The landscape of cryptocurrency is buzzing with news as the US Securities and Exchange Commission (SEC) has once again decided to delay its decisions on several important exchange-traded funds (ETFs) involving popular cryptocurrencies such as XRP, Solana, Litecoin, and Dogecoin. In a significant announcement made on March 11, the SEC stated that it has “designated a longer period” to review proposed rule changes that could pave the way for these ETFs. Notably, the potential approval of Grayscale’s XRP ETF and Cboe BZX Exchange’s spot ETF for Solana has been postponed until May, keeping investors and analysts alike on edge.

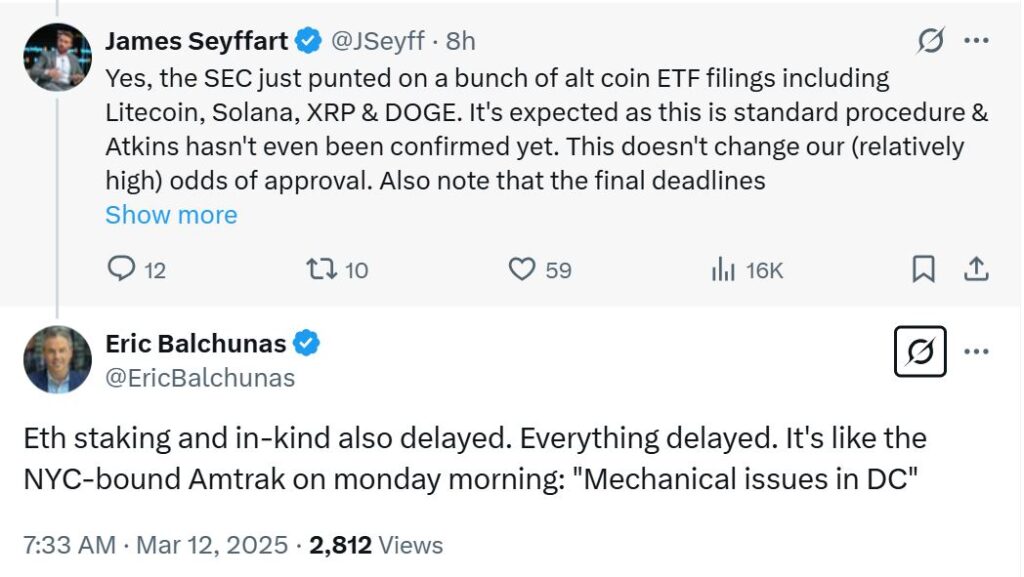

Analyst James Seyffart from Bloomberg noted that while the delay might spark concerns among some, he considers it typical procedure for the SEC. With the agency amidst a significant leadership transition, having yet to confirm Paul Atkins—selected by former President Donald Trump—as its new chair, Seyffart reassured followers that the odds of eventual approval remain reasonably optimistic, especially with final deadlines stretching until October. His colleague, Eric Balchunas, echoed this sentiment, highlighting that the trend of delays isn’t limited to altcoins but extends to other crucial ETF filings, including those concerning Ether (ETH) staking.

“Everything is delayed,” Balchunas remarked, pointing to the broader picture of ETF adjustments underway.

This latest move by the SEC is not an isolated incident; it follows a previous extension concerning Ether ETF options, emphasizing the ongoing complexities within cryptocurrency regulations. Under the previous chair, Gary Gensler, the SEC’s strict regulatory approach saw numerous enforcement actions against crypto firms, but since his departure, several cases against major players like the crypto exchange Gemini have been dismissed, signaling potential shifts in the regulatory landscape.

As the crypto community awaits more definitive news from the SEC, questions remain about how these changes will impact future investments and the overall market. The continuing scrutiny of altcoin ETFs highlights a critical moment for the industry, as firms adapt to a regulatory environment that is still taking shape following leadership changes and policy reviews.

SEC Delays Decision on Altcoin ETFs

The US Securities and Exchange Commission (SEC) has postponed its decision regarding several altcoin exchange-traded funds (ETFs), impacting various cryptocurrencies and potential investors.

- Delayed Decisions:

- SEC has designated a longer period to decide on proposed rule changes for ETFs related to XRP, Solana, Litecoin, and Dogecoin.

- Notable ETF filings affected include Grayscale’s XRP and Cboe BZX’s Solana ETF, with decisions pushed to May.

- Industry Reactions:

- ETF analysts, including James Seyffart, view the delays as standard procedure and not a cause for concern.

- Seyffart maintains high odds for eventual approval of these ETFs.

- Eric Balchunas notes that delays are widespread, even affecting Ether-related ETFs.

- Regulatory Context:

- Former SEC Chair Gary Gensler was known for aggressive cryptocurrency regulations, with over 100 regulatory actions during his term.

- Since Gensler’s resignation, several legal cases against cryptocurrency firms have been dismissed, indicating possible easing of regulatory pressures.

- Acting SEC Chairman Mark Uyeda has proposed abandoning certain regulatory expansions that could have affected crypto firms.

- Market Implications:

- The uncertainty surrounding ETF approvals can impact market sentiment and investor confidence in altcoins.

- Potential approval of these ETFs could increase demand and value for cryptocurrencies like XRP, Solana, and others.

“This doesn’t change our (relatively high) odds of approval. Also note that the final deadlines aren’t until October.” – James Seyffart

Analysis of SEC’s Delay on Altcoin ETFs: Implications and Insights

The recent decision by the US Securities and Exchange Commission (SEC) to postpone its verdict on multiple exchange-traded funds (ETFs) linked to altcoins, including XRP, Solana, Litecoin, and Dogecoin, has caught the attention of both investors and analysts alike. This delay reflects ongoing regulatory caution, which contrasts with earlier periods of heightened scrutiny under former SEC Chair Gary Gensler’s tenure marked by stringent regulations against the cryptocurrency sector. While this regulatory hesitance reveals significant shifts in the landscape since Gensler’s exit, it also opens the door to various potential outcomes for different stakeholders in the crypto ecosystem.

Competitive Advantages: Analysts from Bloomberg, such as James Seyffart, emphasize that the delay is not inherently negative; rather, it aligns with regulatory norms. The anticipated endorsement of altcoin ETFs by the SEC may strengthen the legitimacy of cryptocurrencies in traditional finance, potentially drawing in new investors looking for safer avenues to engage with the volatile crypto market. The entry of more ETFs could mean increased trading volumes, liquidity, and a more robust market environment for these digital assets. Additionally, the nomination of Paul Atkins, a pro-crypto figure, to chair the SEC suggests a promising shift in sentiment towards crypto regulation that may benefit ETFs in the long run.

Competitive Disadvantages: However, such delays can create uncertainty and hesitation among potential investors. The prolonged decision-making process may lead to skepticism and diminish public confidence, particularly among retail investors who may prefer quicker access to investment opportunities. Additionally, the fluctuating political landscape and the prospect of regulatory changes could deter institutional players, as they typically seek clearer, stable environments for investment strategies. The delay might also open the door for alternative investment vehicles, diverting interest away from these altcoin ETFs.

Who Benefits and Who Faces Challenges: This situation primarily benefits seasoned investors and institutional players who thrive on uncertainty and market swings, as they can capitalize on fluctuating prices during the wait. Moreover, firms furthest along with their ETF procedures may maintain a competitive edge, positioning themselves well for an eventual approval. Conversely, retail investors and newer market participants may experience the most frustration. If regulatory clarity does not emerge soon, these parties could feel discouraged, potentially leading to diminished interest in entering the market altogether. Companies seeking to secure regulatory approvals for their crypto products may also find themselves at a crossroads, navigating a complicated web of updated requirements or facing delays similar to those seen currently.