The landscape of cryptocurrency trading is currently stirred with anticipation following the U.S. Securities and Exchange Commission’s (SEC) recent decision to delay its ruling on several proposed exchange-traded funds (ETFs) involving popular altcoins such as XRP, Solana, Litecoin, and Dogecoin. In filings submitted on March 11, the SEC specified that it has chosen to extend the evaluation period for these ETF applications, affecting prominent proposals such as Grayscale’s XRP ETF and the Cboe BZX Exchange’s spot Solana ETF, with announcements on their fate now expected by May.

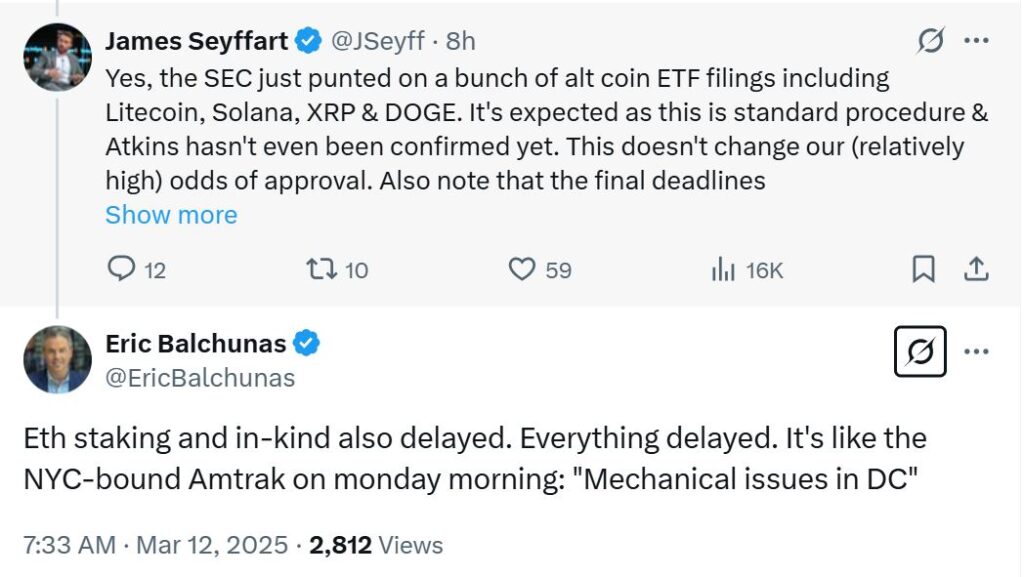

This move, while causing a ripple of speculation among investors and analysts alike, has been characterized as part of a standard procedure by experts. James Seyffart, an ETF analyst at Bloomberg, pointed out in a social media post that these delays are not uncommon, especially as the SEC awaits the confirmation of Paul Atkins, whom former President Donald Trump nominated as the new chair of the SEC. Seyffart noted that despite the postponement, the likelihood of approval for these ETFs remains relatively high, especially with final deadlines extending into October.

“It’s expected, as this is standard procedure,” Seyffart stated, reassuring the market amidst concerns.

His colleague, Eric Balchunas, echoed these sentiments, emphasizing that delays are pervasive across the board, even affecting other financial products linked to Ethereum staking and in-kind redemptions. This recent flurry of ETF filings follows the mounting interest in cryptocurrency trading after a period of regulatory strictness under former SEC Chair Gary Gensler, whose tenure was marked by a decisive approach that included numerous actions against crypto enterprises.

Intriguingly, since Gensler’s departure in January, the SEC’s regulatory landscape appears to be shifting, with several legal challenges against major crypto firms resulting in dismissals. Furthermore, acting SEC Chairman Mark Uyeda’s proposal to ease regulations for alternative trading systems catering to cryptocurrencies signals a potentially more accommodating direction for the agency in the future.

Delay in Approval of Altcoin ETFs by the SEC

The US Securities and Exchange Commission (SEC) has postponed its decisions on several cryptocurrency exchange-traded funds (ETFs). Here are the key points regarding this development:

- Delayed Decisions:

- The SEC has extended the timeframe to decide on several ETF filings, including those for XRP, Solana, Litecoin, and Dogecoin.

- Key ETFs affected include Grayscale’s XRP and Cboe BZX Exchange’s spot Solana ETF, with decisions now pushed to May.

- Standard Procedure:

- ETF analyst James Seyffart stated that delays are a typical part of the process and shouldn’t raise red flags.

- He mentioned that current odds for approval remain relatively high, with final deadlines extending to October.

- Regulatory Context:

- The SEC has seen changes in leadership, with Paul Atkins, a pro-crypto businessman, nominated as the next chair, pending congressional confirmation.

- During Gary Gensler’s chairmanship, the SEC took a notably aggressive regulatory stance on cryptocurrencies.

- Impact on the Crypto Market:

- The ongoing delays could influence market sentiment towards altcoins and the overall crypto industry.

- Approval of these ETFs could lead to greater institutional investment in cryptocurrencies, potentially impacting prices and adoption rates.

This development highlights the evolving landscape of cryptocurrency regulation in the US and the significance of regulatory bodies in shaping market dynamics.

Analysis of SEC’s Delay on Altcoin ETF Approvals

The recent announcement from the U.S. Securities and Exchange Commission (SEC) regarding the delay in approving various altcoin exchange-traded funds (ETFs), including XRP, Solana, and others, is a significant signal in the financial landscape. This move comes at a time of heightened interest in cryptocurrency asset classes, especially following the recent shifts in regulatory dynamics. While the SEC’s decision to push back the deadlines may seem concerning at first glance, it also reflects a larger trend of cautious progression in the realm of digital assets.

Competitive Advantages: One notable advantage of this delay is that it allows the SEC more time to thoroughly evaluate the proposed ETFs, ensuring that all regulatory facets are considered before making a decision. This might appeal to investors who prefer a more responsible and well-vetted approach to altcoins, which have historically displayed volatility. Additionally, analysts like James Seyffart indicate that this delay is a part of standard procedure, which might alleviate immediate concerns for potential investors. The anticipation surrounding these ETF approvals can also create buzz and interest in the altcoin market, keeping them in public discourse.

Disadvantages: On the flip side, prolonged uncertainty could deter potential investors who are eager to enter the altcoin space. With each delay, the market could experience fluctuating sentiments, leading to temporary drops in coin values. Furthermore, the fact that U.S. regulatory bodies are still sorting through an influx of applications post the Trump administration’s election might create a perception of inconsistency or indecision. A hesitant regulatory environment could potentially pave the way for further delays or rejections in the future.

This latest development could benefit institutional investors who prefer a more regulated market, as well as asset management firms that specialize in ETFs. However, retail investors looking to capitalize on the rising altcoin trends may find themselves frustrated by the drawn-out process. Smaller crypto firms or emerging players in the altcoin space also face challenges, as the SEC’s cautious approach may hinder their potential for growth and expansion amid an evolving market landscape.

Overall, while the SEC’s delays in approving altcoin ETFs might provide some level of safety and oversight, they also introduce a host of uncertainties that could impact both investor sentiment and the broader crypto market. As firms work through ongoing legal challenges and the cryptocurrency framework continues to develop, stakeholders must navigate a landscape marked by both promise and hesitation.