscape, potentially impacting individual investors and the broader market.

David Sacks’ Strategic Divestment: Implications for the Crypto Industry

David Sacks, the newly appointed White House AI and crypto czar, has recently made headlines with his substantial divestment from the crypto sector. This move, involving the sale of over 0 million in crypto and crypto-related stocks, aims to mitigate any perceptions of conflict of interest as he takes on a pivotal role in shaping the regulatory landscape for digital currencies. However, how does Sacks’ strategic withdrawal stack up against current trends in the crypto world, particularly concerning governance and investment practices?

Advantages of Sacks’ Approach: By proactively divesting from liquid cryptocurrencies and related stocks, Sacks positions himself as a responsible leader committed to transparency. This decisive action may bolster the public’s trust in his role, especially amid increasing scrutiny from policymakers and consumers alike. The high-value divestment also indicates a cautious optimism about the blockchain space’s future, suggesting that his focus might be on developing sustainable frameworks rather than speculative profiteering.

In contrast, many prominent figures in the cryptocurrency arena continue to hold significant stakes in various projects, often leading to accusations of conflicts of interest. Sacks’ comprehensive strategy stands out as a clear, calculated response to such criticisms, setting a precedent for ethical governance that could resonate with investors looking for stability in a volatile market.

Disadvantages and Challenges: However, this move is not without its pitfalls. Sacks’ rapid divestment could be perceived as a signal of impending trouble within the crypto market, sparking uncertainty among investors and potentially triggering additional sell-offs. The letter from Senator Elizabeth Warren underscores this tension, as she demands confirmation of Sacks’ commitment to divest from digital assets—suggesting ongoing political scrutiny could affect his ability to navigate complex regulatory waters effectively.

The ramifications of Sacks’ actions may create a mixed bag of consequences for the broader crypto community. While his divestment could provide a template for future leaders, it might also deter emerging entrepreneurs who see the volatility in the space as a threat to stable governance. Startups reliant on favorable regulatory conditions could find themselves facing headwinds if established figures continue to retreat from investments due to political pressures.

Who Could Benefit or Face Challenges? The most immediate beneficiaries of Sacks’ actions could be veteran investors and established firms who prioritize compliance and strategic governance. As the framework for the crypto industry evolves under his guidance, entities emphasizing ethical practices may thrive. Conversely, newer or less-established players might struggle to adapt to the increasing regulatory burdens that could come as a direct consequence of heightened scrutiny and the potential for stringent regulations in the crypto market.

Sacks’ experience and connections may enhance the credibility of the U.S. approach to digital assets, but the ultimate success of his tenure will rely heavily on how well he can balance the interests of various stakeholders while fostering innovation in an often turbulent market.