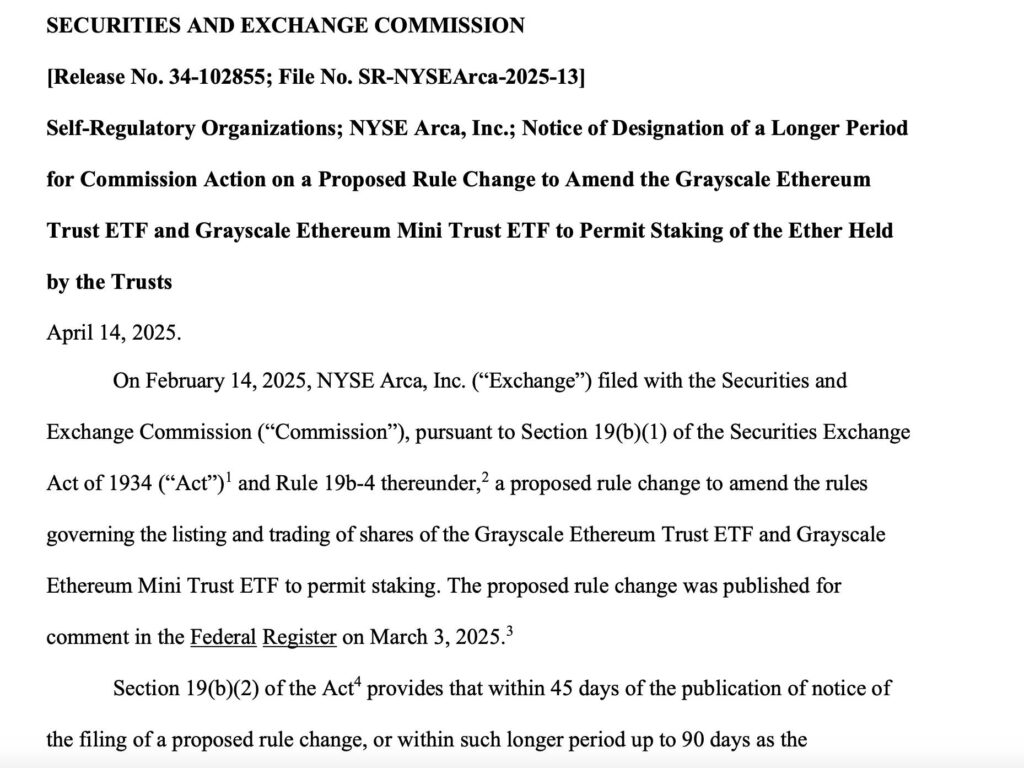

The United States Securities and Exchange Commission (SEC) has recently announced a delay regarding its decision on whether to approve Ether staking in two significant Grayscale funds. This announcement, made on April 14, puts the decision on the Grayscale Ethereum Trust ETF and Grayscale Ethereum Mini Trust ETF on hold until June 1, with a final deadline set for the end of October. This delay comes on the heels of a proposed rule change by the New York Stock Exchange (NYSE) aimed at allowing investors to stake their Ether (ETH) holdings within these exchange-traded funds (ETFs).

Staking, a process where cryptocurrency is locked in a digital wallet to bolster blockchain operations and security, offers participants rewards—a feature that could enhance the appeal of Ether ETFs by providing a yield for investors. Currently, the estimated annual yield on staked Ether varies widely among platforms, with Coinbase reporting approximately 2.4%, while Kraken lists yields ranging from 2% to a noteworthy 7%.

“Ether ETFs have seen a cumulative net inflow of $2.28 billion since their 2024 launch.”

The competition in the Ether ETF space is heating up, with notable asset managers like BlackRock vying to introduce staking services for their own ETFs. Despite the delay in the staking decision, the SEC has been active in approving options trading for multiple spot Ether ETFs. This recent move enables derivatives trading on funds from prominent players such as BlackRock, Bitwise, and Grayscale, thereby broadening their utility for institutional investors.

While Ether ETFs are making strides, they still face challenges when compared to their Bitcoin counterparts. In just a few months, Bitcoin funds have attracted an impressive $35.4 billion, outpacing the total $2.2 billion net inflow for Ether ETFs as of mid-April. Additionally, Ether’s performance in the current market has not been as robust as other assets like XRP and Solana, with the cryptocurrency trading below the $2,000 mark despite hitting a 52-week high of $4,112—still shy of its all-time high of $4,866 recorded in November 2021.

Impact of SEC Delay on Ether Staking in Grayscale Funds

The decision by the SEC regarding Ether staking in Grayscale’s Ethereum Trust ETF and Ethereum Mini Trust ETF has significant implications for investors and the cryptocurrency landscape. Here are the key points to consider:

- SEC Decision Delay: The SEC has postponed its decision on Grayscale’s staking proposal until June 1, impacting stakeholders waiting for clarity.

- Potential for Increased Yield: Staking Ether could offer an annual yield estimated between 2% to 7%, making the ETFs more appealing to investors.

- Market Inflows: Ether ETFs have attracted a cumulative net inflow of $2.28 billion since their inception in 2024, indicating a growing interest in these investment vehicles.

- Competition Among Asset Managers: Other firms, including BlackRock and 21Shares, are also vying to offer staking options, which could intensify market competition and innovation.

- Regulatory Approvals: The SEC’s approval of options trading for multiple spot Ether ETFs highlights the ongoing development of crypto regulations, which can enhance fund utility for institutional investors.

- Comparison with Bitcoin ETFs: Ether ETFs have seen significantly lower adoption compared to Bitcoin ETFs, which had $35.4 billion in flows, reflecting ongoing challenges in establishing Ether as an investment asset.

- Current Market Performance: Ether’s recent trading below $2,000, and its inability to surpass its previous all-time high, may affect investor sentiment and market dynamics moving forward.

The developments around staking and ETF approvals may impact how investors approach not only Ether but the broader cryptocurrency market, guiding investment strategies and expectations in the evolving digital asset space.

SEC’s Stalemate: The Stakes of Ether Staking Delays

The U.S. Securities and Exchange Commission’s (SEC) recent decision to delay the verdict on Ether staking within Grayscale’s funds puts a spotlight on the complexities of cryptocurrency regulation and investment opportunities. While regulators grapple with their stance on staking, the landscape for Ether ETFs presents both challenges and advantages compared to other crypto assets, specifically Bitcoin.

Competitive Advantages: Grayscale’s push for Ether staking is a strategic attempt to enhance the appeal of its Ethereum Trust ETF and Mini Trust ETF. With the potential for annual yields between 2% and 7%—depending on the exchange—stakers are incentivized by the promise of rewards for their commitments. This could significantly increase the attractiveness of these funds for income-seeking investors, particularly as they lack the massive $35.4 billion inflow spotlighted for Bitcoin ETFs. The SEC’s approval of options trading for multiple spot Ether ETFs, including those from BlackRock and Bitwise, further amplifies the utility and flexibility of these investment vehicles for institutional investors who value diverse strategies.

Competitive Disadvantages: On the flip side, the SEC’s delay creates uncertainty that can deter potential investors. Unlike Bitcoin ETFs, which are enjoying robust adoption rates, Ether’s continued struggle to capture market interest is evident, with cumulative net inflows of just $2.28 billion since their inception. Furthermore, recent performance metrics reveal Ether has not performed as well as competitors like XRP or Solana during this market cycle. These challenges not only hinder investor confidence but can potentially lead to a stagnant growth trajectory for Ether ETFs while their Bitcoin counterparts surge ahead.

For retail investors seeking yield opportunities through secure staking options, the SEC’s indecision could become a significant roadblock, delaying potential gains and underscoring the importance of regulatory clarity. Conversely, institutional investors may see this situation as a chance to capitalize on the temporary market imbalance. If Ether staking faces further delays while Bitcoin ETFs continue to flourish, it may cement Bitcoin’s dominance in the crypto ETF sector, leaving Ether at a competitive disadvantage.

The ongoing regulatory dialogues and approval timelines surrounding staking in Ether ETFs make for a captivating narrative in the cryptocurrency investment realm. Engaging with this market requires a nuanced understanding of the risks and rewards, particularly as the SEC navigates these uncharted waters.