The cryptocurrency market has recently been abuzz with news that the U.S. Securities and Exchange Commission (SEC) has delayed its decision regarding a proposed spot Solana exchange-traded fund (ETF). This decision has cascaded interest and scrutiny within the crypto community as investors eagerly await similar rulings on other digital assets.

According to a filing from May 13, the SEC has pushed back the timeline for Grayscale’s spot Solana (SOL) Trust ETF application, now projecting a ruling for October 2025. This delay follows another recent postponement concerning a Litecoin (LTC) ETF application, as noted by Bloomberg Intelligence analyst James Seyffart.

“Spot ETFs are viewed as key drivers of liquidity and institutional adoption for digital assets,”

Spot ETFs have historically played a significant role in driving institutional investment. For instance, Bitcoin’s spot ETFs accounted for an impressive 75% of new investments shortly after their introduction, effectively helping Bitcoin regain its footing above the $50,000 mark in February 2024.

While the anticipated Solana ETF may not attract the same level of investment as Bitcoin, experts believe it could nonetheless serve as a gateway for institutional adoption. Ryan Lee, chief analyst at Bitget Research, suggests that such a regulated investment vehicle could lure billions into Solana, bolstering its market presence over time.

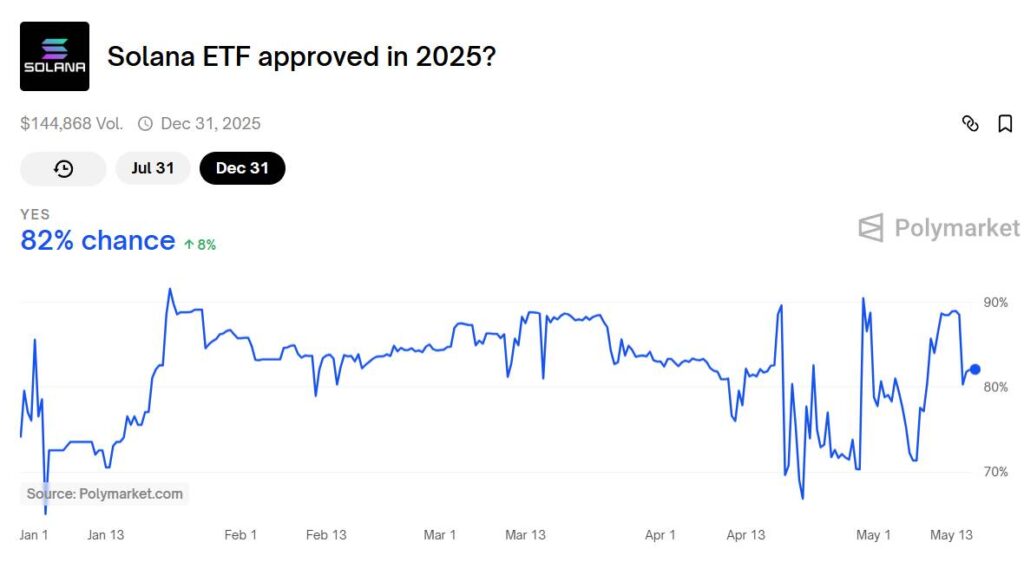

Despite the SEC’s delay, market sentiment remains relatively optimistic. Predictions indicate an 82% probability that the Solana ETF will gain approval by the end of 2025. Interestingly, Polymarket data also reflects a robust 80% chance of approval for a Litecoin ETF within the same timeframe.

“Several other crypto ETF applications are approaching SEC deadlines in June.”

Looking ahead, several other ETF applications are nearing crucial decision dates this June. The SEC is expected to announce its verdict on Grayscale’s Polkadot (DOT) ETF by June 11, with 21Shares’ Polkadot ETF decision set for June 24. Additionally, the SEC’s ruling on Franklin Templeton’s spot XRP ETF and Bitwise’s spot Dogecoin (DOGE) ETF is also anticipated in June. However, with the SEC’s history of utilizing its full review period for crypto-related products, further delays remain a possibility.

US SEC Delays Decision on Spot Solana ETF

The recent decision by the US Securities and Exchange Commission (SEC) impacts the cryptocurrency market significantly. Here are the key points from the article:

- Delay on Grayscale’s Solana ETF: The SEC has postponed its decision on Grayscale’s Solana (SOL) Trust ETF until October 2025.

- Impact of Spot ETFs: Spot ETFs serve as crucial mechanisms for enhancing liquidity and attracting institutional interest in digital assets.

- Success of Bitcoin ETFs: The US spot Bitcoin ETFs contributed approximately 75% of new investments, facilitating Bitcoin’s price increase to over $50,000 in February 2024.

- Long-term Potential of Solana ETF: Despite potentially lower inflows compared to Bitcoin, a Solana ETF could significantly enhance institutional adoption by providing a regulated investment vehicle.

- Investor Optimism: Currently, there is an 82% likelihood of a Solana ETF approval by December 31, 2025, reflecting strong investor confidence in the crypto market.

- Upcoming ETF Decisions: The SEC is expected to make decisions on several other crypto ETFs, including those for Polkadot, XRP, and Dogecoin, in June 2025.

- Review Period Utilization: Historically, the SEC often utilizes its full review period of up to 240 days, suggesting that many applications could face delays.

These points underscore the ongoing volatility and complexity of the cryptocurrency market, and how federal regulatory decisions may shape investment opportunities, influencing individual investor strategies and market dynamics.

SEC Delays on Solana ETF: What It Means for the Crypto Market

The recent decision by the US Securities and Exchange Commission (SEC) to delay the ruling on Grayscale’s proposed spot Solana (SOL) exchange-traded fund (ETF) until October 2025 has sparked a wave of discussions within the cryptocurrency community. While this postponement raises eyebrows, it also sets a backdrop for a broader analysis of the crypto ETF landscape and its implications for various stakeholders in the market.

Competitive Advantages of Solana ETF Delays

One of the key competitive advantages is the rising anticipation and optimism from investors regarding the long-term implications of a future Solana ETF. With an impressive 82% likelihood predicted for its approval by the end of 2025, investors remain hopeful. This optimism mirrors the sentiments seen with Bitcoin ETFs when they were first introduced, showing that initial delays can often lead to heightened interest and speculation. Moreover, the potential for Solana to capture institutional investment by providing a regulated avenue is significant. Similar ETFs have previously been recognized for enhancing liquidity, as evidenced by Bitcoin’s phenomenal price recovery following its ETF launch, offering a prosperous view for Solana’s adoption in the institutional arena.

Competitive Disadvantages and Market Challenges

On the flip side, the extended timeline for the Solana ETF could create challenges for both Solana and the broader cryptocurrency sphere. Investors often grow impatient with prolonged delays, potentially leading to diminished confidence in Solana’s market momentum. Additionally, this delay coincides with other cryptocurrency ETFs waiting for SEC green lights, such as those for Polkadot and XRP, which may redirect investors’ attention and funds away from Solana. As competition for ETF approvals increases, other cryptocurrencies could snatch potential market share, diminishing Solana’s standing in a crowded marketplace.

Impact on Stakeholders

For institutional investors, the protracted decision timeline could either provide an opportunity to strategize their entries into Solana or create uncertainty, leading them to explore other digital assets with more immediate access points, such as the competing Litecoin ETF. Retail investors may face similar dilemmas; the delay could either inhibit their enthusiasm or offer a buying opportunity at lower prices before the anticipated approval hype kicks in. Conversely, crypto enthusiasts and tech advocates should also monitor these developments closely, as they could shape the future utility and adoption of Solana within the broader blockchain ecosystem.

As the SEC navigates these pivotal decisions, the outcomes not only impact Solana but could ripple throughout the landscape of cryptocurrency investment products. Keeping an eye on the evolving scenario could prove essential for anyone involved in or considering entry into the crypto market.