The landscape of cryptocurrency investments is seeing significant movement as the U.S. Securities and Exchange Commission (SEC) has recently announced a delay in its decision regarding the approval of a proposed exchange-traded fund (ETF) that would hold Polkadot’s native token, DOT. This regulatory filing, disclosed on April 24, indicates that the SEC has extended its deadline for a final ruling to June 11. This extension comes nearly four months after Nasdaq submitted a request to list the Grayscale Polkadot Trust on February 24.

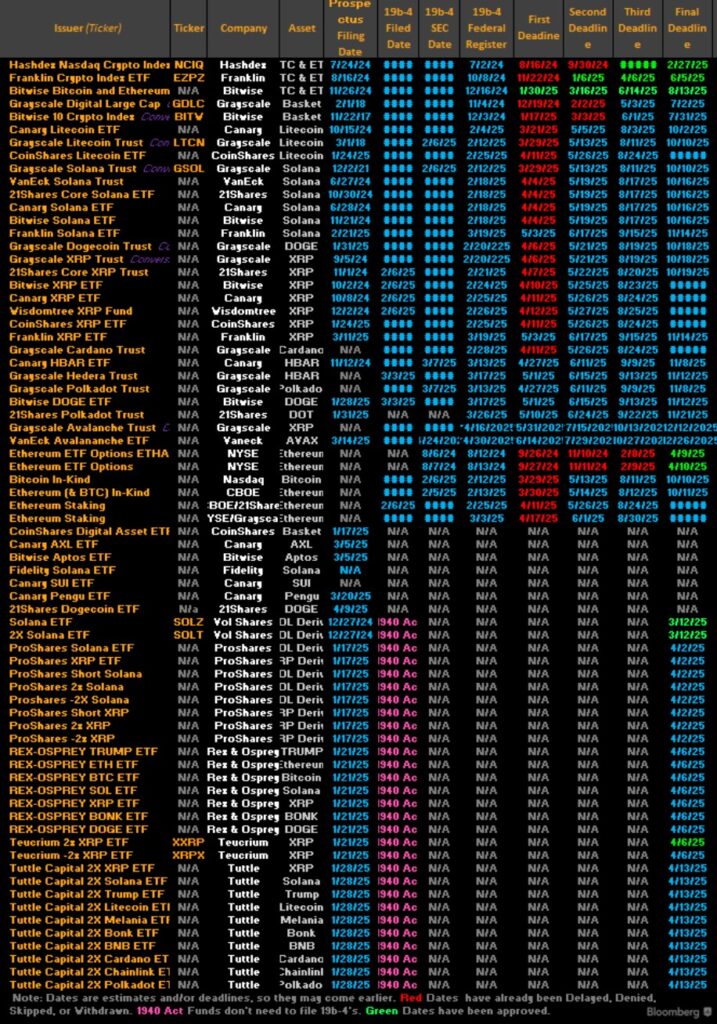

Grayscale’s application is part of a growing list of approximately 70 proposed ETFs currently awaiting SEC approval. Notably, these proposals span various categories, including funds focused on altcoins, popular memecoins, and crypto-related financial derivatives. According to Bloomberg analyst Eric Balchunas, asset managers are pitching ETF proposals for a diverse array of cryptocurrencies, ranging from established names like XRP and Solana to more niche options such as Dogecoin.

Polkadot, launched in 2020, is a layer-1 blockchain network designed to enable better interoperability between different blockchains. As of April 24, its market capitalization stood at approximately $6.6 billion, emphasizing its relevance in the cryptocurrency market. Additionally, asset manager 21Shares is also waiting for the green light to launch its own Polkadot ETF, further showcasing the growing interest in ETF investments tied to specific cryptocurrencies.

“Having your coin get ETF-ized is like being in a band and getting your songs added to all the music streaming services,” noted Balchunas. “It doesn’t guarantee listens but it puts your music where the vast majority of the listeners are.”

While the SEC is reviewing these ETF proposals, a recent report by Coinbase and EY-Parthenon reveals that over 80% of institutional investors plan to increase their allocations to cryptocurrency by 2025. However, analysts warn that the demand for altcoin ETFs may not reach the same levels as those for leading cryptocurrencies such as Bitcoin and Ether. This sentiment highlights the evolving narrative within the cryptocurrency market as it awaits regulatory clarity and broader acceptance.

Impact of SEC’s Delay on Polkadot ETF Approval

The recent decision by the US SEC to delay the approval of an ETF holding Polkadot’s native token, DOT, could have significant implications for investors and the broader cryptocurrency market. Here are the key points related to this development:

- SEC’s Extended Deadline: The SEC has postponed its final ruling on the proposed Polkadot ETF until June 11, extending the timeline for investors awaiting clarity.

- Growing ETF Proposals: There are approximately 70 proposed ETFs awaiting SEC approval, which includes a variety of altcoins and crypto derivatives, indicating a growing interest in crypto investment vehicles.

- Market Capitalization: As of April 24, Polkadot’s token DOT has a market capitalization of around $6.6 billion, showcasing its significant position in the market.

- Institutional Interest: Over 80% of institutional investors plan to increase their crypto allocations by 2025, highlighting a potential increase in demand for crypto products, including ETFs.

- Analysts’ Cautions: Despite interest, demand for altcoin ETFs may be limited compared to Bitcoin and Ether funds, suggesting that not all cryptocurrencies will benefit equally from ETF listings.

- Impact on Investors: The approval of ETFs could lead to wider adoption and increased investment in the cryptocurrency space, driving demand and potentially impacting the prices of underlying assets.

“Having your coin get ETF-ized is like being in a band and getting your songs added to all the music streaming services.” – Eric Balchunas

This quote illustrates the potential benefit of ETF approval, as it can give cryptocurrencies exposure to a larger audience of institutional and retail investors.

SEC ETF Approval Delay: Implications for Polkadot and the Crypto Market

The recent decision by the US Securities and Exchange Commission (SEC) to delay its ruling on the proposed exchange-traded fund (ETF) for Polkadot’s native token, DOT, underscores a significant moment for both asset managers and the broader cryptocurrency landscape. The extension until June 11 is not just a ticking clock; it reflects the regulatory complexities surrounding altcoin investments. This situation embodies the dynamics faced by various crypto assets as they vie for institutional acceptance.

Competitive Advantages: Grayscale’s position as a frontrunner in the race for an ETF focused on Polkadot offers them a competitive edge in the crowded altcoin market. It suggests that demand for altcoin ETFs is gaining traction, albeit cautiously. With numerous asset managers, including 21Shares, also in the pipeline, the competition could foster innovation in product offerings that cater to diverse investor interests. Moreover, the impending rules could invigorate institutional investment in the altcoin sector, as shown by the significant percentage of institutional investors planning to increase their crypto allocations by 2025.

Disadvantages: However, the overall market sentiment for altcoin ETFs appears to be lukewarm. Analysts have pointed out that while the interest in Bitcoin and Ethereum remains high, altcoins might struggle to attract the same level of investment. This hesitance could pose challenges for firms like Grayscale and others that are investing extensively in developing altcoin-centric products. The fear of regulatory hurdles exacerbates this uncertainty, especially for assets perceived as riskier or less stable than Bitcoin or Ether.

For investors, this delay could either present an opportunity or create hesitation. On one hand, early adopters of Polkadot ETFs might enjoy potential gains if institutional interest grows; on the other, those waiting on the sidelines might find themselves grappling with volatility and market risks.

Opposition also looms for cryptocurrencies vying for SEC approval during a period where other leading assets are more established and trusted among institutions. This scenario could stifle newcomers like Polkadot, as investors might prefer sticking to the more ‘tried and tested’ tokens.

In essence, while the SEC’s indecision could rejuvenate interest in Polkadot among some investors, it also reflects the complexities and challenges that come with navigating a heavily regulated and evolving market.